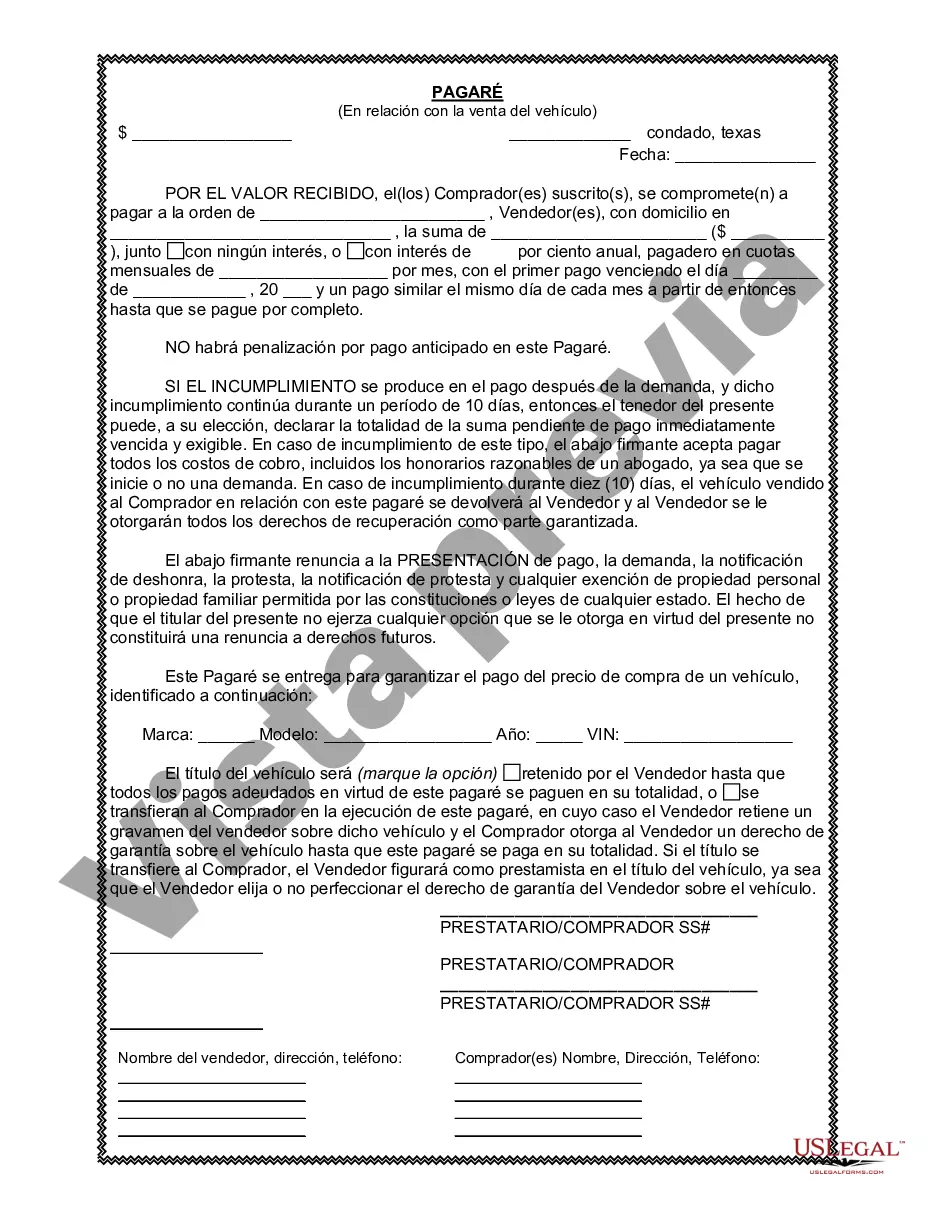

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

Austin Texas Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and a seller. This note is commonly used when the buyer cannot pay the full purchase price upfront and requires financing from the seller. Keywords: Austin Texas, Promissory Note, vehicle, automobile, sale, loan agreement, buyer, seller, financing. The purpose of the Austin Texas Promissory Note in connection with the sale of a vehicle or automobile is to establish a binding agreement between the involved parties regarding the terms of the loan. It serves as evidence of the loan transaction, ensuring that both parties are protected and aware of their responsibilities. This promissory note specifies important details such as the names and contact information of the buyer and seller, detailed vehicle description, purchase price, down payment, interest rate, payment plan, and repayment terms. It also includes provisions regarding late fees, default, and repossession of the vehicle in case of non-payment. Different types of Austin Texas Promissory Note in connection with the sale of a vehicle or automobile may include: 1. Secured Promissory Note: This type of promissory note includes a security interest in the vehicle, granting the seller the right to repossess the vehicle if the buyer defaults on the loan. In such cases, the seller can reclaim the vehicle and sell it to recover the outstanding balance. 2. Unsecured Promissory Note: Unlike the secured promissory note, this type does not involve any collateral. It solely relies on the buyer's promise to repay the loan as agreed upon. If the buyer defaults, the seller may need to pursue legal action to recover the owed amount. 3. Installment Promissory Note: This note outlines a repayment plan where the seller agrees to accept payments in installments over a specific period. The payment schedule is usually structured monthly, detailing the amount due, including interest, until the loan is fully repaid. It is important for both parties involved to thoroughly review and understand the terms and conditions of the promissory note before signing. It is recommended to consult with legal professionals or experts in Austin, Texas, to ensure that the promissory note complies with all applicable state laws and regulations. In conclusion, an Austin Texas Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that helps facilitate a loan agreement between a buyer and a seller. The note specifies the terms of the loan, repayment schedule, interest rate, and provisions for default or repossession. Different types of promissory notes may exist depending on whether the agreement is secured or unsecured, and whether payments are made in installments.Austin Texas Promissory Note in