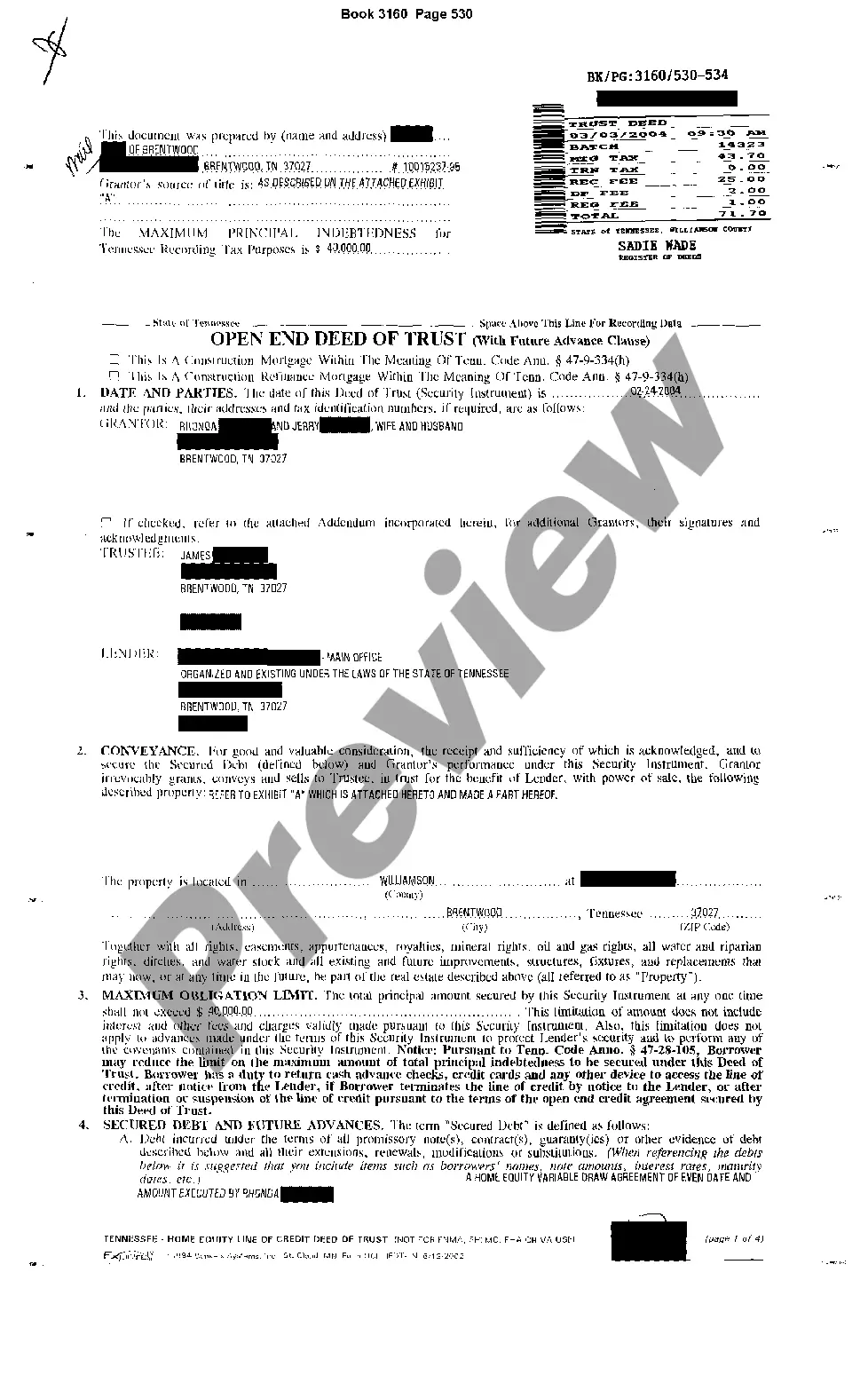

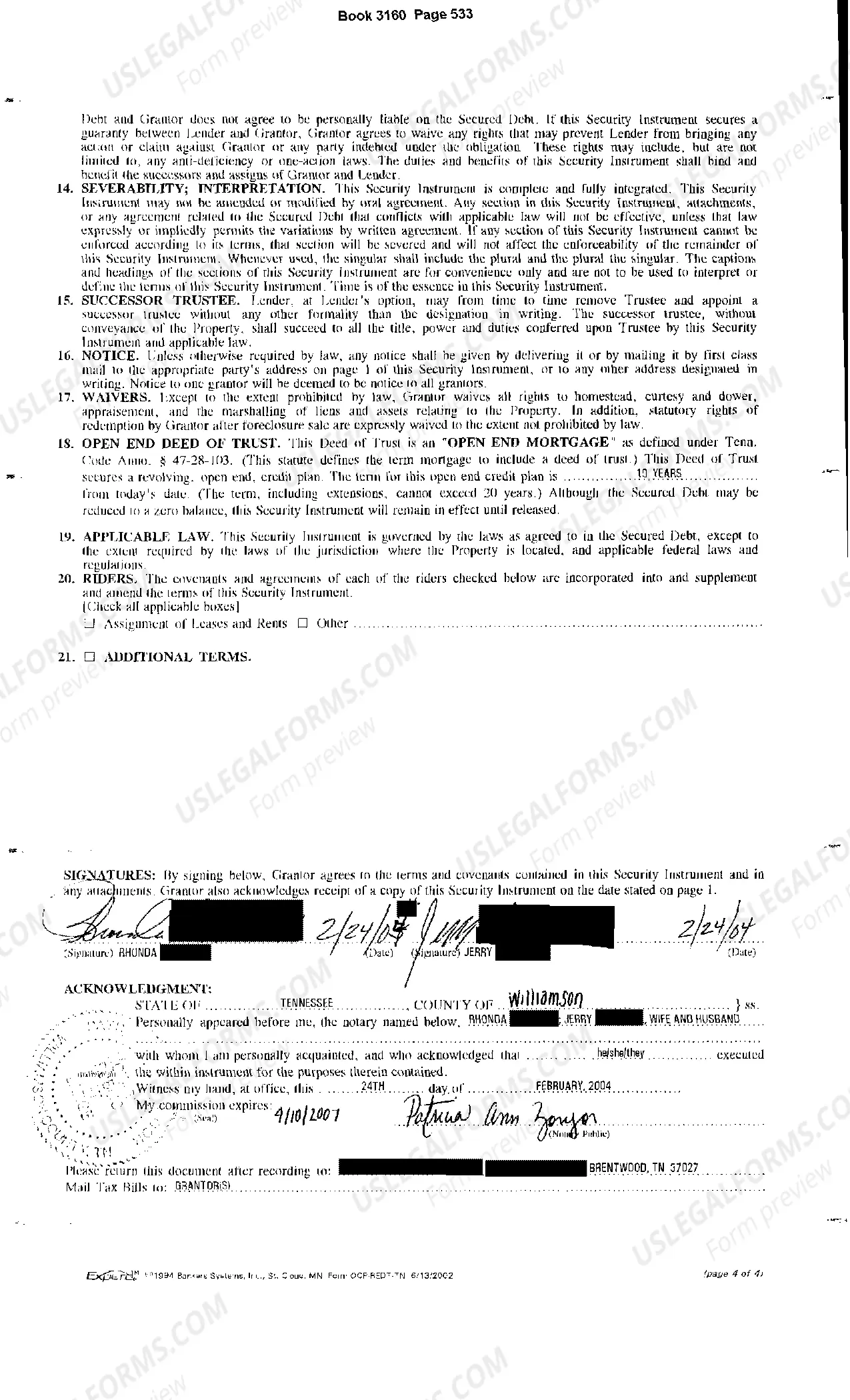

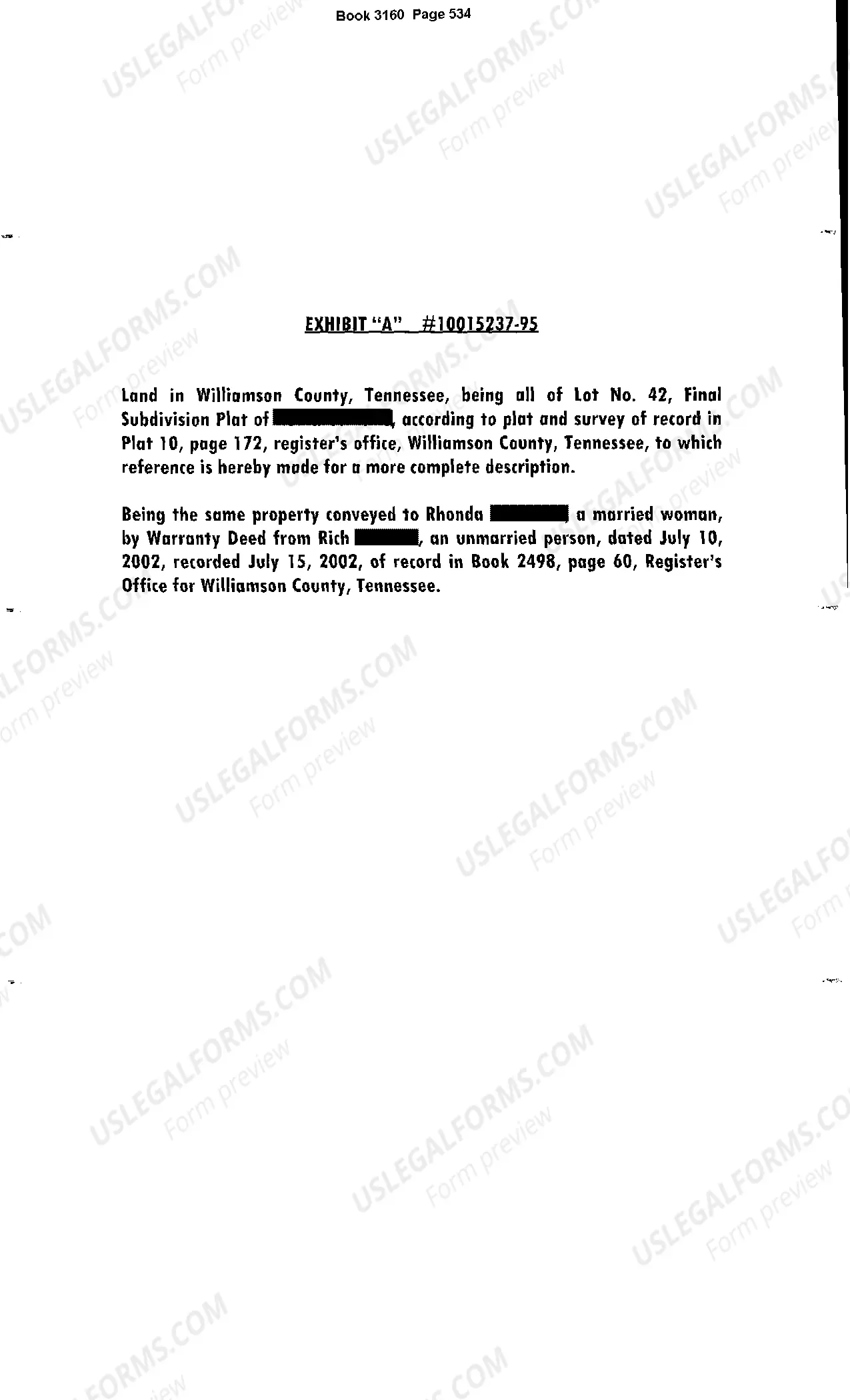

Memphis Tennessee Deed of Trust With Future Advance is a legal document that pertains to real estate transactions in the city of Memphis, Tennessee. This agreement is typically used when a borrower is obtaining a loan that will be secured by a property through a deed of trust arrangement. The Deed of Trust With Future Advance outlines the terms and conditions of the loan, including the amount borrowed, interest rate, repayment schedule, and any additional fees or charges. It also establishes the property being used as collateral for the loan, which will be described in detail within the document. One important aspect of the Memphis Tennessee Deed of Trust With Future Advance is the inclusion of future advances. This provision allows the lender to provide additional funds to the borrower in the future, secured by the same property and subject to the terms and conditions of the original loan. This can be beneficial for borrowers who may require additional funds for renovations, repairs, or other purposes without needing to initiate a new loan application process. Different types of Deed of Trust With Future Advance may exist depending on the specific needs of the borrower and lender. These variations may include fixed-rate or adjustable-rate loans, with or without a balloon payment, and specific