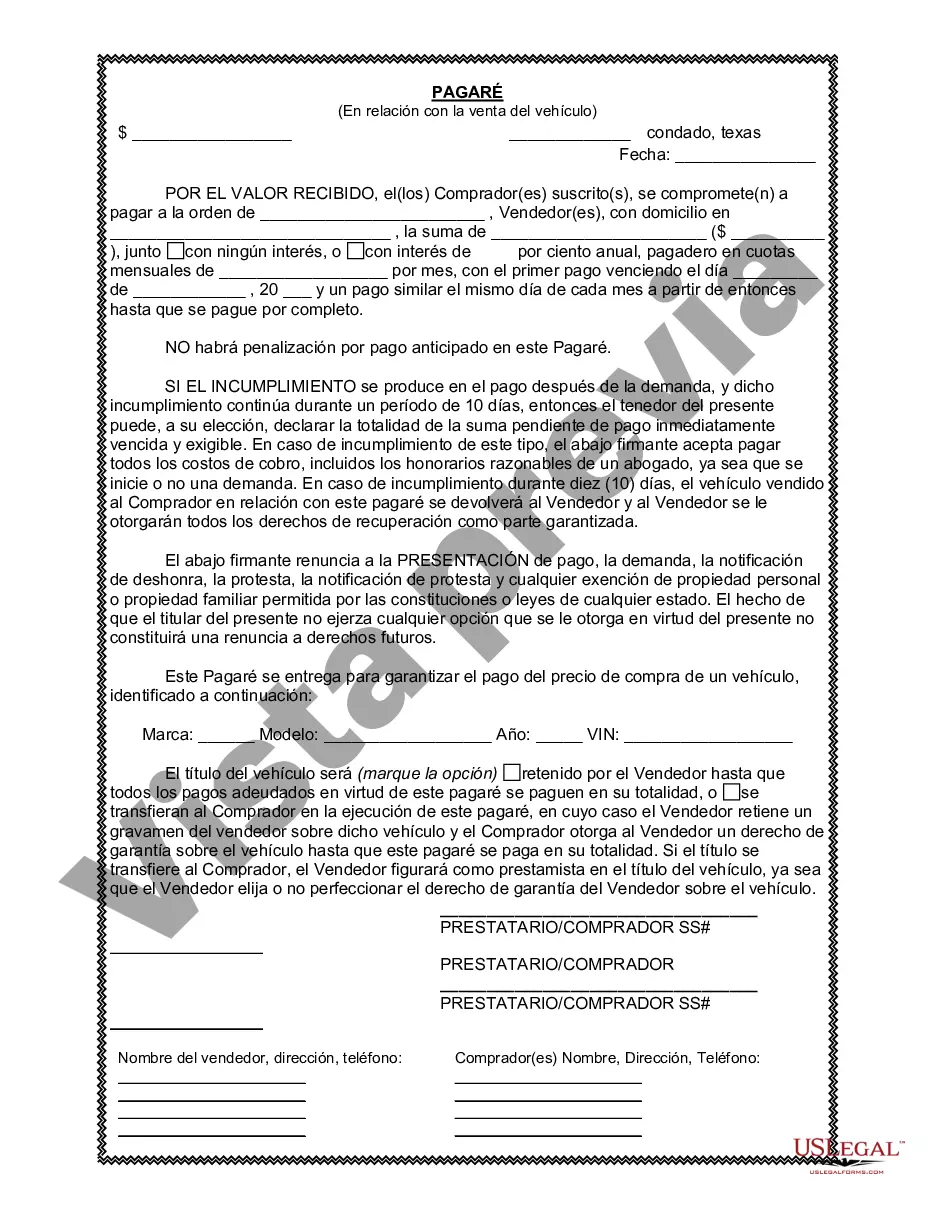

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legal document that outlines the terms and conditions of a loan agreement between two parties. In the context of a sale of a vehicle or automobile in Grand Prairie, Texas, a promissory note can be used to formalize the payment arrangement between the buyer and the seller. It serves as a contract that ensures the buyer's obligation to pay the agreed amount within a specific period of time. The Grand Prairie Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a crucial document in such transactions, providing protection and clarity for both parties involved. It contains key details, including the amount borrowed, interest rate (if any), repayment schedule, consequences of default, and any additional terms that the parties may agree upon. In Grand Prairie, Texas, there may be different types of promissory notes used in connection with the sale of a vehicle or automobile. Some of these variations include: 1. Installment Sales Promissory Note: This type of promissory note outlines a repayment plan divided into installments. It specifies the amount of each installment payment and the due dates until the total amount is fulfilled. 2. Balloon Payment Promissory Note: A balloon payment promissory note allows the buyer to make smaller monthly payments, with a larger lump sum payment at the end of the term. This type of note is commonly used when the buyer needs time to arrange financing for the final payment. 3. Secured Promissory Note: In this type of promissory note, the seller retains a security interest in the vehicle or automobile until the debt is fully paid. If the buyer fails to make payments as agreed, the seller has the right to repossess the vehicle. 4. Unsecured Promissory Note: An unsecured promissory note does not require collateral. Instead, it relies solely on the borrower's promise to repay the debt. This type of note may include a higher interest rate to offset the absence of collateral. Regardless of the type of promissory note used, it is essential to consult with legal professionals to ensure compliance with Grand Prairie, Texas, laws and regulations. This documentation can help protect the rights of both the buyer and seller and establish a clear understanding of the payment terms and responsibilities.A promissory note is a legal document that outlines the terms and conditions of a loan agreement between two parties. In the context of a sale of a vehicle or automobile in Grand Prairie, Texas, a promissory note can be used to formalize the payment arrangement between the buyer and the seller. It serves as a contract that ensures the buyer's obligation to pay the agreed amount within a specific period of time. The Grand Prairie Texas Promissory Note in Connection with Sale of Vehicle or Automobile is a crucial document in such transactions, providing protection and clarity for both parties involved. It contains key details, including the amount borrowed, interest rate (if any), repayment schedule, consequences of default, and any additional terms that the parties may agree upon. In Grand Prairie, Texas, there may be different types of promissory notes used in connection with the sale of a vehicle or automobile. Some of these variations include: 1. Installment Sales Promissory Note: This type of promissory note outlines a repayment plan divided into installments. It specifies the amount of each installment payment and the due dates until the total amount is fulfilled. 2. Balloon Payment Promissory Note: A balloon payment promissory note allows the buyer to make smaller monthly payments, with a larger lump sum payment at the end of the term. This type of note is commonly used when the buyer needs time to arrange financing for the final payment. 3. Secured Promissory Note: In this type of promissory note, the seller retains a security interest in the vehicle or automobile until the debt is fully paid. If the buyer fails to make payments as agreed, the seller has the right to repossess the vehicle. 4. Unsecured Promissory Note: An unsecured promissory note does not require collateral. Instead, it relies solely on the borrower's promise to repay the debt. This type of note may include a higher interest rate to offset the absence of collateral. Regardless of the type of promissory note used, it is essential to consult with legal professionals to ensure compliance with Grand Prairie, Texas, laws and regulations. This documentation can help protect the rights of both the buyer and seller and establish a clear understanding of the payment terms and responsibilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.