The Fort Worth Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made is a legal document that sets out the terms and conditions of a contract for deed agreement in Fort Worth, Texas. This notice is specifically related to the default provisions triggered when either 40% of the loan has been paid or when 48 payments have been made, whichever comes first. In a contract for deed agreement, also known as a land contract or installment sale agreement, a buyer purchases a property from a seller under the condition that they will make regular payments directly to the seller, rather than obtaining a traditional mortgage from a bank. The seller retains legal title to the property until the buyer fulfills all the agreed-upon payment obligations. When 40% of the loan has been paid or when 48 payments have been made, the seller has the right to issue a Notice of Default, which notifies the buyer that they have breached the terms of the contract. This notice alerts the buyer that they are in danger of losing their rights to the property if they do not remedy the default. It is important to note that there may be different types of Fort Worth Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made, depending on the specific provisions included in the contract. Variations could include different payment milestones, such as 30% of the loan paid or 36 payments made, which could trigger a notice of default. The notice itself should contain detailed information about the default, including the specific terms violated, the amount owed, and any actions required to cure the default. It may also provide a grace period in which the buyer can rectify the breach and bring the contract back into good standing. Failure to cure the default within the stipulated timeframe may result in the seller initiating legal proceedings to regain possession of the property. Keywords: Fort Worth Texas, contract for deed, notice of default, loan paid, payments made, contract, agreement, default provisions, breach, property, legal title, mortgage, repayment, seller, buyer, milestones, grace period, cure, legal proceedings.

