Clarksville, Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage serve as legal documents that regulate the maximum principal amount that can be secured by a credit line mortgage in Clarksville, Tennessee. This provision ensures a fair and transparent process for both borrowers and lenders. The purpose of the Clarksville, Tennessee Notice and Affidavit is to notify parties involved in a credit line mortgage transaction and to establish the predetermined limit on the principal amount. By doing so, it protects both the borrower and the lender, preventing excessive borrowing or lending beyond a certain threshold. This allows borrowers to have a clear understanding of their financial obligations and lenders to mitigate their risk exposure. There are several types of Clarksville, Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage, depending on the specific situation and parties involved: 1. Residential Mortgage: This type of notice and affidavit applies to residential properties, including single-family homes, condos, and townhouses, where the homeowners seek a credit line mortgage. 2. Commercial Mortgage: The notice and affidavit for commercial mortgages pertain to non-residential properties, such as office buildings, retail spaces, or industrial facilities. This ensures that business owners or property investors are aware of the maximum principal limit for their credit line mortgage. 3. Joint Credit Line Mortgage: In cases where multiple individuals share the responsibility of repaying a credit line mortgage, a joint notice and affidavit will be required. This document outlines the maximum principal amount that can be secured collectively by all parties involved. 4. Refinancing Credit Line Mortgage: When an existing credit line mortgage is being refinanced, a notice and affidavit specifically tailored for refinancing purposes is necessary. This ensures that any increase in the maximum principal amount is appropriately established and acknowledged. It's important to consult with a qualified attorney or legal professional familiar with local laws and regulations to accurately prepare and execute the Clarksville, Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage, as requirements may vary based on the specific circumstances and jurisdiction.

Clarksville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage

State:

Tennessee

City:

Clarksville

Control #:

TN-E387

Format:

