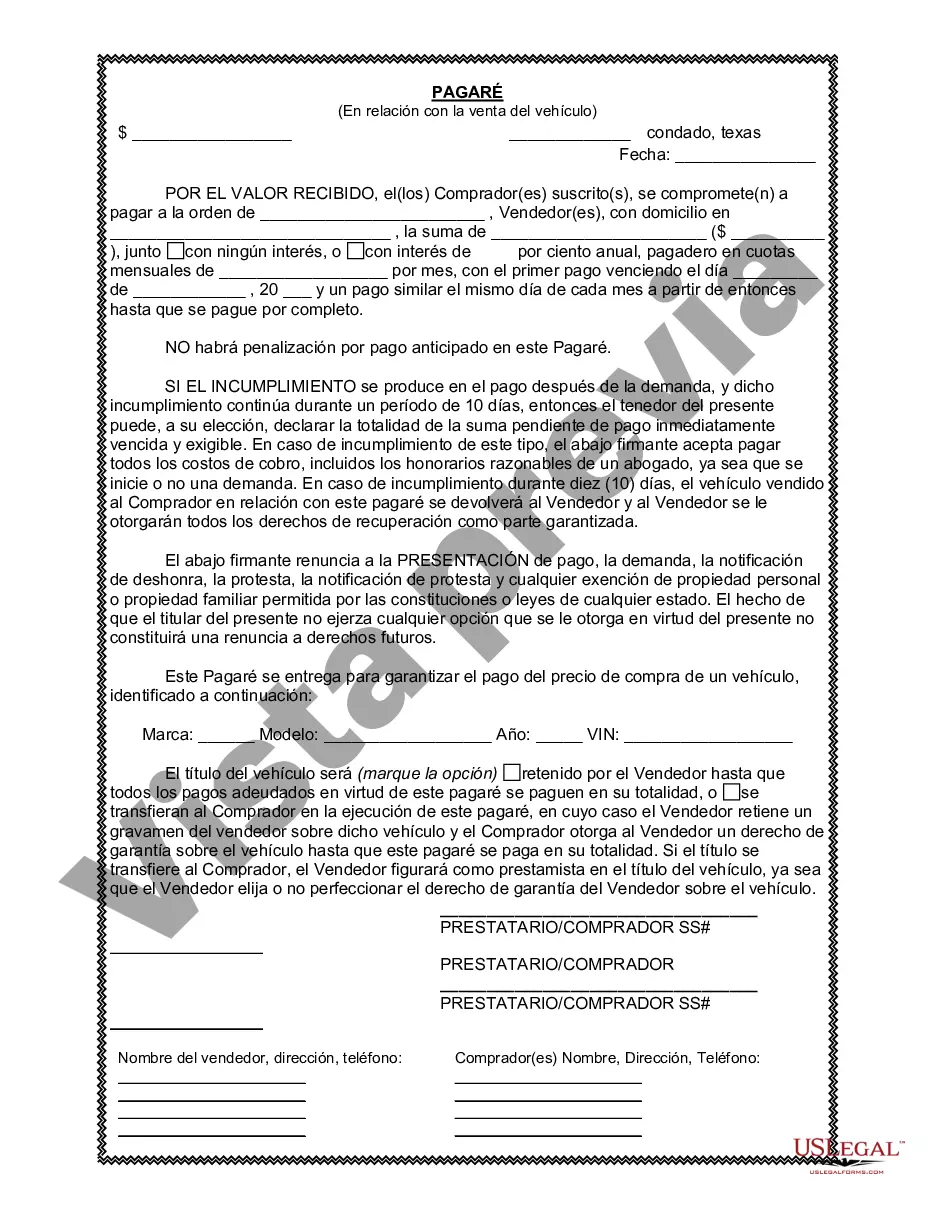

This form is a Promissory Note in connection with the sale of a vehicle where the Buyer is to pay a portion of the purchase price over time.

A promissory note is a legal document commonly utilized in Round Rock, Texas, in connection with the sale of a vehicle or automobile. This document outlines the terms and conditions agreed upon between the buyer and seller. It serves as a binding agreement and provides financial security for the seller. Several types of promissory notes are used in Round Rock, Texas, in relation to the sale of vehicles or automobiles, including: 1. Secured Promissory Note: This type of promissory note includes a security clause that allows the seller to take possession of the vehicle if the buyer fails to make the agreed-upon payments. It provides additional protection to the seller by ensuring collateral in case of default. 2. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not require collateral. This type of note relies solely on the buyer's promise to repay the loan. Without any collateral, the seller takes on a greater risk if the buyer defaults on payments. 3. Installment Promissory Note: An installment promissory note divides the total purchase amount into smaller, periodic payments. In Round Rock, Texas, this note is commonly used for longer-term payment plans, allowing buyers to pay for the vehicle over an extended period while ensuring regular payments for the seller. 4. Balloon Promissory Note: A balloon promissory note sets an agreed-upon short-term repayment period, typically between one and five years, during which the buyer makes lower monthly installments. However, at the end of the agreed term, a larger lump sum payment, often known as the balloon payment, is due. 5. Simple Promissory Note: A simple promissory note outlines the basic terms of the loan, such as the loan amount, interest rate, repayment schedule, and consequences of default. This type of note is straightforward and commonly used for straightforward transactions without complex or specific requirements. Round Rock, Texas, promissory notes in connection with the sale of vehicles or automobiles are crucial for both buyers and sellers. They ensure transparency, protect the interests of all parties involved, and establish a binding agreement for the sale and purchase of a vehicle. It is important to consult legal professionals or use pre-written templates specifically designed for such transactions to ensure the promissory note adheres to local laws and regulations.A promissory note is a legal document commonly utilized in Round Rock, Texas, in connection with the sale of a vehicle or automobile. This document outlines the terms and conditions agreed upon between the buyer and seller. It serves as a binding agreement and provides financial security for the seller. Several types of promissory notes are used in Round Rock, Texas, in relation to the sale of vehicles or automobiles, including: 1. Secured Promissory Note: This type of promissory note includes a security clause that allows the seller to take possession of the vehicle if the buyer fails to make the agreed-upon payments. It provides additional protection to the seller by ensuring collateral in case of default. 2. Unsecured Promissory Note: Unlike a secured promissory note, an unsecured note does not require collateral. This type of note relies solely on the buyer's promise to repay the loan. Without any collateral, the seller takes on a greater risk if the buyer defaults on payments. 3. Installment Promissory Note: An installment promissory note divides the total purchase amount into smaller, periodic payments. In Round Rock, Texas, this note is commonly used for longer-term payment plans, allowing buyers to pay for the vehicle over an extended period while ensuring regular payments for the seller. 4. Balloon Promissory Note: A balloon promissory note sets an agreed-upon short-term repayment period, typically between one and five years, during which the buyer makes lower monthly installments. However, at the end of the agreed term, a larger lump sum payment, often known as the balloon payment, is due. 5. Simple Promissory Note: A simple promissory note outlines the basic terms of the loan, such as the loan amount, interest rate, repayment schedule, and consequences of default. This type of note is straightforward and commonly used for straightforward transactions without complex or specific requirements. Round Rock, Texas, promissory notes in connection with the sale of vehicles or automobiles are crucial for both buyers and sellers. They ensure transparency, protect the interests of all parties involved, and establish a binding agreement for the sale and purchase of a vehicle. It is important to consult legal professionals or use pre-written templates specifically designed for such transactions to ensure the promissory note adheres to local laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.