A Nashville Tennessee Hyphenation Agreement refers to a legal contract entered into by a borrower (hypothenar) and a lender (hypothecatee) in the city of Nashville, Tennessee. This agreement enables the borrower to secure a loan or credit facility by using a valuable asset, typically a vehicle, as collateral. Keywords: Nashville Tennessee, hyphenation agreement, borrower, lender, legal contract, loan, credit facility, valuable asset, collateral. When an individual or a business entity wishes to obtain financing, they may choose to collateralize their vehicle through a Nashville Tennessee Hyphenation Agreement to provide assurance to the lender. By pledging the vehicle as collateral, the borrower places a lien on the asset, granting the lender the legal right to seize and sell it in the event of default. This additional security allows the lender to offer better terms, such as lower interest rates or higher loan amounts. Types of Nashville Tennessee Hyphenation Agreements may vary based on the specific asset being used as collateral. While vehicles, such as cars, trucks, motorcycles, and boats, are commonly used in this type of agreement, other assets like machinery or equipment can also be collateralized. In Nashville, there are certain regulations and guidelines that govern the creation and execution of Hyphenation Agreements. These agreements typically outline the terms and conditions of the loan, the amount borrowed, the period of lending, the interest rate, and the consequences of default. It is crucial for both parties involved in a Nashville Tennessee Hyphenation Agreement to fully understand the terms and obligations stated in the contract. The borrower must ensure they can meet the repayment schedule to avoid any potential loss of the collateral asset. The lender, on the other hand, must diligently assess the value and condition of the asset before approving the loan to mitigate their risk. In conclusion, a Nashville Tennessee Hyphenation Agreement is a legal contract that enables individuals or businesses in Nashville to secure a loan using a valuable asset as collateral. This agreement provides added security for the lender and allows the borrower to access loan facilities that they might not have qualified for without collateral. Different agreements exist depending on the type of asset being used as collateral, and it is essential for both parties involved to fully comprehend the terms and responsibilities outlined in the contract.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nashville Tennessee Acuerdo de hipoteca - Tennessee Hypothecation Agreement

Description

How to fill out Nashville Tennessee Acuerdo De Hipoteca?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly categorized by area of usage and jurisdiction areas, so searching for the Nashville Tennessee Hypothecation Agreement becomes as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, getting the Nashville Tennessee Hypothecation Agreement takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional steps to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form catalogue:

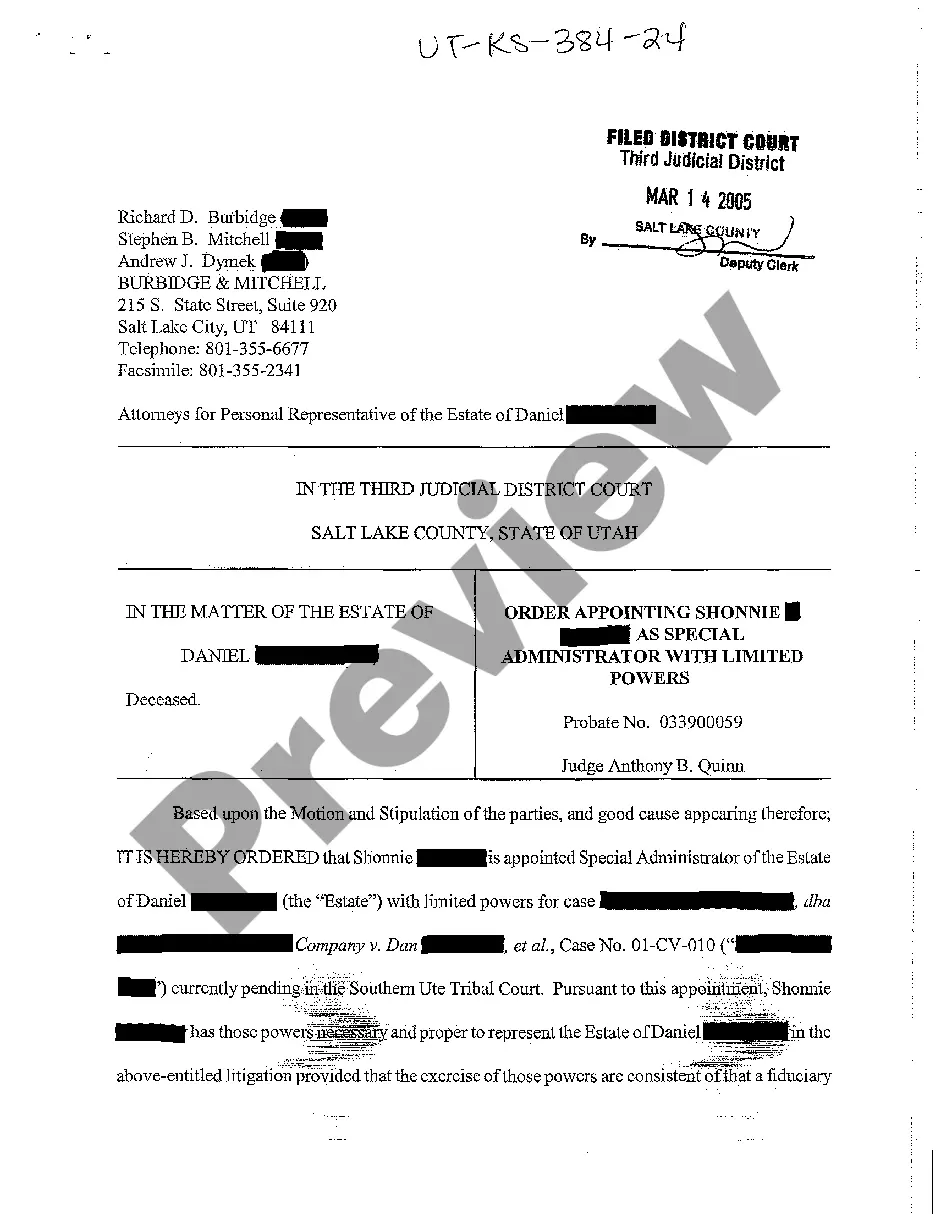

- Look at the Preview mode and form description. Make sure you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, utilize the Search tab above to get the right one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Give your credit card details or use your PayPal account to pay for the service.

- Download the Nashville Tennessee Hypothecation Agreement. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!