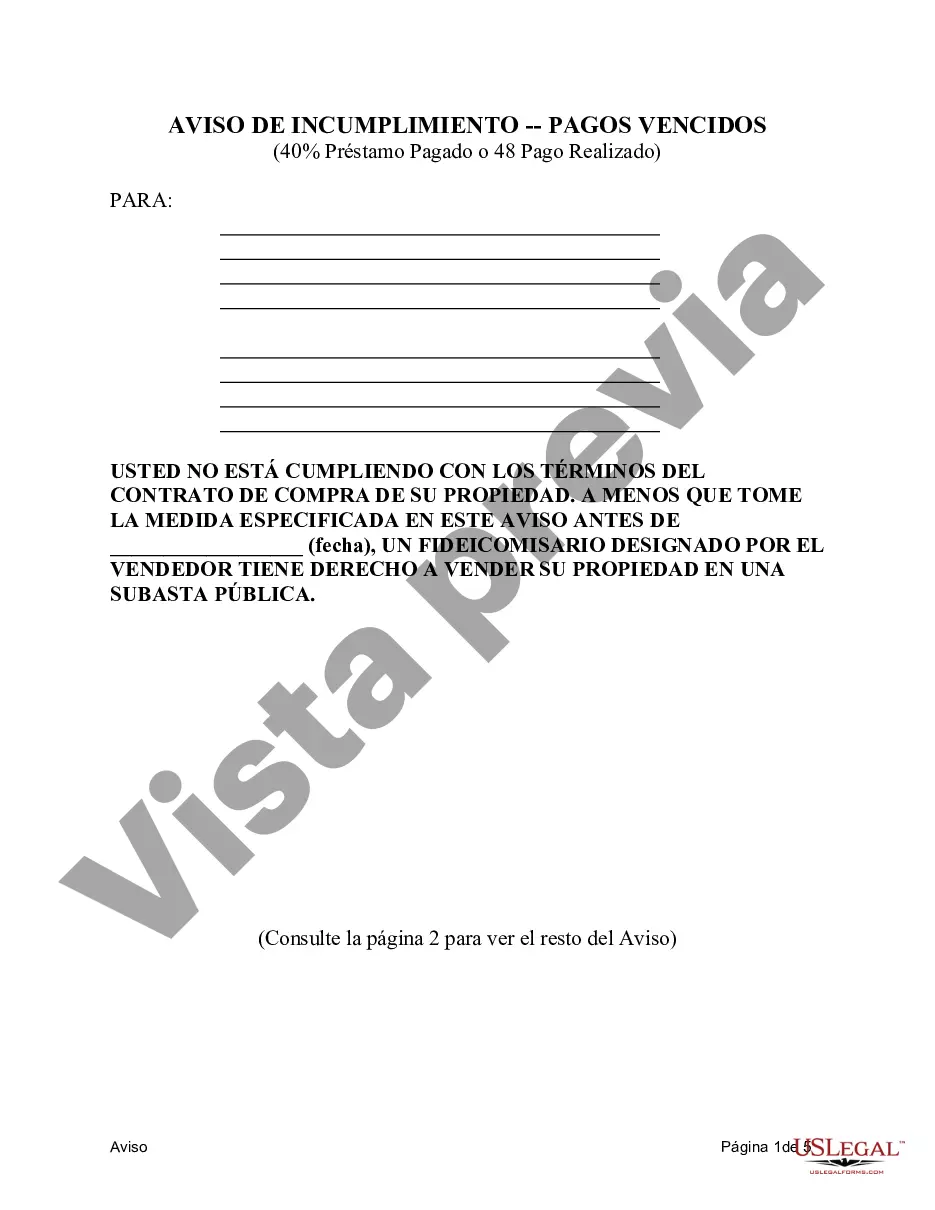

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fort Worth Texas Contrato de escritura Notificación de incumplimiento cuando se pagó el 40% del préstamo o se realizaron 48 pagos - Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made

State:

Texas

City:

Fort Worth

Control #:

TX-00470-10

Format:

Word

Instant download

Description

Este es un Aviso de Incumplimiento y proporciona al Comprador los detalles sobre el incumplimiento y las medidas correctivas necesarias para evitar la ejecución hipotecaria. Este formulario en particular se utiliza cuando el Comprador ha pagado el 40% del precio del contrato o ha realizado 48 o más pagos en virtud del contrato.

The Fort Worth Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made is a legal document that sets out the terms and conditions of a contract for deed agreement in Fort Worth, Texas. This notice is specifically related to the default provisions triggered when either 40% of the loan has been paid or when 48 payments have been made, whichever comes first. In a contract for deed agreement, also known as a land contract or installment sale agreement, a buyer purchases a property from a seller under the condition that they will make regular payments directly to the seller, rather than obtaining a traditional mortgage from a bank. The seller retains legal title to the property until the buyer fulfills all the agreed-upon payment obligations. When 40% of the loan has been paid or when 48 payments have been made, the seller has the right to issue a Notice of Default, which notifies the buyer that they have breached the terms of the contract. This notice alerts the buyer that they are in danger of losing their rights to the property if they do not remedy the default. It is important to note that there may be different types of Fort Worth Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made, depending on the specific provisions included in the contract. Variations could include different payment milestones, such as 30% of the loan paid or 36 payments made, which could trigger a notice of default. The notice itself should contain detailed information about the default, including the specific terms violated, the amount owed, and any actions required to cure the default. It may also provide a grace period in which the buyer can rectify the breach and bring the contract back into good standing. Failure to cure the default within the stipulated timeframe may result in the seller initiating legal proceedings to regain possession of the property. Keywords: Fort Worth Texas, contract for deed, notice of default, loan paid, payments made, contract, agreement, default provisions, breach, property, legal title, mortgage, repayment, seller, buyer, milestones, grace period, cure, legal proceedings.

