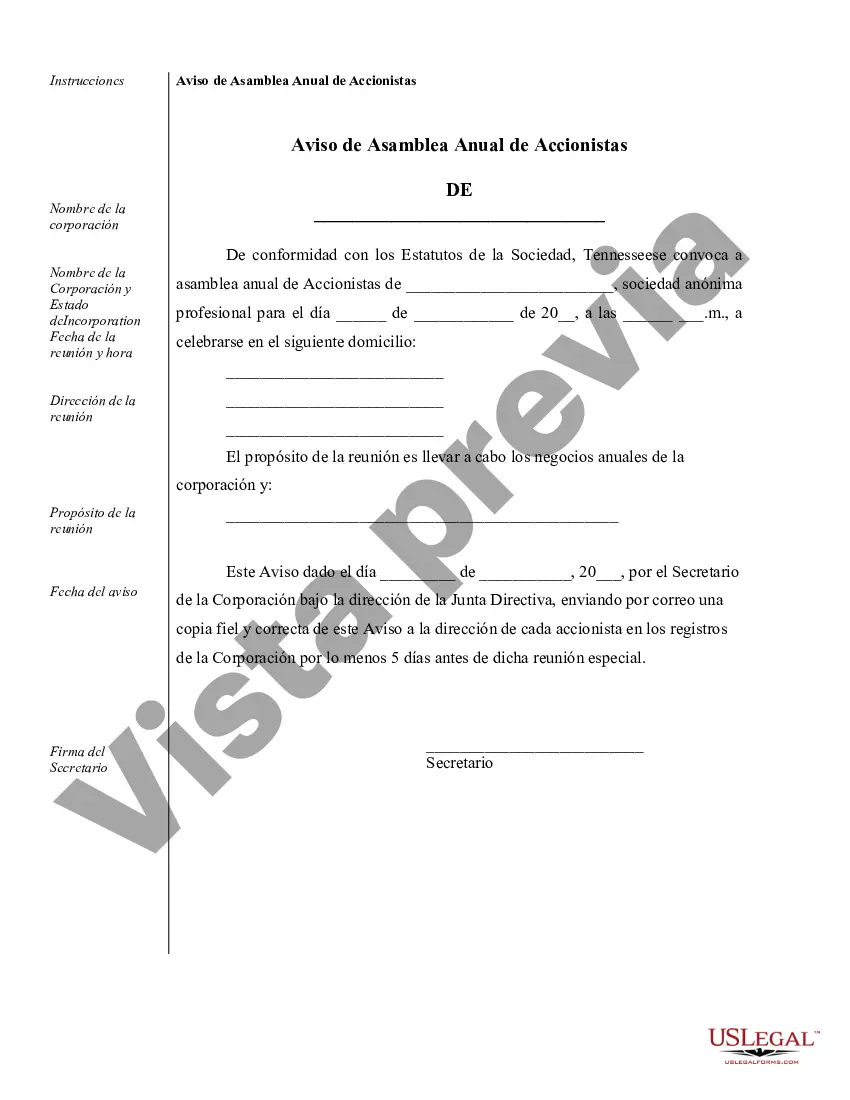

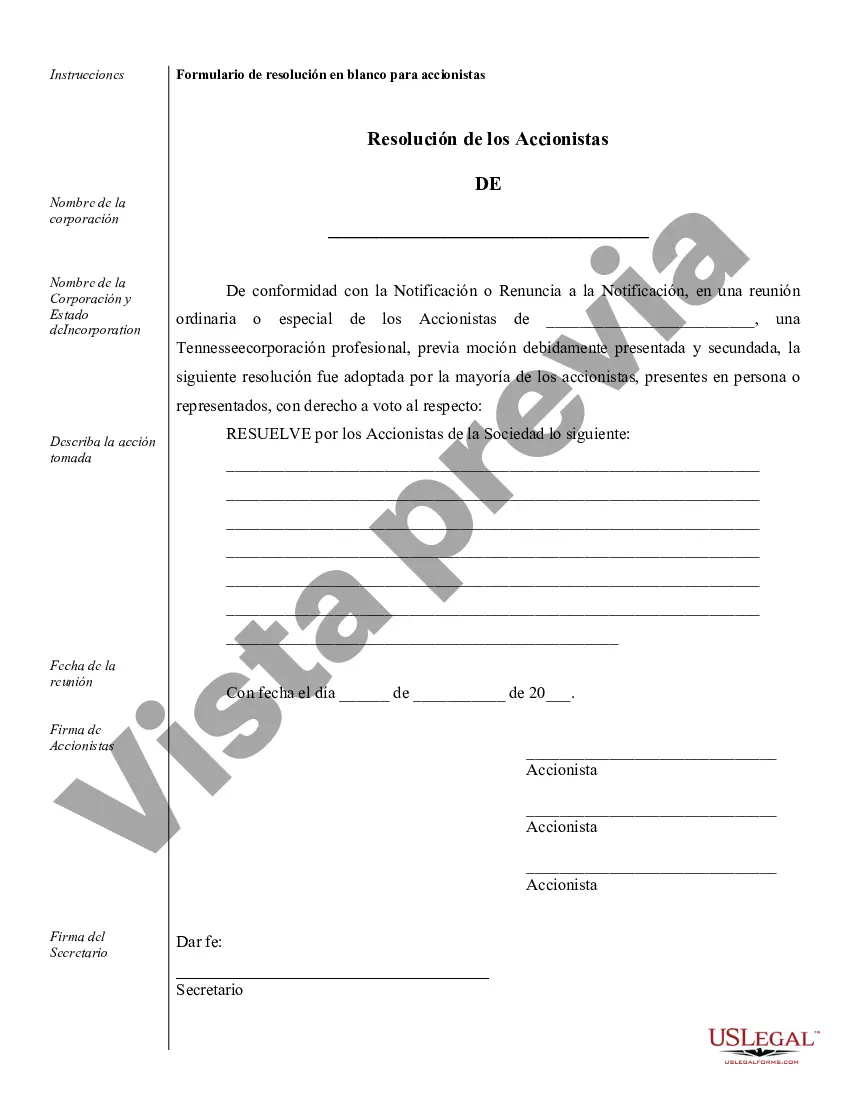

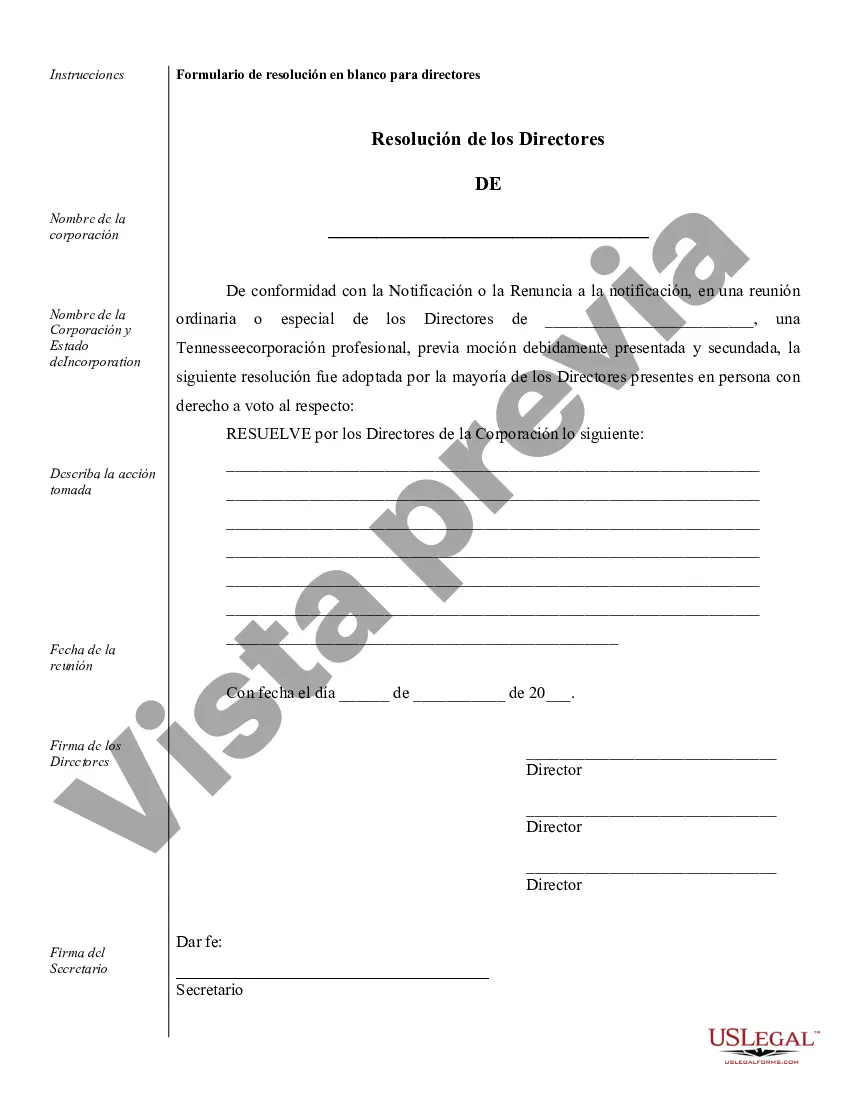

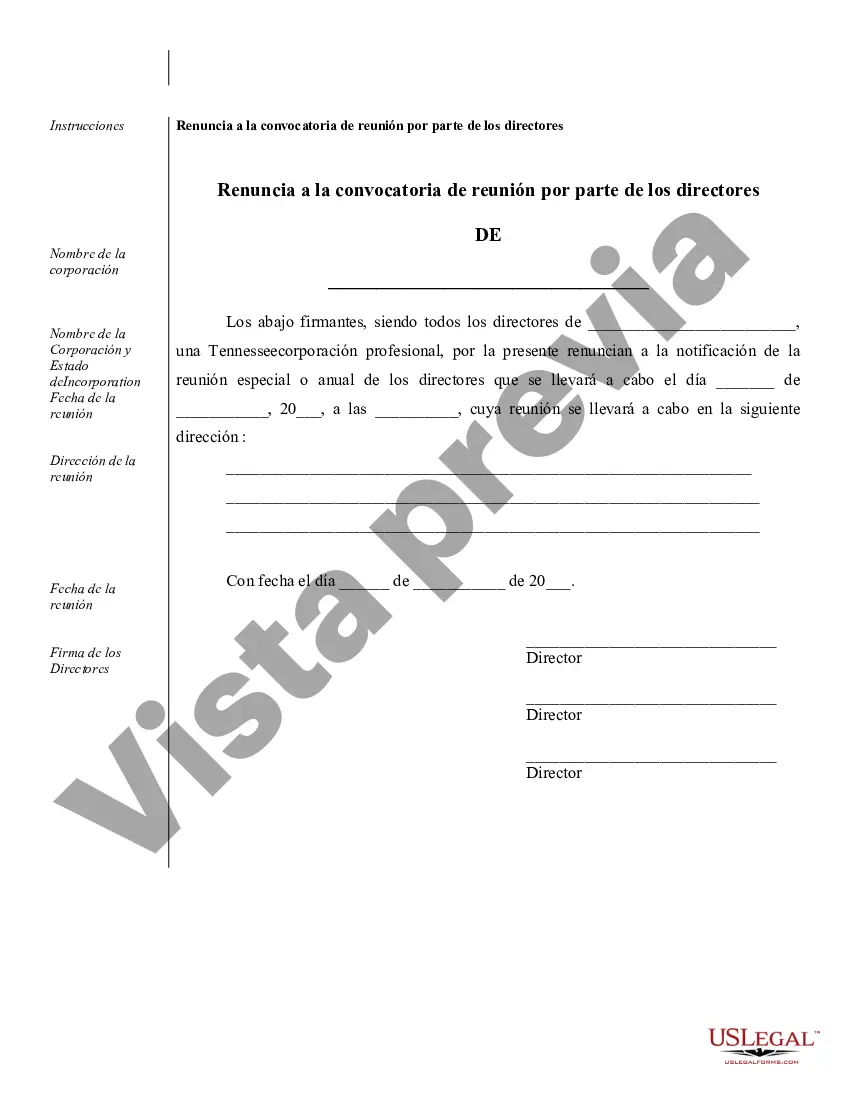

Nashville Sample Corporate Records for a Tennessee Professional Corporation play a vital role in ensuring the transparency and legal compliance of businesses operating in Tennessee. These records encompass a wide range of documentation and paperwork that details important aspects of the corporation's formation, structure, and ongoing operations. They enable corporate entities to maintain accurate records as required by state law and provide a record of the company's activities for future reference. Several types of Nashville Sample Corporate Records exist for a Tennessee Professional Corporation, including: 1. Articles of Incorporation: This document outlines the essential information about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. 2. Bylaws: Bylaws are rules and regulations established by the corporation to govern its internal affairs and ensure smooth operation. They address matters like the composition of the board of directors, frequency of meetings, voting procedures, and management of corporate records. 