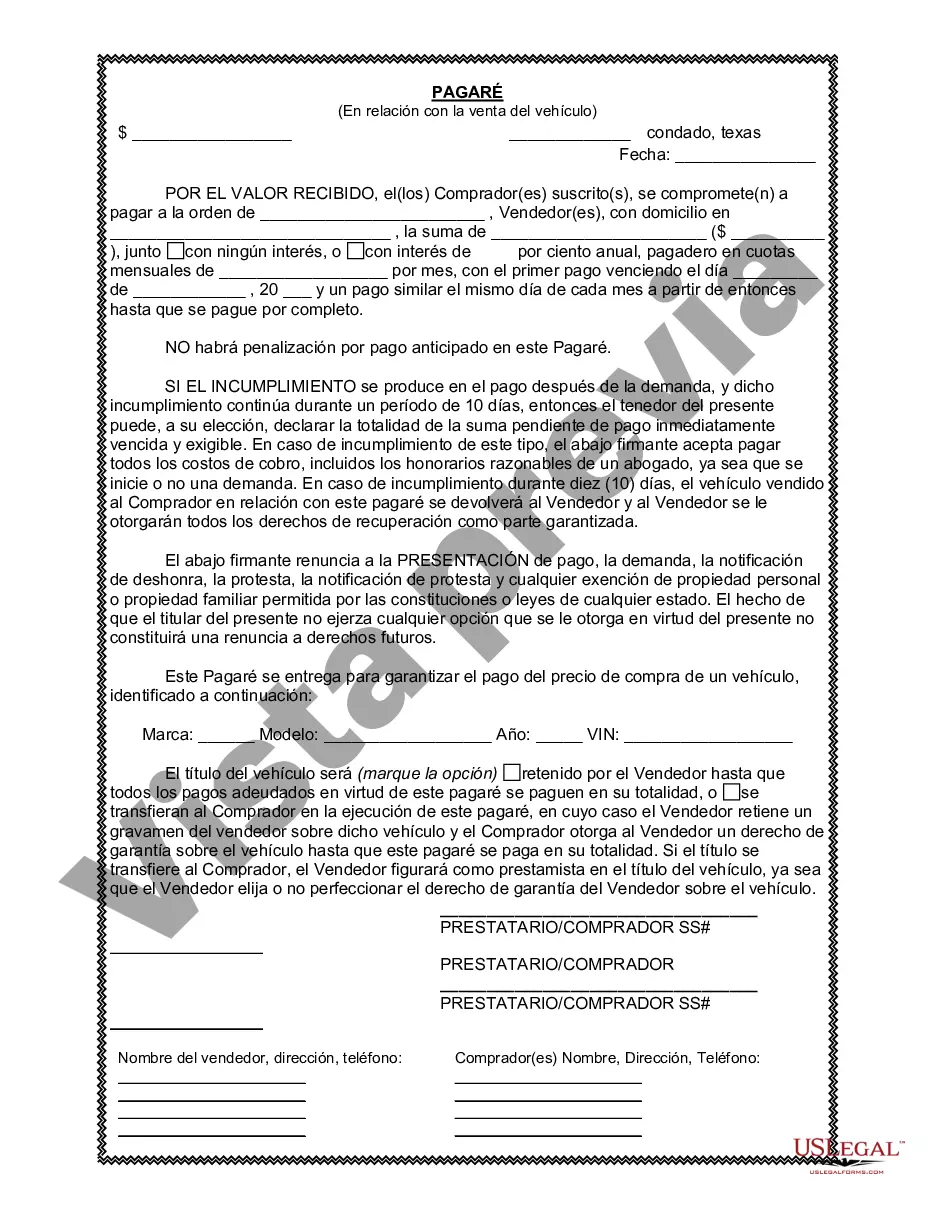

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legal document that establishes a written agreement between a buyer and a seller in a financial transaction. In the context of a vehicle or automobile purchase, an Odessa Texas Promissory Note in Connection with the Sale of Vehicle or Automobile is a document that outlines the terms and conditions of the sale, including the payment agreement between the buyer and the seller. This promissory note serves as evidence of the buyer's promise to repay the agreed-upon purchase price to the seller within a specified period. It also provides legal protection to both parties by clearly stating the obligations, rights, and responsibilities involved in the transaction. Key elements that are typically included in an Odessa Texas Promissory Note in Connection with the Sale of Vehicle or Automobile are: 1. Parties involved: The promissory note should clearly identify the buyer and seller involved in the transaction, including their full names and contact details. 2. Vehicle details: The note must provide a detailed description of the vehicle being sold, including its make, model, year, identification number, and any other pertinent information that helps identify the automobile. 3. Purchase price: The agreed-upon sale price of the vehicle should be explicitly mentioned in the promissory note. If there are any additional costs or taxes included, they should be specified as well. 4. Payment terms: This section outlines the agreed-upon payment terms, such as the total amount to be paid, the down payment (if applicable), and the method of payment (cash, check, etc.). The frequency and due dates of subsequent installments or payments should also be clearly stated. 5. Interest rate: If there is any interest charged on the outstanding balance, the promissory note should specify the interest rate, whether it is fixed or variable, and how it will be calculated. 6. Collateral: In some cases, the note may include provisions about using the vehicle itself as collateral. This means that if the buyer defaults on the payments, the seller can take possession of the vehicle as a form of repayment. Details about the collateral should be clearly outlined. 7. Default and remedies: The note should describe the consequences of default and the remedies available to the parties involved. This section may include late payment fees, penalties, or allowing the seller to repossess the vehicle under certain circumstances. Different types of Odessa Texas Promissory Notes in Connection with the Sale of Vehicle or Automobile may vary based on the specific terms and conditions of the agreement. For instance: — Secured promissory note: This type of note includes provisions for collateral, such as using the vehicle as security. — Unsecured promissory note: In this case, there is no collateral involved, and the note is solely based on the buyer's promise to repay the agreed amount. — Installment promissory note: This note involves a series of payments over a specific period, with interest calculated on the outstanding balance. — Balloon promissory note: This note entails smaller installment payments during the repayment term, with a larger final payment due at the end. It is crucial to consult with a legal professional or use a reliable template specific to Odessa, Texas, to ensure that the promissory note effectively addresses the buyer's and the seller's rights and obligations while meeting the legal requirements of