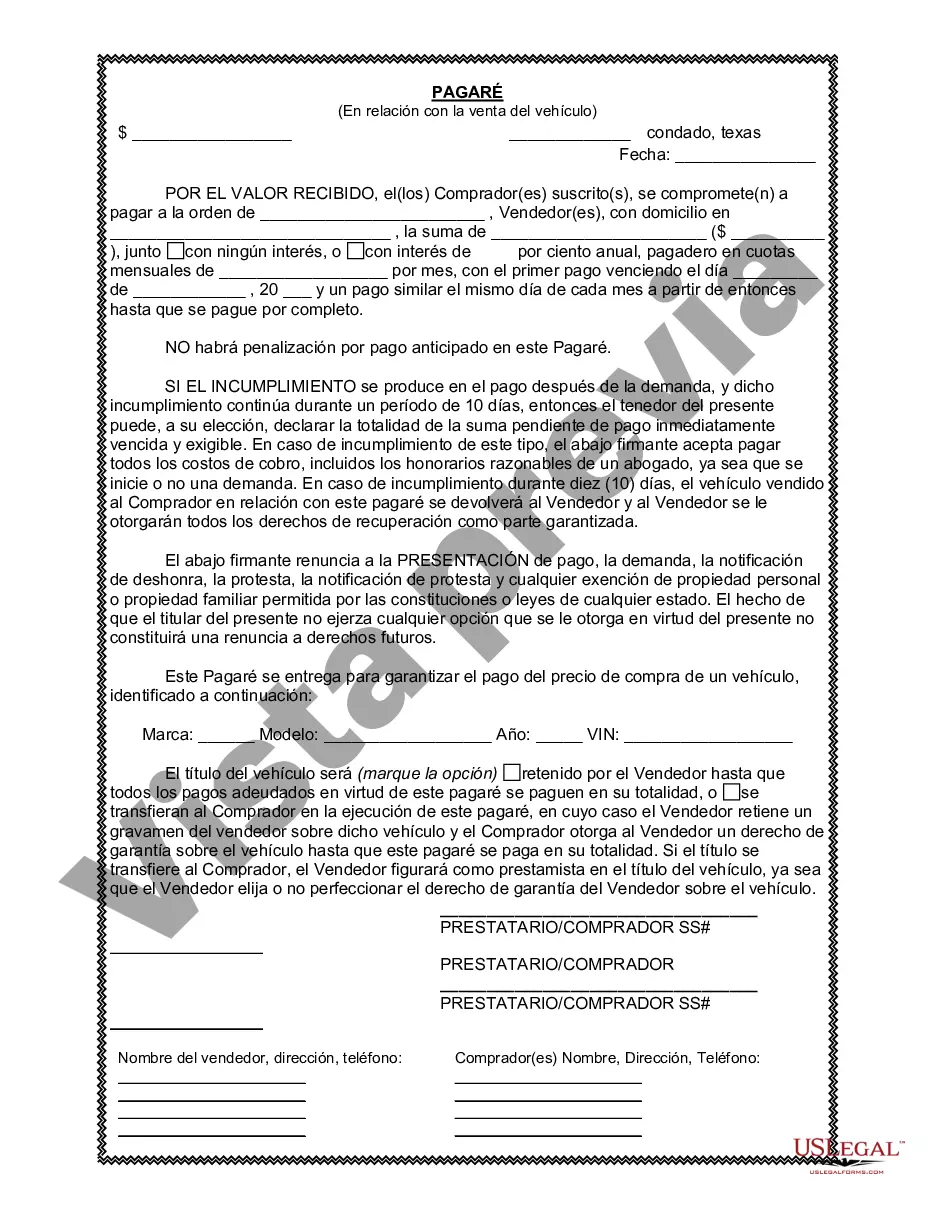

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A Collin Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller in Collin County, Texas, specifically for the purchase of a vehicle or automobile. This promissory note serves as a written agreement and provides protection for both parties involved in the transaction. Keywords: Collin Texas Promissory Note, Sale of Vehicle, Sale of Automobile, Loan Agreement, Buyer, Seller, Collin County, Texas, Terms and Conditions, Purchase, Written Agreement, Protection. There are different types of Collin Texas Promissory Note in Connection with Sale of Vehicle or Automobile that can be used depending on the specific terms agreed upon by the buyer and seller. Some commonly used types are: 1. Fixed-Term Promissory Note: This type of promissory note specifies a specific repayment period, usually in monthly installments, over a predetermined length of time. The terms will include the repayment schedule, the interest rate, and any penalties for late payments or default. 2. Balloon-Payment Promissory Note: A balloon-payment promissory note is an arrangement where the buyer agrees to make smaller monthly payments for a specific period of time, with a large final payment (balloon payment) due at the end of the term. This may be suitable for buyers who expect to have a large sum of money available at a later date. 3. Installment Promissory Note: An installment promissory note allows the buyer to pay for the vehicle in regular, equal installment payments over a specified period. The note will outline the amounts, due dates, and interest rate for each installment. 4. Variable Interest Rate Promissory Note: In a variable interest rate promissory note, the interest rate charged on the loan may change over time based on specific conditions or market interest rates. This kind of note will specify how the interest rate will be determined and the frequency of adjustment. 5. Secured Promissory Note: A secured promissory note includes a provision that allows the seller to take possession of the vehicle in the event of default or failure to make payments. This provision provides an added layer of security for the seller. It is crucial for both buyers and sellers to fully understand the terms and conditions outlined in the Collin Texas Promissory Note in Connection with Sale of Vehicle or Automobile. Seeking legal advice or professional assistance when drafting or signing this document is highly recommended ensuring compliance with local laws and to protect the interests of both parties involved.A Collin Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a legal document that outlines the terms and conditions of a loan agreement between a buyer and seller in Collin County, Texas, specifically for the purchase of a vehicle or automobile. This promissory note serves as a written agreement and provides protection for both parties involved in the transaction. Keywords: Collin Texas Promissory Note, Sale of Vehicle, Sale of Automobile, Loan Agreement, Buyer, Seller, Collin County, Texas, Terms and Conditions, Purchase, Written Agreement, Protection. There are different types of Collin Texas Promissory Note in Connection with Sale of Vehicle or Automobile that can be used depending on the specific terms agreed upon by the buyer and seller. Some commonly used types are: 1. Fixed-Term Promissory Note: This type of promissory note specifies a specific repayment period, usually in monthly installments, over a predetermined length of time. The terms will include the repayment schedule, the interest rate, and any penalties for late payments or default. 2. Balloon-Payment Promissory Note: A balloon-payment promissory note is an arrangement where the buyer agrees to make smaller monthly payments for a specific period of time, with a large final payment (balloon payment) due at the end of the term. This may be suitable for buyers who expect to have a large sum of money available at a later date. 3. Installment Promissory Note: An installment promissory note allows the buyer to pay for the vehicle in regular, equal installment payments over a specified period. The note will outline the amounts, due dates, and interest rate for each installment. 4. Variable Interest Rate Promissory Note: In a variable interest rate promissory note, the interest rate charged on the loan may change over time based on specific conditions or market interest rates. This kind of note will specify how the interest rate will be determined and the frequency of adjustment. 5. Secured Promissory Note: A secured promissory note includes a provision that allows the seller to take possession of the vehicle in the event of default or failure to make payments. This provision provides an added layer of security for the seller. It is crucial for both buyers and sellers to fully understand the terms and conditions outlined in the Collin Texas Promissory Note in Connection with Sale of Vehicle or Automobile. Seeking legal advice or professional assistance when drafting or signing this document is highly recommended ensuring compliance with local laws and to protect the interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.