The Memphis Tennessee Intercreditor Agreement is a legally binding contract that outlines the rights and responsibilities of multiple creditors who have a claim on the same assets or collateral in the city of Memphis, Tennessee. This agreement is commonly used in various financial transactions, such as loans, mortgages, or lease agreements, where more than one lender or creditor is involved. The purpose of the intercreditor agreement is to establish a clear hierarchy of creditor rights and to define the priority of payment in case of default or liquidation. It ensures that each creditor's interests are protected and that there is a predetermined order in which they will be repaid. This agreement is crucial for maintaining stability and clarity in complex financial transactions involving multiple parties. There may be different types of Memphis Tennessee Intercreditor Agreements based on the specific circumstances of the transaction. These include: 1. First Lien Intercreditor Agreement: This agreement is made between the first lien holder and subsequent lien holders. It establishes the priority of payments between these parties if the borrower defaults on their obligations. The first lien holder is entitled to be repaid first, and the subsequent lien holders are ranked in order of priority. 2. Second Lien Intercreditor Agreement: This agreement is made between the second lien holder and subsequent lien holders. It establishes the priority of payments between these parties if the borrower defaults. The first lien holder's claims are prioritized over the second lien holder's claims, and subsequent lien holders are ranked accordingly. 3. Subordination Agreement: In certain cases, a subordination agreement may be included as part of the intercreditor agreement. This agreement establishes that one creditor agrees to subordinate their claim to another creditor. It effectively lowers the priority of the subordinated creditor's claim, which can provide additional security or leverage to the primary creditor. Regardless of the specific type of intercreditor agreement, these documents play a vital role in protecting the interests of multiple creditors in Memphis, Tennessee, by clearly defining their rights and obligations. They ensure a fair and efficient distribution of assets in case of default or liquidation and help maintain a transparent and orderly financial system.

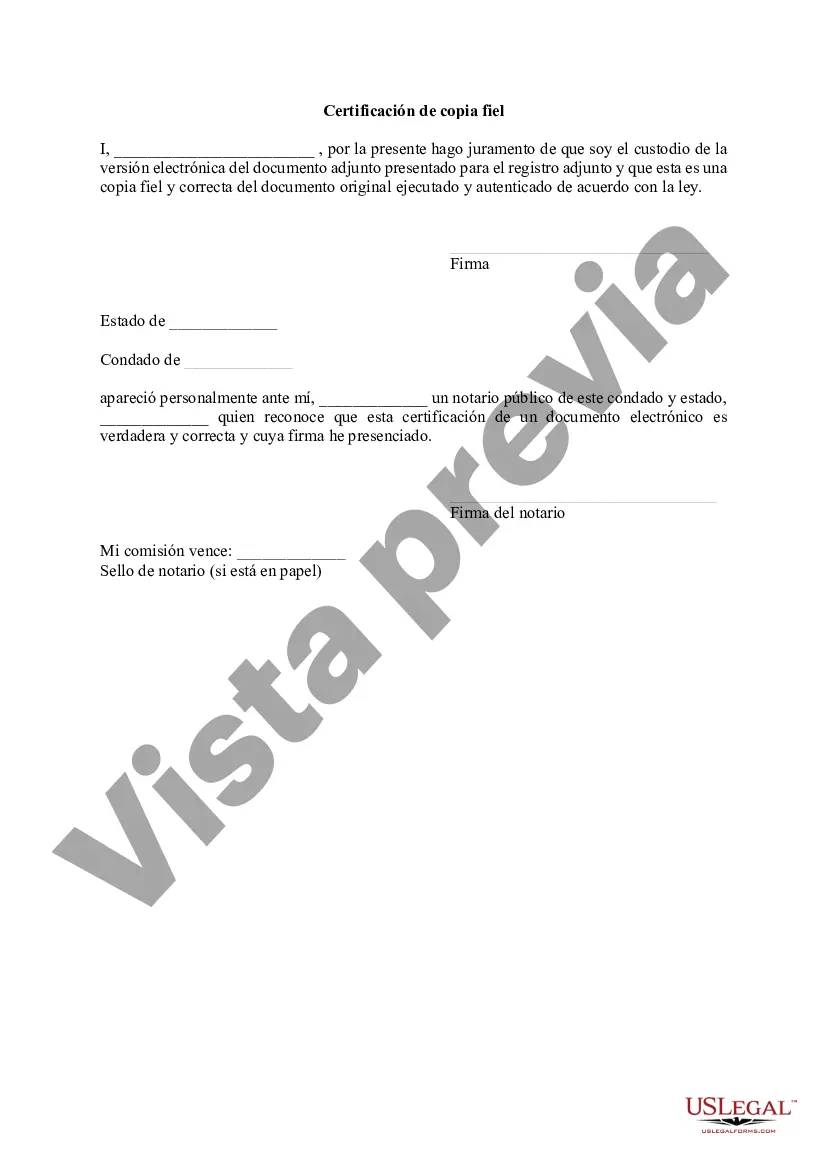

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Memphis Tennessee Acuerdo entre acreedores - Tennessee Intercreditor Agreement

Description

How to fill out Memphis Tennessee Acuerdo Entre Acreedores?