the state.A promissory note is a legal document that establishes a written agreement between a buyer and a seller in a financial transaction. In the context of a vehicle or automobile purchase, an Odessa Texas Promissory Note in Connection with the Sale of Vehicle or Automobile is a document that outlines the terms and conditions of the sale, including the payment agreement between the buyer and the seller. This promissory note serves as evidence of the buyer's promise to repay the agreed-upon purchase price to the seller within a specified period. It also provides legal protection to both parties by clearly stating the obligations, rights, and responsibilities involved in the transaction. Key elements that are typically included in an Odessa Texas Promissory Note in Connection with the Sale of Vehicle or Automobile are: 1. Parties involved: The promissory note should clearly identify the buyer and seller involved in the transaction, including their full names and contact details. 2. Vehicle details: The note must provide a detailed description of the vehicle being sold, including its make, model, year, identification number, and any other pertinent information that helps identify the automobile. 3. Purchase price: The agreed-upon sale price of the vehicle should be explicitly mentioned in the promissory note. If there are any additional costs or taxes included, they should be specified as well. 4. Payment terms: This section outlines the agreed-upon payment terms, such as the total amount to be paid, the down payment (if applicable), and the method of payment (cash, check, etc.). The frequency and due dates of subsequent installments or payments should also be clearly stated. 5. Interest rate: If there is any interest charged on the outstanding balance, the promissory note should specify the interest rate, whether it is fixed or variable, and how it will be calculated. 6. Collateral: In some cases, the note may include provisions about using the vehicle itself as collateral. This means that if the buyer defaults on the payments, the seller can take possession of the vehicle as a form of repayment. Details about the collateral should be clearly outlined. 7. Default and remedies: The note should describe the consequences of default and the remedies available to the parties involved. This section may include late payment fees, penalties, or allowing the seller to repossess the vehicle under certain circumstances. Different types of Odessa Texas Promissory Notes in Connection with the Sale of Vehicle or Automobile may vary based on the specific terms and conditions of the agreement. For instance: — Secured promissory note: This type of note includes provisions for collateral, such as using the vehicle as security. — Unsecured promissory note: In this case, there is no collateral involved, and the note is solely based on the buyer's promise to repay the agreed amount. — Installment promissory note: This note involves a series of payments over a specific period, with interest calculated on the outstanding balance. — Balloon promissory note: This note entails smaller installment payments during the repayment term, with a larger final payment due at the end. It is crucial to consult with a legal professional or use a reliable template specific to Odessa, Texas, to ensure that the promissory note effectively addresses the buyer's and the seller's rights and obligations while meeting the legal requirements of the state.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.