Title: Knoxville Tennessee Financial Account Transfer to Living Trust: A Detailed Guide Introduction: In Knoxville, Tennessee, individuals have the option to transfer their financial accounts to a living trust as part of their estate planning strategy. This process allows for efficient management, protection, and distribution of assets, ensuring the seamless transfer of wealth to beneficiaries. This article will provide a comprehensive overview of Knoxville Tennessee financial account transfer to living trusts, covering associated benefits, applicable laws, and different types of transfers available. I. Understanding the Basics of Living Trusts: 1. Definition of a Living Trust 2. Benefits of Establishing a Living Trust 3. Key Participants in a Living Trust 4. Legal Framework for Living Trusts in Knoxville, Tennessee II. Financial Account Transfer to Living Trust: 1. Types of Financial Accounts Eligible for Transfer: a. Bank Accounts (Checking, Savings, Money Market) b. Investment Accounts (Stocks, Bonds, Mutual Funds) c. Retirement Accounts (IRA, 401(k), 403(b)) d. Life Insurance Policies with Cash Value e. Real Estate Holdings III. Steps for Financial Account Transfer to Living Trust: 1. Determine the Assets to Transfer 2. Identify Trustworthy Trustees and Successor Trustees 3. Complete Required Documentation for Account Transfer 4. Maintain Consistency with Account Management and Record-Keeping 5. Review and Update Beneficiary Designations IV. Importance of Consultation with Estate Planning Professionals: 1. Seeking Professional Assistance for Creating a Living Trust 2. Benefits of Legal Advice for Financial Account Transfers 3. Selecting a Qualified Estate Planning Attorney in Knoxville, Tennessee V. Potential Challenges and Considerations: 1. Tax Implications of Financial Account Transfers 2. Ensuring Adequate Funding of the Living Trust 3. Potential Pitfalls and Precautions during Account Transfers Conclusion: In conclusion, Knoxville, Tennessee residents have several types of financial accounts that can be transferred to a living trust. By doing so, individuals can protect and efficiently manage their wealth, ensuring its seamless transfer to beneficiaries. Engaging with a qualified estate planning attorney is crucial to navigate the legal complexities associated with financial account transfers to living trusts. By following the recommended steps and considering all relevant factors, individuals can establish a robust and comprehensive estate plan tailored to their specific needs.

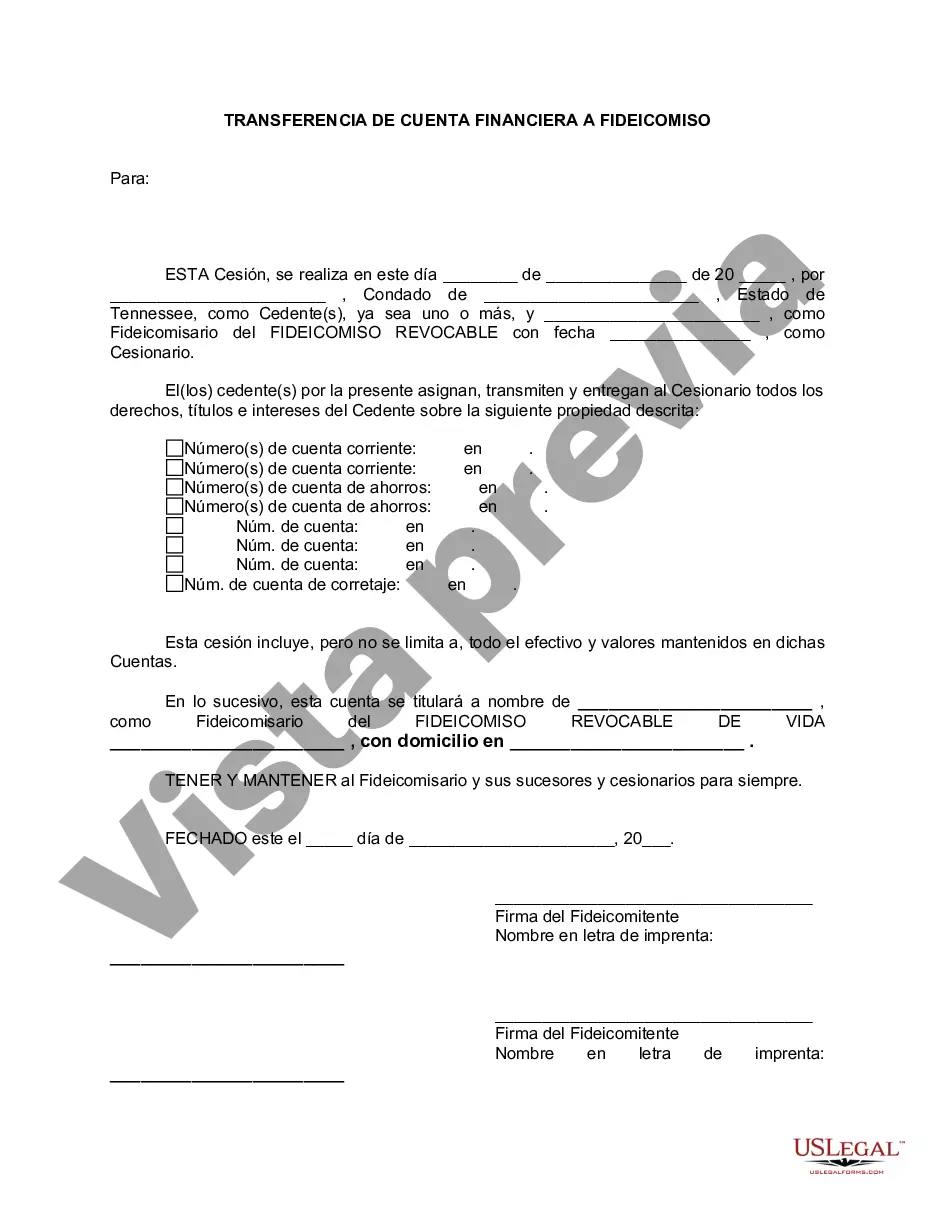

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Knoxville Tennessee Transferencia de cuenta financiera a fideicomiso en vida - Tennessee Financial Account Transfer to Living Trust

Description

How to fill out Knoxville Tennessee Transferencia De Cuenta Financiera A Fideicomiso En Vida?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To do so, we apply for legal services that, as a rule, are extremely expensive. However, not all legal issues are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based catalog of up-to-date DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without using services of an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Knoxville Tennessee Financial Account Transfer to Living Trust or any other form quickly and safely. Simply log in to your account and click the Get button next to it. If you happened to lose the form, you can always re-download it from within the My Forms tab.

The process is equally straightforward if you’re new to the platform! You can create your account within minutes.

- Make sure to check if the Knoxville Tennessee Financial Account Transfer to Living Trust complies with the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s outline (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve made sure that the Knoxville Tennessee Financial Account Transfer to Living Trust is suitable for your case, you can select the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve served millions of people by providing ready to customize and up-to-date legal forms. Make the most of US Legal Forms now to save efforts and resources!