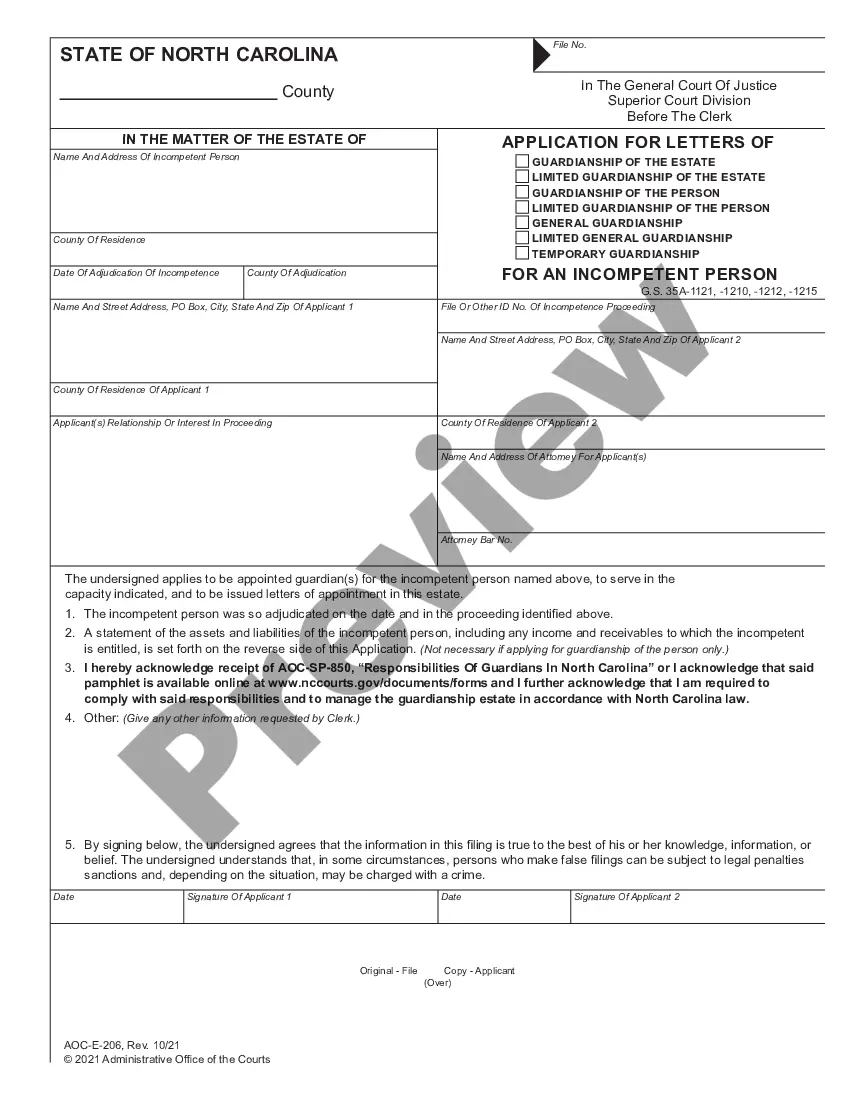

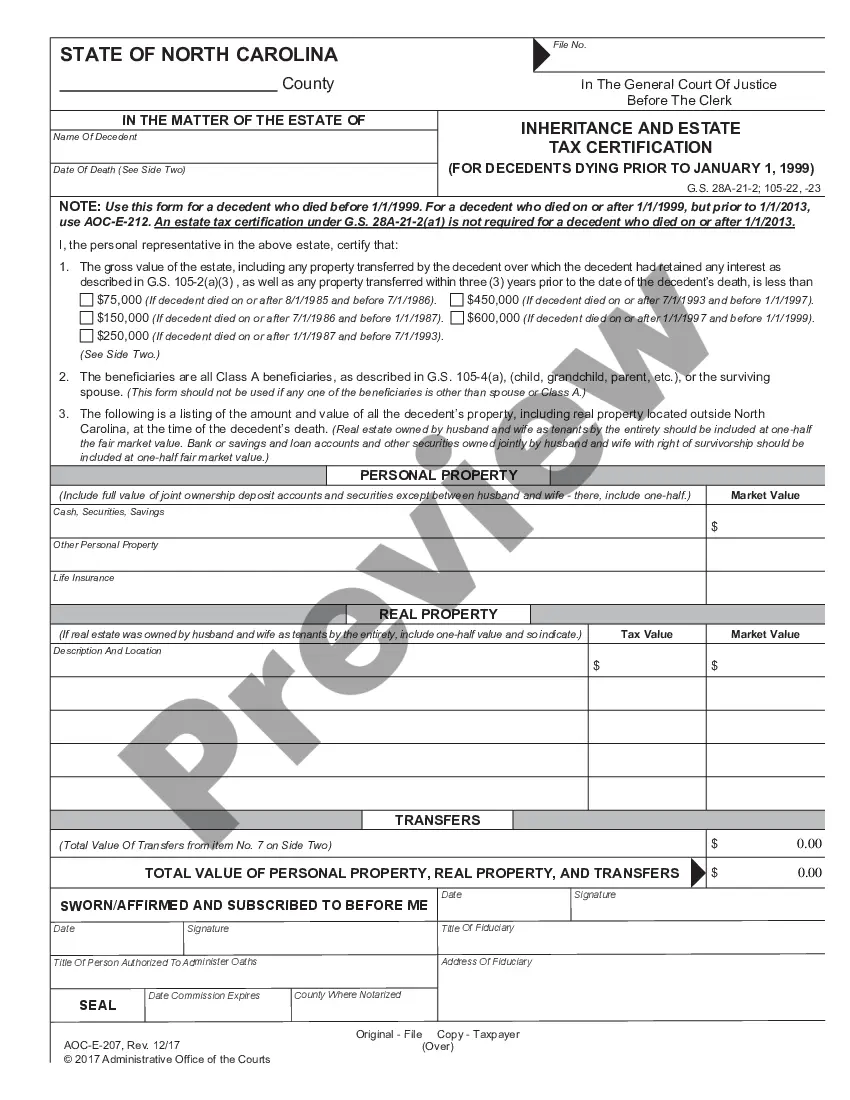

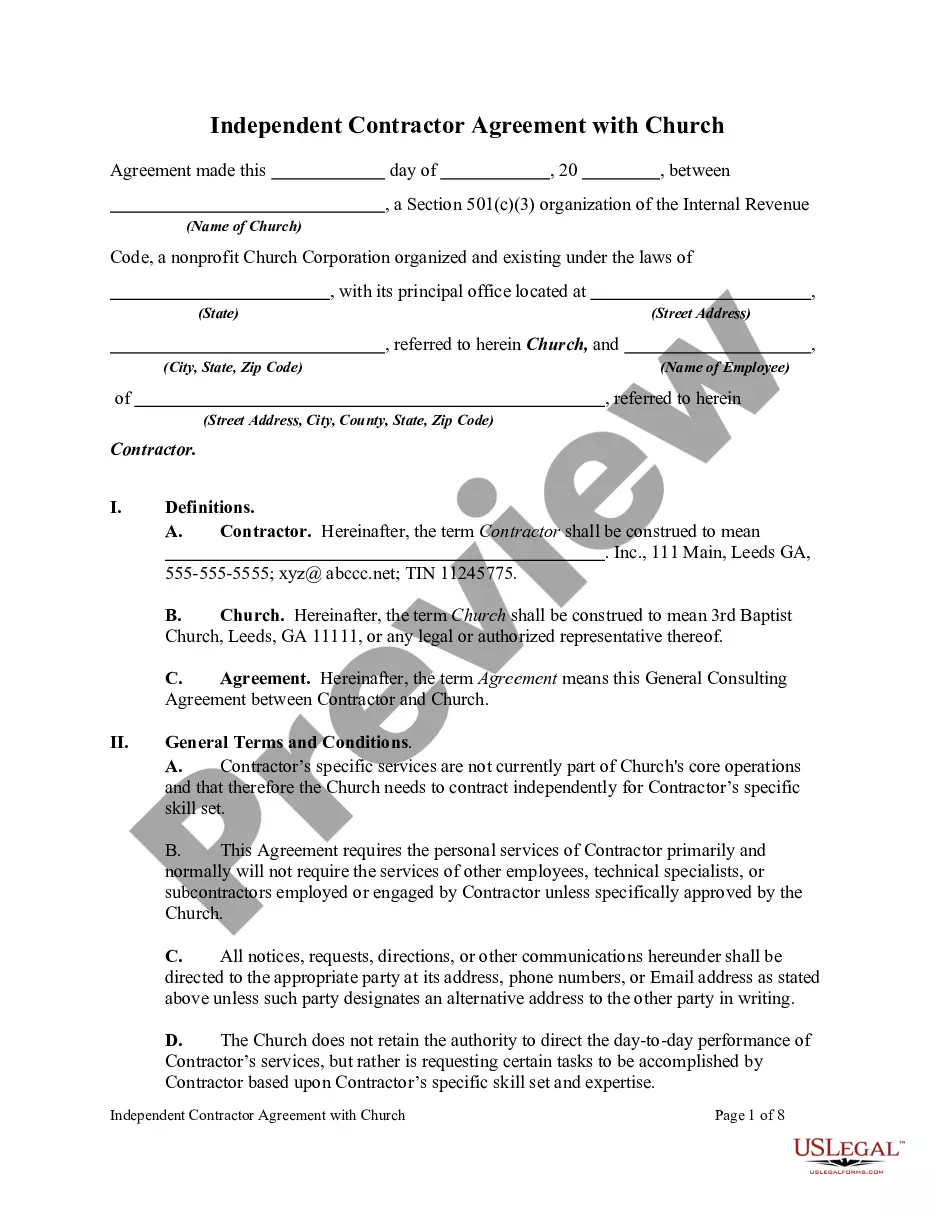

Free preview

How to fill out Fort Worth Texas Contrato De Escritura Notificación De Incumplimiento Cuando Se Pagó El 40% Del Préstamo O Se Realizaron 48 Pagos?

If you’ve already used our service before, log in to your account and download the Fort Worth Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your file:

- Ensure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the transaction.

- Get your Fort Worth Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made. Select the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have bought: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your individual or professional needs!