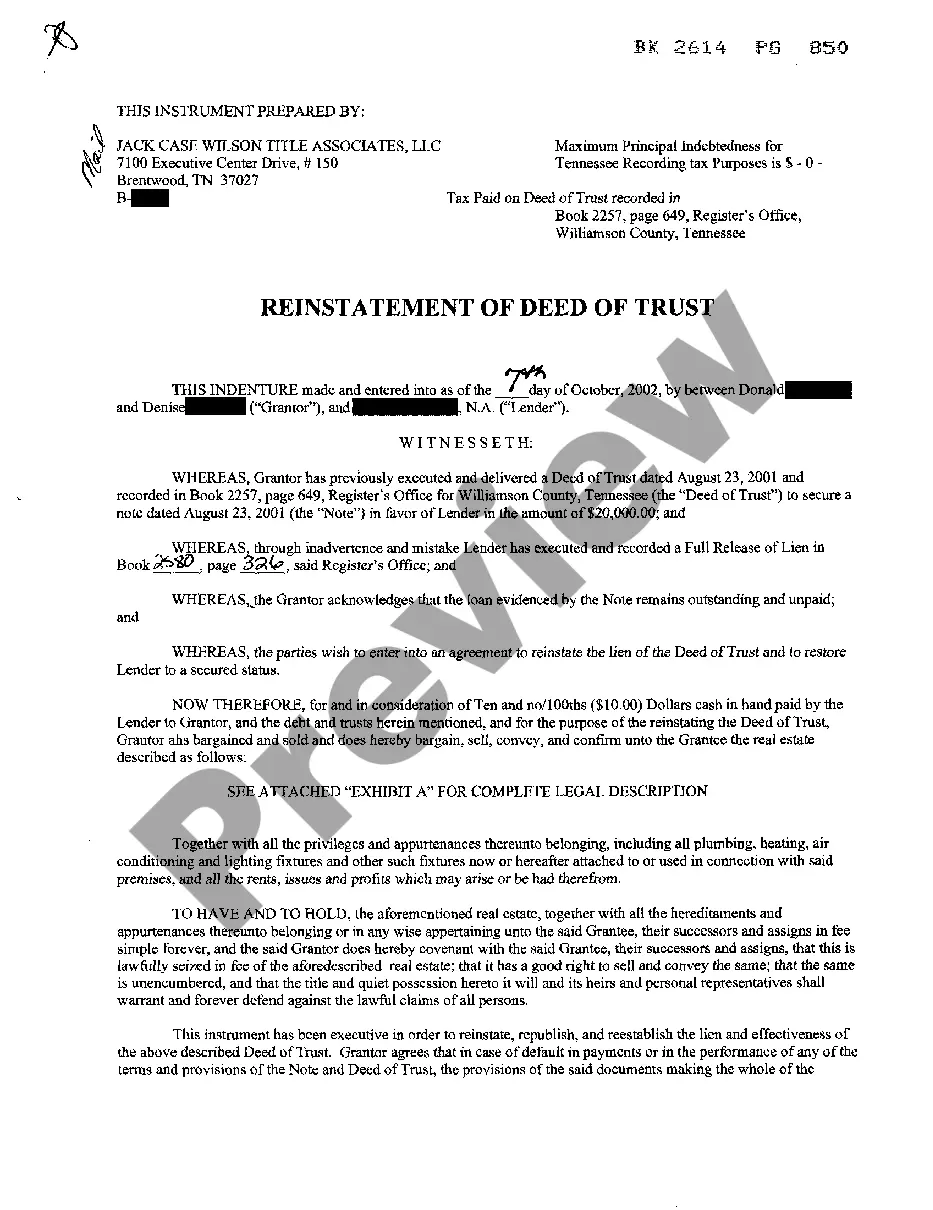

Murfreesboro Tennessee Reinstatement of Deed of Trust

Description

How to fill out Tennessee Reinstatement Of Deed Of Trust?

If you are looking for an appropriate document, it’s incredibly difficult to find a more suitable location than the US Legal Forms site – arguably the most extensive collections available online.

With this collection, you can discover countless form templates for business and personal needs categorized by types and states, or keywords.

With our exceptional search feature, locating the newest Murfreesboro Tennessee Reinstatement of Deed of Trust is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Obtain the document. Choose the format and download it to your device.

- Moreover, the accuracy of each document is verified by a group of qualified lawyers who routinely review the templates on our platform and refresh them according to the latest state and local laws.

- If you are already acquainted with our service and possess a registered account, all you need to obtain the Murfreesboro Tennessee Reinstatement of Deed of Trust is to Log In to your account and select the Download option.

- For first-time users of US Legal Forms, simply follow the instructions provided below.

- Ensure you have selected the form you desire. Examine its details and utilize the Preview function (if applicable) to review its contents. If it doesn’t fulfill your needs, use the Search feature located at the top of the page to find the suitable document.

- Verify your choice. Click the Buy now button. After that, select your preferred payment plan and enter your details to create an account.

Form popularity

FAQ

A trustee of a trust is an individual or institution appointed to manage and administer the trust's assets according to the trust document's terms. This trustee has a fiduciary duty to act in the best interests of the beneficiaries. In the context of the Murfreesboro Tennessee Reinstatement of Deed of Trust, understanding the role of trustees can help borrowers navigate their reinstatement options more effectively.

The three main types of deeds are warranty deeds, quitclaim deeds, and special warranty deeds. A warranty deed provides the highest level of protection, assuring that the grantor has the right to transfer the property. A quitclaim deed offers no guarantees, merely transferring whatever interest the grantor has. If you’re exploring Murfreesboro Tennessee Reinstatement of Deed of Trust, understanding these types can inform your decisions.

Several factors can override a deed, including foreclosure actions, liens, or a court order. Additionally, if a deed is found to be fraudulent or not properly executed, it may be contested in court. Understanding these significant points is crucial when considering the implications of the Murfreesboro Tennessee Reinstatement of Deed of Trust to protect your interests.

Yes, if your name appears on the deed, you hold an ownership stake in the property and are considered a homeowner. This status grants you certain rights and responsibilities regarding the property. It is important to clarify ownership terms when navigating processes such as the Murfreesboro Tennessee Reinstatement of Deed of Trust.

A deed in Tennessee requires the names of the grantor and grantee, a legal property description, and must reflect the grantor's intent to transfer ownership. The grantor must sign the document, and it is beneficial to have it witnessed. These details play a significant role in ensuring a smooth process, particularly during the Murfreesboro Tennessee Reinstatement of Deed of Trust.

In Tennessee, a deed must be in writing, must include a legal description of the property, and must be signed by the grantor. Additionally, it must be recorded with the local county register to provide public notice and protect the interests of the parties. Understanding these requirements is essential when navigating the Murfreesboro Tennessee Reinstatement of Deed of Trust.

For a deed to be valid in Tennessee, it must include specific elements: it should identify the parties involved, describe the property, clearly state the grantor's intent, be signed by the grantor, and include a witness. It often requires notarization and proper delivery to the grantee. Failing to meet these requirements can complicate processes, such as the Murfreesboro Tennessee Reinstatement of Deed of Trust.

A quit claim deed in Rutherford County, Tennessee, transfers any ownership rights the grantor has in a property to the grantee. This deed does not guarantee clear title or interest, making it crucial for parties to understand their rights. When dealing with the Murfreesboro Tennessee Reinstatement of Deed of Trust, using a quit claim deed can simplify transferring interests, but it is wise to consult with a legal professional.