Take advantage of the US Legal Forms and obtain instant access to any form template you want. Our beneficial platform with thousands of templates makes it easy to find and get virtually any document sample you will need. It is possible to export, complete, and certify the Memphis Tennessee Intercreditor Agreement in just a couple of minutes instead of surfing the Net for many hours looking for the right template.

Utilizing our library is a wonderful strategy to raise the safety of your form filing. Our experienced legal professionals regularly review all the documents to make sure that the templates are relevant for a particular state and compliant with new laws and polices.

How do you get the Memphis Tennessee Intercreditor Agreement? If you already have a profile, just log in to the account. The Download option will be enabled on all the samples you view. Additionally, you can get all the previously saved files in the My Forms menu.

If you haven’t registered a profile yet, follow the tips below:

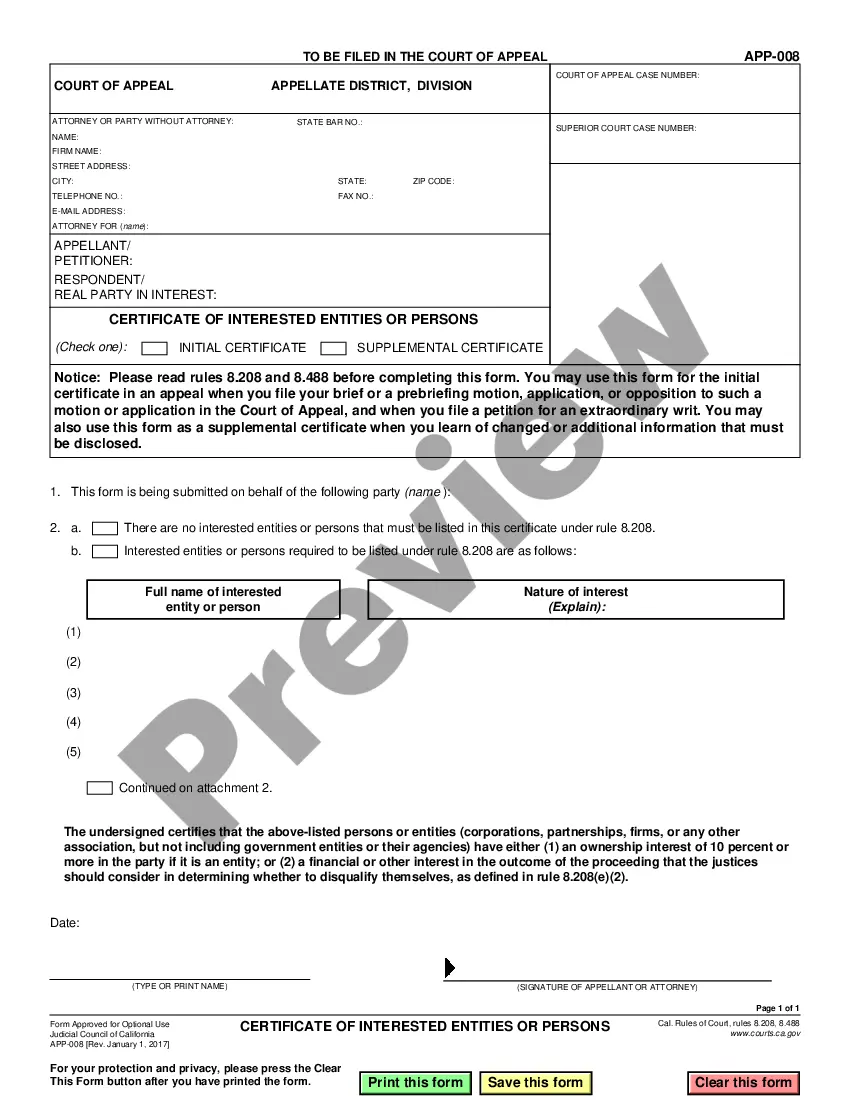

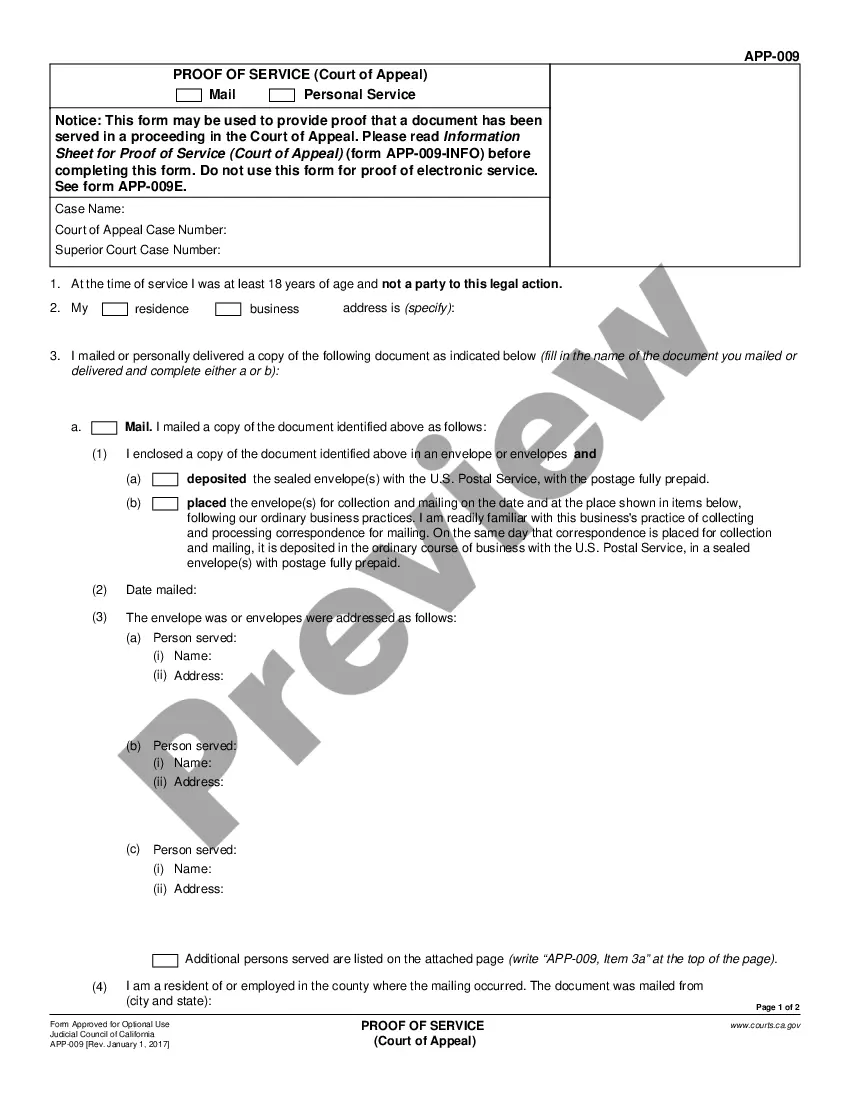

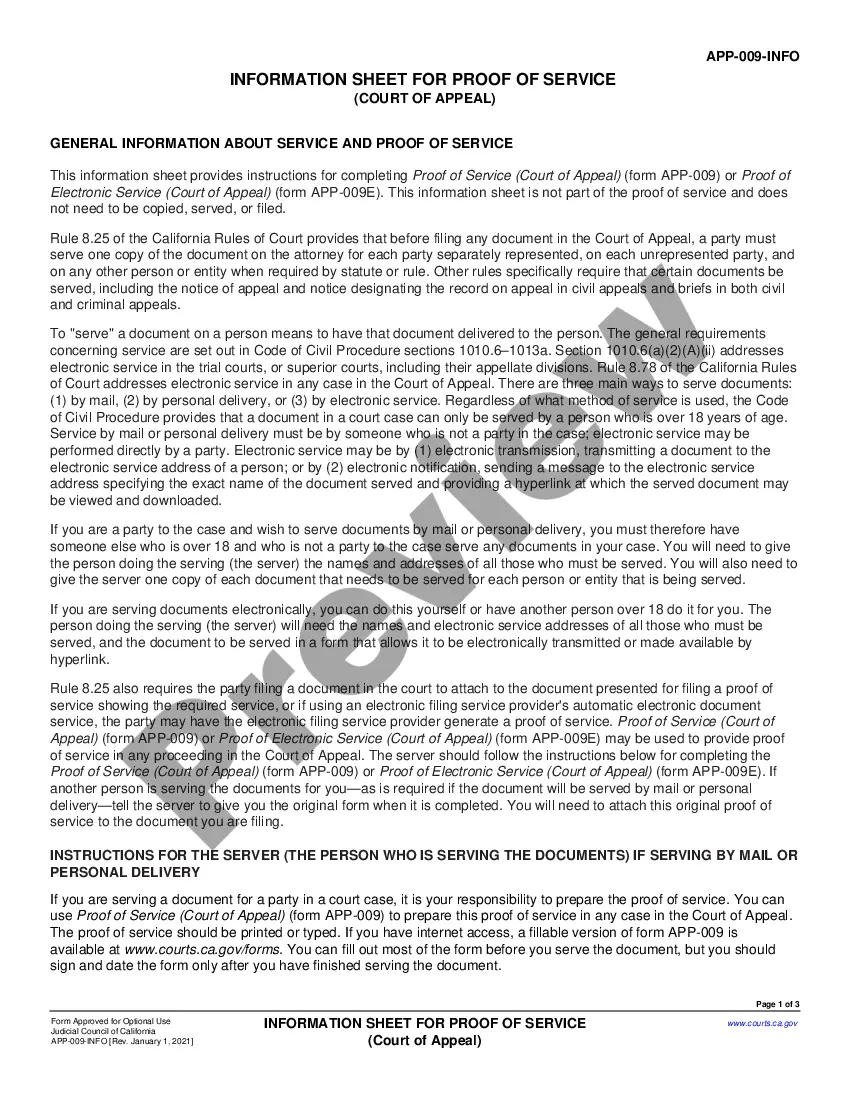

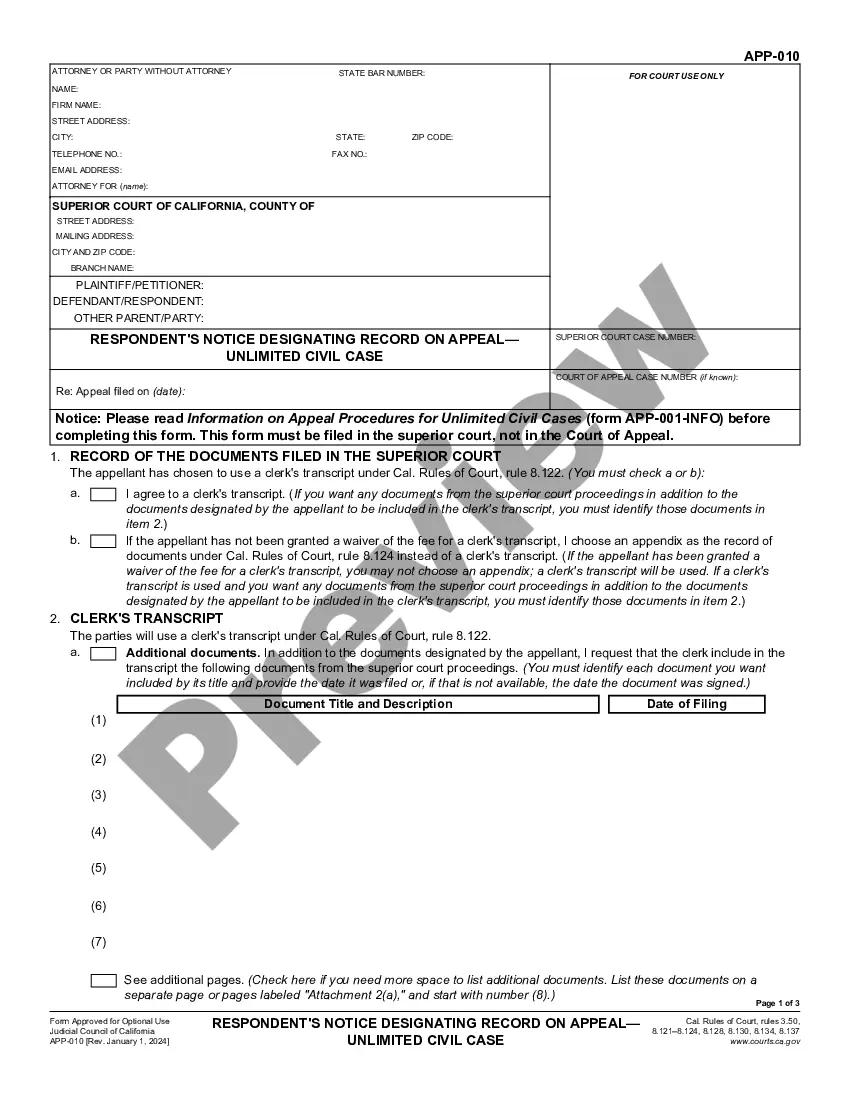

- Open the page with the form you need. Ensure that it is the form you were looking for: verify its name and description, and make use of the Preview option when it is available. Otherwise, make use of the Search field to find the appropriate one.

- Start the saving process. Select Buy Now and choose the pricing plan that suits you best. Then, sign up for an account and pay for your order with a credit card or PayPal.

- Download the document. Choose the format to obtain the Memphis Tennessee Intercreditor Agreement and revise and complete, or sign it according to your requirements.

US Legal Forms is probably the most extensive and trustworthy document libraries on the internet. We are always happy to help you in any legal process, even if it is just downloading the Memphis Tennessee Intercreditor Agreement.

Feel free to make the most of our platform and make your document experience as convenient as possible!