Title: Understanding Beaumont Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made Introduction: In Beaumont, Texas, the Contract for Deed Notice of Default serves as an important legal document that outlines the conditions under which a default occurs when 40% of the loan has been repaid or after 48 scheduled payments have been made. This detail-oriented article will dive deep into the intricacies of this notice, shedding light on various types, implications, and steps involved. Key Keywords: Beaumont Texas, Contract for Deed, Notice of Default, 40% of Loan Paid, 48 Payments Made 1. Types of Beaumont Texas Contract for Deed Notice of Default: a) "40% of Loan Paid" Default Notice: This variant of the notice comes into play when 40% of the loan, stipulated in the Contract for Deed, has been paid by the buyer. It triggers specific actions and legal steps by the seller to address the default situation. b) "48 Payments Made" Default Notice: This type of notice is activated when the buyer has successfully completed 48 scheduled payments as specified in the Contract for Deed. Non-compliance at this stage can lead to significant consequences. 2. Implied Consequences of Default: a) Loss of Property Ownership: Depending on the terms of the Contract for Deed, a default can result in the forfeiture of the buyer's ownership rights. The property may revert to the seller, giving them the authority to reclaim ownership. b) Financial Implications: Defaulting on a Beaumont Texas Contract for Deed can have severe financial consequences for the buyer, including the loss of invested funds, accumulated equity, and future accrued benefits. 3. The Notice of Default Process: a) Notification: Once the default conditions are met, the seller must issue a Notice of Default to the buyer, informing them about the breach of the contract. b) Grace Period: In some cases, a grace period may be granted to the buyer, allowing them to rectify the default within a specified timeframe. c) Legal Procedures: If the default remains unresolved, the seller may initiate legal proceedings, including foreclosure, to protect their interests. The buyer may be required to vacate the property, facing potential litigation and damage to their credit score. d) Negotiation and Settlement: In some instances, the seller and buyer may engage in negotiations to find an alternative solution, such as payment plan restructuring or refinancing, to avoid the foreclosure process. Conclusion: Understanding the intricacies of the Beaumont Texas Contract for Deed Notice of Default when 40% of the loan has been paid or 48 payments have been made is crucial for both buyers and sellers. Vigilance in adhering to the contractual terms, along with open communication and proactive resolution of disputes, can help mitigate any potential default risks.

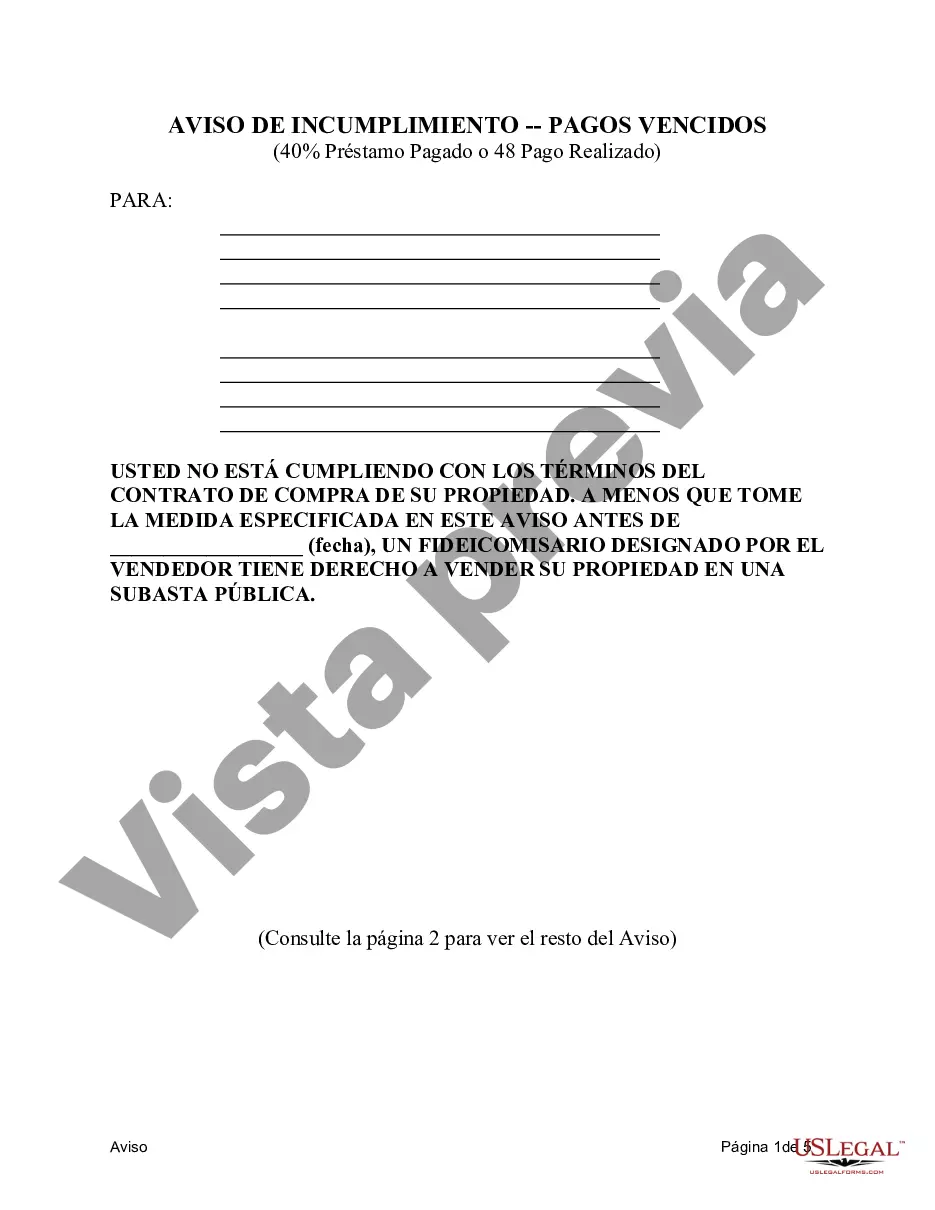

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Beaumont Texas Contrato de escritura Notificación de incumplimiento cuando se pagó el 40% del préstamo o se realizaron 48 pagos - Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made

Description

How to fill out Beaumont Texas Contrato De Escritura Notificación De Incumplimiento Cuando Se Pagó El 40% Del Préstamo O Se Realizaron 48 Pagos?

Locating verified templates specific to your local laws can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both individual and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Beaumont Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made gets as quick and easy as ABC.

For everyone already acquainted with our library and has used it before, obtaining the Beaumont Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made takes just a couple of clicks. All you need to do is log in to your account, choose the document, and click Download to save it on your device. This process will take just a few additional actions to make for new users.

Adhere to the guidelines below to get started with the most extensive online form library:

- Look at the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you find any inconsistency, use the Search tab above to get the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Beaumont Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has significant importance. Benefit from the US Legal Forms library to always have essential document templates for any demands just at your hand!