terms regarding the future advance provisions. It is essential for all parties involved in a Memphis Tennessee Deed of Trust With Future Advance to understand their rights and obligations under the agreement. The borrower must make timely payments as specified in the loan documents, while the lender has the right to foreclose on the property in the event of default. To ensure the validity and enforceability of the Memphis Tennessee Deed of Trust With Future Advance, it must be executed in writing, signed by the borrower, and notarized. It is also generally recorded in the county where the property is located to provide public notice of the lien on the property. Overall, the Memphis Tennessee Deed of Trust With Future Advance is a crucial legal document that establishes the terms of a loan and the property's collateral in real estate transactions. It provides the necessary framework for both borrowers and lenders to protect their interests and fulfill their respective obligations.

Memphis Tennessee Deed of Trust With Future Advance

Description

How to fill out Memphis Tennessee Deed Of Trust With Future Advance?

Are you looking for a trustworthy and inexpensive legal forms supplier to get the Memphis Tennessee Deed of Trust With Future Advance? US Legal Forms is your go-to solution.

No matter if you require a simple arrangement to set regulations for cohabitating with your partner or a set of forms to move your divorce through the court, we got you covered. Our website provides more than 85,000 up-to-date legal document templates for personal and company use. All templates that we give access to aren’t universal and frameworked in accordance with the requirements of specific state and county.

To download the document, you need to log in account, locate the needed template, and hit the Download button next to it. Please remember that you can download your previously purchased document templates at any time from the My Forms tab.

Are you new to our platform? No worries. You can set up an account in minutes, but before that, make sure to do the following:

- Check if the Memphis Tennessee Deed of Trust With Future Advance conforms to the regulations of your state and local area.

- Read the form’s description (if available) to find out who and what the document is intended for.

- Start the search over if the template isn’t suitable for your specific situation.

Now you can create your account. Then pick the subscription option and proceed to payment. Once the payment is completed, download the Memphis Tennessee Deed of Trust With Future Advance in any available format. You can get back to the website when you need and redownload the document free of charge.

Getting up-to-date legal forms has never been easier. Give US Legal Forms a try now, and forget about wasting your valuable time researching legal papers online for good.