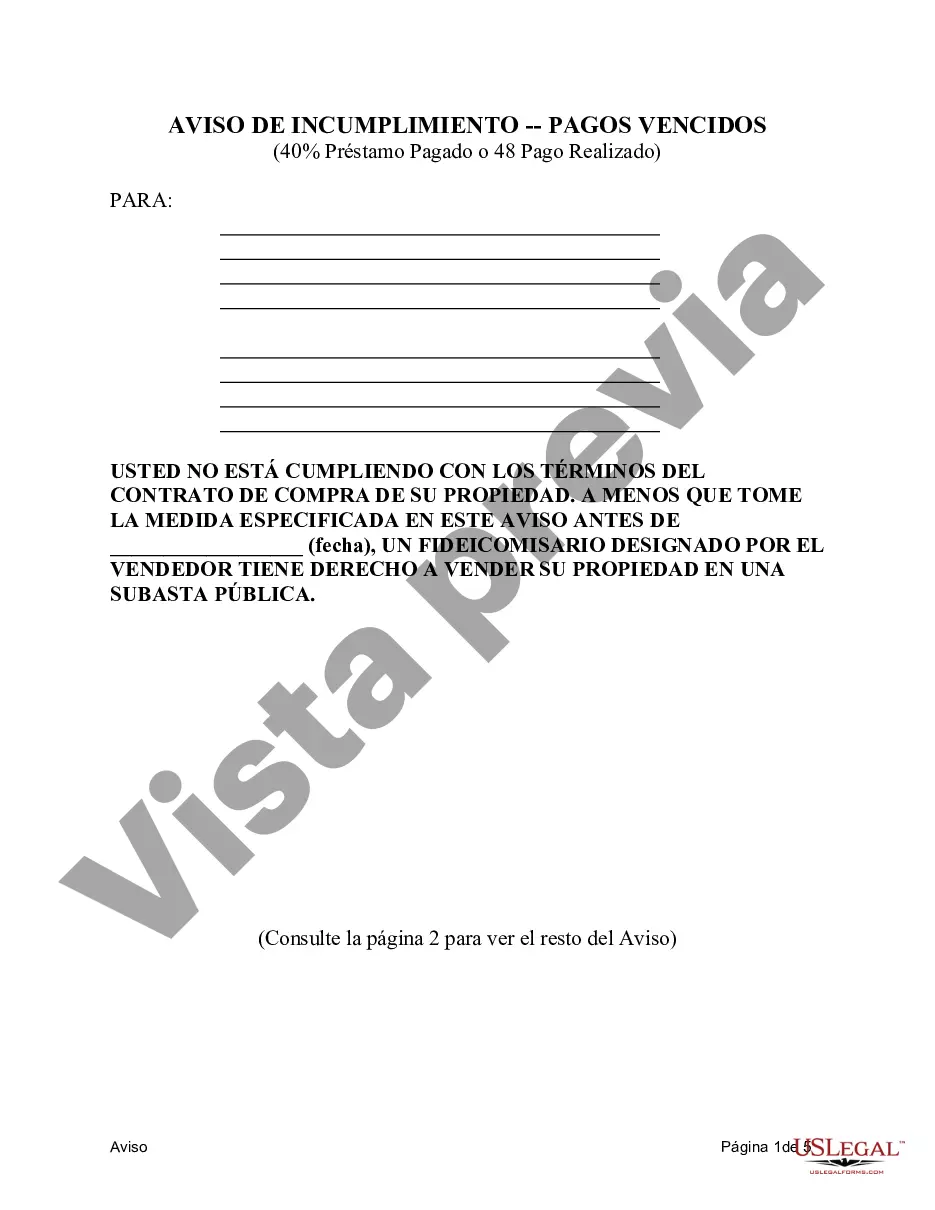

Dallas Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made is a legal document that outlines the conditions under which a default notice may be issued in a contract for deed agreement in Dallas, Texas. This notice is triggered when either 40% of the loan has been paid or 48 payments have been made, whichever comes first. In a contract for deed agreement, the seller finances the purchase of the property, acting as the lender rather than a traditional mortgage lender. The buyer agrees to make monthly payments to the seller until either the full purchase price or a predetermined percentage of the loan is paid off. If the buyer fails to meet these payment obligations, the seller has the right to issue a notice of default. The Dallas Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made serves as a warning to the buyer, informing them that they are in danger of losing their rights to the property if they do not take corrective actions promptly. This notice typically includes the following information: 1. Identification of the parties involved: The notice will identify both the buyer and the seller, providing the names and contact information of each party. 2. Description of the property: The notice will include a detailed description of the property, including its address, legal description, and any other relevant details. 3. Default conditions: The notice will outline the specific conditions that have triggered the default, which may either be 40% of the loan paid or 48 payments made, as stated in the contract for deed agreement. 4. Remedies and actions required: The notice will specify the actions the buyer needs to take to rectify the default, such as making outstanding payments by a certain deadline or bringing the loan balance up to the required threshold. 5. Consequences of non-compliance: The notice will inform the buyer that failure to meet the specified requirements within the given timeframe may result in further legal actions, including potential foreclosure or eviction. It is crucial to understand that while this description provides a general idea of what a Dallas Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made entails, the actual terms and conditions may differ depending on the specific agreement in place. Additionally, laws governing contract for deed agreements can vary, and it is essential to consult with a legal professional specializing in real estate in Dallas, Texas, for accurate guidance. Different types of Dallas Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made may exist due to variations in individual contracts and the specific terms agreed upon by the buyer and seller. These variations can include different threshold percentages or payment milestones triggering the default notice, specific remedies or courses of action outlined in the notice, or any additional conditions imposed by the parties involved. It is crucial for both buyers and sellers to carefully review their contract for deed agreement to understand the specific terms and conditions in place.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Contrato de escritura Notificación de incumplimiento cuando se pagó el 40% del préstamo o se realizaron 48 pagos - Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made

Description

How to fill out Dallas Texas Contrato De Escritura Notificación De Incumplimiento Cuando Se Pagó El 40% Del Préstamo O Se Realizaron 48 Pagos?

If you are looking for a valid form template, it’s extremely hard to choose a better service than the US Legal Forms website – one of the most comprehensive online libraries. Here you can find thousands of form samples for organization and individual purposes by categories and regions, or key phrases. Using our high-quality search option, getting the latest Dallas Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made is as easy as 1-2-3. Furthermore, the relevance of each record is verified by a team of expert attorneys that regularly check the templates on our platform and update them according to the most recent state and county regulations.

If you already know about our platform and have a registered account, all you need to get the Dallas Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made is to log in to your account and click the Download option.

If you make use of US Legal Forms for the first time, just follow the guidelines below:

- Make sure you have discovered the form you need. Look at its information and use the Preview feature to see its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to find the needed file.

- Affirm your selection. Select the Buy now option. Next, pick your preferred pricing plan and provide credentials to sign up for an account.

- Process the transaction. Utilize your bank card or PayPal account to complete the registration procedure.

- Get the template. Select the file format and download it to your system.

- Make changes. Fill out, edit, print, and sign the obtained Dallas Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made.

Every template you save in your account has no expiration date and is yours forever. It is possible to access them via the My Forms menu, so if you need to receive an additional duplicate for enhancing or creating a hard copy, you may return and save it once more at any moment.

Take advantage of the US Legal Forms extensive collection to get access to the Dallas Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made you were seeking and thousands of other professional and state-specific samples on a single website!