connection with the sale of a vehicle or automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and a seller. This note is commonly used when the buyer cannot pay the full purchase price upfront and requires financing from the seller. Keywords: Austin Texas, Promissory Note, vehicle, automobile, sale, loan agreement, buyer, seller, financing. The purpose of the Austin Texas Promissory Note in connection with the sale of a vehicle or automobile is to establish a binding agreement between the involved parties regarding the terms of the loan. It serves as evidence of the loan transaction, ensuring that both parties are protected and aware of their responsibilities. This promissory note specifies important details such as the names and contact information of the buyer and seller, detailed vehicle description, purchase price, down payment, interest rate, payment plan, and repayment terms. It also includes provisions regarding late fees, default, and repossession of the vehicle in case of non-payment. Different types of Austin Texas Promissory Note in connection with the sale of a vehicle or automobile may include: 1. Secured Promissory Note: This type of promissory note includes a security interest in the vehicle, granting the seller the right to repossess the vehicle if the buyer defaults on the loan. In such cases, the seller can reclaim the vehicle and sell it to recover the outstanding balance. 2. Unsecured Promissory Note: Unlike the secured promissory note, this type does not involve any collateral. It solely relies on the buyer's promise to repay the loan as agreed upon. If the buyer defaults, the seller may need to pursue legal action to recover the owed amount. 3. Installment Promissory Note: This note outlines a repayment plan where the seller agrees to accept payments in installments over a specific period. The payment schedule is usually structured monthly, detailing the amount due, including interest, until the loan is fully repaid. It is important for both parties involved to thoroughly review and understand the terms and conditions of the promissory note before signing. It is recommended to consult with legal professionals or experts in Austin, Texas, to ensure that the promissory note complies with all applicable state laws and regulations. In conclusion, an Austin Texas Promissory Note in connection with the sale of a vehicle or automobile is a legally binding document that helps facilitate a loan agreement between a buyer and a seller. The note specifies the terms of the loan, repayment schedule, interest rate, and provisions for default or repossession. Different types of promissory notes may exist depending on whether the agreement is secured or unsecured, and whether payments are made in installments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.