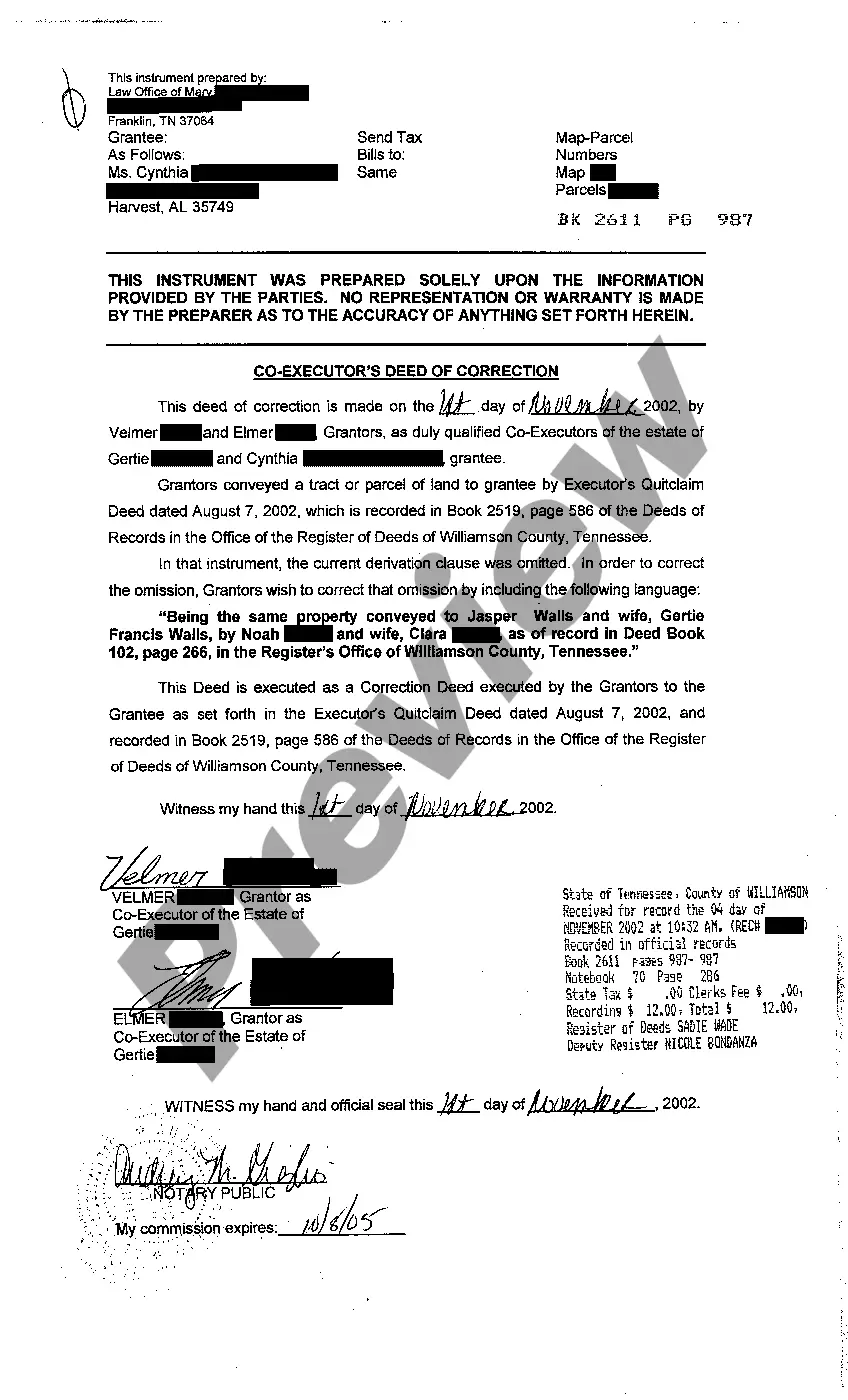

The Clarksville Tennessee Co-Executor's Deed of Correction is a legal document that is used in Clarksville, Tennessee, to rectify or address mistakes or errors made in a previous co-executor's deed. This document allows the co-executors of an estate to correct any issues that arise in the administration of the property. One type of Clarksville Tennessee Co-Executor's Deed of Correction is the Corrective Deed of Distribution. This type of deed is used when there is a need to correct errors in the distribution of assets from the estate. It may involve reallocating assets that were improperly distributed or adjusting shares of beneficiaries due to miscalculations or oversights. Another type is the Corrective Deed of Title. This deed is utilized when there are errors or inaccuracies in the original transfer of property ownership. It is often necessary when there is a mistake in the legal description of the property or if the names of the co-executors or beneficiaries were misspelled or listed incorrectly in the initial documentation. The Co-Executor's Deed of Correction can also be used to amend any mistakes in the recording of deeds, such as incorrect recording dates, wrong book and page numbers, or incomplete or inaccurate legal descriptions. This document ensures that the property records are accurate, up-to-date, and reflect the true intentions of the co-executors. When preparing the Clarksville Tennessee Co-Executor's Deed of Correction, it is crucial to include specific details such as the names of the co-executors, the original date of the co-executor's deed, and a clear description of the error or mistake that needs to be corrected. It is advisable to consult with an attorney experienced in estate administration to ensure that the document complies with all legal requirements and is properly executed. In conclusion, the Clarksville Tennessee Co-Executor's Deed of Correction is a vital legal instrument used to rectify errors or issues in previous co-executor's deeds. It allows co-executors to correct mistakes in the distribution of assets, title transfers, or any inconsistencies in property records. With the help of this document, the co-executors can ensure that the estate administration process is accurate, compliant, and fulfills the intentions of the decedent.

Clarksville Tennessee Co-Executor's Deed of Correction

Description

How to fill out Clarksville Tennessee Co-Executor's Deed Of Correction?

No matter the social or professional status, filling out law-related forms is an unfortunate necessity in today’s professional environment. Too often, it’s almost impossible for a person with no legal background to create this sort of paperwork cfrom the ground up, mainly due to the convoluted terminology and legal nuances they entail. This is where US Legal Forms comes in handy. Our platform offers a massive library with more than 85,000 ready-to-use state-specific forms that work for practically any legal situation. US Legal Forms also is a great asset for associates or legal counsels who want to save time utilizing our DYI forms.

Whether you need the Clarksville Tennessee Co-Executor's Deed of Correction or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Clarksville Tennessee Co-Executor's Deed of Correction quickly using our trustworthy platform. In case you are presently a subscriber, you can proceed to log in to your account to download the appropriate form.

Nevertheless, in case you are new to our library, make sure to follow these steps prior to obtaining the Clarksville Tennessee Co-Executor's Deed of Correction:

- Ensure the form you have found is specific to your area because the regulations of one state or county do not work for another state or county.

- Review the form and go through a brief description (if available) of scenarios the document can be used for.

- In case the form you selected doesn’t meet your requirements, you can start again and search for the necessary form.

- Click Buy now and pick the subscription plan you prefer the best.

- with your login information or register for one from scratch.

- Pick the payment gateway and proceed to download the Clarksville Tennessee Co-Executor's Deed of Correction once the payment is through.

You’re all set! Now you can proceed to print out the form or complete it online. In case you have any problems locating your purchased forms, you can easily find them in the My Forms tab.

Regardless of what situation you’re trying to sort out, US Legal Forms has got you covered. Try it out today and see for yourself.