PDF

Instant download

This form is available by subscription

Description

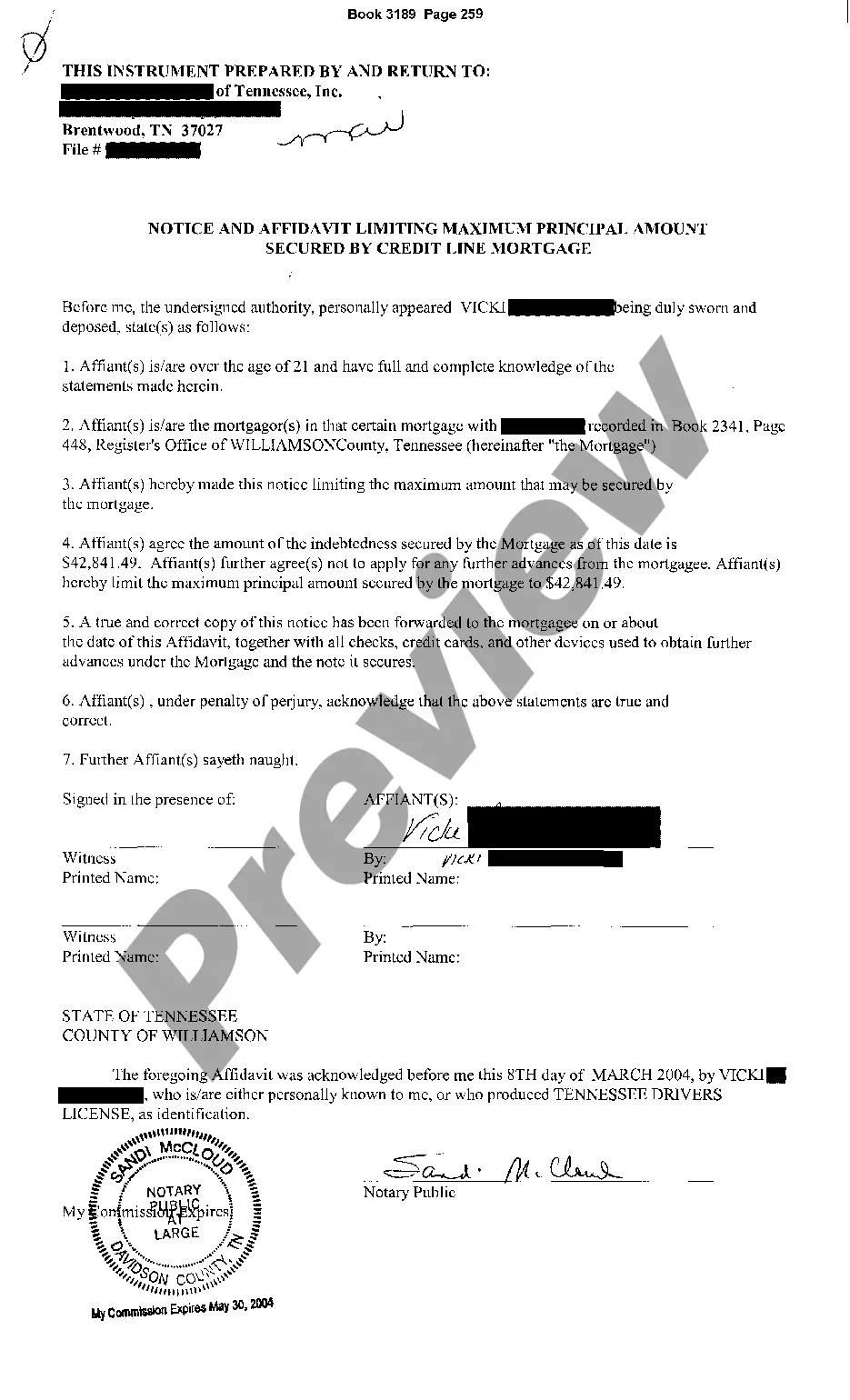

Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage

Clarksville, Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage serve as legal documents that regulate the maximum principal amount that can be secured by a credit line mortgage in Clarksville, Tennessee. This provision ensures a fair and transparent process for both borrowers and lenders. The purpose of the Clarksville, Tennessee Notice and Affidavit is to notify parties involved in a credit line mortgage transaction and to establish the predetermined limit on the principal amount. By doing so, it protects both the borrower and the lender, preventing excessive borrowing or lending beyond a certain threshold. This allows borrowers to have a clear understanding of their financial obligations and lenders to mitigate their risk exposure. There are several types of Clarksville, Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage, depending on the specific situation and parties involved: 1. Residential Mortgage: This type of notice and affidavit applies to residential properties, including single-family homes, condos, and townhouses, where the homeowners seek a credit line mortgage. 2. Commercial Mortgage: The notice and affidavit for commercial mortgages pertain to non-residential properties, such as office buildings, retail spaces, or industrial facilities. This ensures that business owners or property investors are aware of the maximum principal limit for their credit line mortgage. 3. Joint Credit Line Mortgage: In cases where multiple individuals share the responsibility of repaying a credit line mortgage, a joint notice and affidavit will be required. This document outlines the maximum principal amount that can be secured collectively by all parties involved. 4. Refinancing Credit Line Mortgage: When an existing credit line mortgage is being refinanced, a notice and affidavit specifically tailored for refinancing purposes is necessary. This ensures that any increase in the maximum principal amount is appropriately established and acknowledged. It's important to consult with a qualified attorney or legal professional familiar with local laws and regulations to accurately prepare and execute the Clarksville, Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage, as requirements may vary based on the specific circumstances and jurisdiction.

Free preview

How to fill out Clarksville Tennessee Notice And Affidavit Limiting Maximum Principal Amount Secured By Credit Line Mortgage?

If you’ve already used our service before, log in to your account and save the Clarksville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage on your device by clicking the Download button. Make sure your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to get your document:

- Make certain you’ve located the right document. Read the description and use the Preview option, if any, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and choose a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Clarksville Tennessee Notice and Affidavit Limiting Maximum Principal Amount Secured by Credit Line Mortgage. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your personal or professional needs!