3. Board of Directors’ Meeting Minutes: These records document the discussions and decisions made during board meetings. They provide a comprehensive account of board actions, including voting outcomes, resolutions, and corporate initiatives. 4. Shareholder Meeting Minutes: Similar to board meeting minutes, shareholder meeting minutes record the discussions and decisions made during general meetings. These minutes disclose the views of shareholders, major voting outcomes, and any changes to the company's structure. 5. Stock Ledger: This record maintains information on the corporation's stock issuance, transfers, and ownership details. It includes the names of shareholders, the number of shares held, and any changes to stock ownership. 6. Financial Statements: Essential financial documentation, including balance sheets, income statements, and cash flow statements, are necessary to assess the corporation's financial health and aid in tax filings and audits. 7. Contracts and Agreements: Records of contracts and agreements entered into by the corporation, such as leases, employment contracts, vendor agreements, and client contracts, should be maintained for legal purposes. 8. Licenses and Permits: Copies of all licenses and permits obtained by the corporation, including professional licenses specific to the industry it operates in, should be kept in compliance with state and local regulations. 9. Tax Filings: These records include federal, state, and local tax returns, along with supporting documents, to ensure timely and accurate reporting of the corporation's financial activities to tax authorities. 10. Annual Reports: Tennessee law may require Professional Corporations to file an annual report with the Secretary of State, providing an overview of the corporation's activities, including financial information and changes in company structure. Keeping meticulously organized Nashville Sample Corporate Records for a Tennessee Professional Corporation is crucial for maintaining compliance, efficient internal governance, and protecting the corporation's legal interests. It is advisable to consult with legal professionals to ensure all required records are appropriately maintained throughout the corporation's existence.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nashville Ejemplos de registros corporativos para una corporación profesional de Tennessee - Sample Corporate Records for a Tennessee Professional Corporation

Description

How to fill out Nashville Ejemplos De Registros Corporativos Para Una Corporación Profesional De Tennessee?

We always strive to minimize or prevent legal damage when dealing with nuanced legal or financial matters. To do so, we sign up for attorney services that, as a rule, are very expensive. However, not all legal matters are as just complex. Most of them can be dealt with by ourselves.

US Legal Forms is a web-based collection of updated DIY legal documents addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without turning to an attorney. We provide access to legal form templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Benefit from US Legal Forms whenever you need to get and download the Nashville Sample Corporate Records for a Tennessee Professional Corporation or any other form quickly and securely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again in the My Forms tab.

The process is just as effortless if you’re unfamiliar with the platform! You can create your account in a matter of minutes.

- Make sure to check if the Nashville Sample Corporate Records for a Tennessee Professional Corporation adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Nashville Sample Corporate Records for a Tennessee Professional Corporation is proper for you, you can pick the subscription option and proceed to payment.

- Then you can download the form in any available file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Make the most of US Legal Forms now to save efforts and resources!