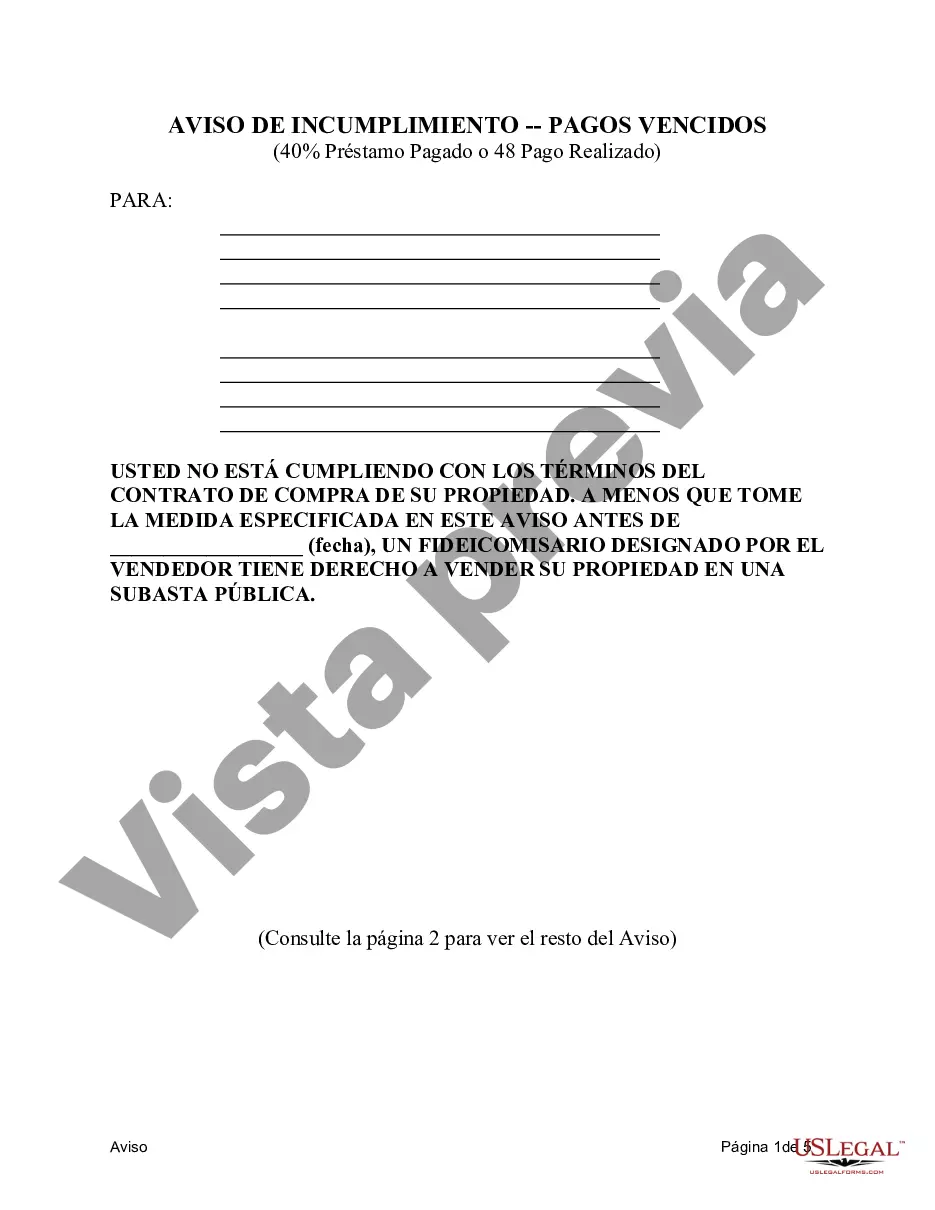

A Harris Texas Contract for Deed Notice of Default is an important legal document that outlines specific conditions and circumstances under which a buyer may face default on their contract for deed agreement. This notice is particularly triggered when either 40% of the loan has been paid off or 48 payments have been made, depending on the terms set forth in the contract. It serves as a formal communication from the seller to the buyer, indicating that the buyer is in breach of the agreement and may face potential consequences. In Harris County, Texas, there may be different variations or types of Contract for Deed Notices of Default when 40% of the loan is paid or 48 payments have been made, including: 1. Harris Texas Contract for Deed Notice of Default — 40% Loan Paid: This type of notice is issued when the buyer has paid off 40% of the total loan amount outlined in the contract for deed agreement. It signifies that failing to fulfill the remaining payment obligations may result in potential default. 2. Harris Texas Contract for Deed Notice of Default — 48 Payments Made: This specific notice is sent when the buyer has made a total of 48 payments as stipulated in the contract for deed. It serves as a reminder that any failure to continue making subsequent payments could lead to default. 3. Combination of Conditions: It's worth mentioning that a Contract for Deed Notice of Default in Harris County, Texas, may combine both the conditions mentioned above. This means that either the 40% loan payment threshold or the completion of 48 payments will trigger the notice of default, depending on which criteria occur first. To avoid potential default and its consequences, it is crucial for buyers to carefully review the terms and conditions outlined in the Harris Texas Contract for Deed. It is essential to make timely payments, meet the specified requirements, and seek legal advice when necessary to ensure compliance and prevent any potential default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Contrato de escritura Notificación de incumplimiento cuando se pagó el 40% del préstamo o se realizaron 48 pagos - Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made

Description

How to fill out Harris Texas Contrato De Escritura Notificación De Incumplimiento Cuando Se Pagó El 40% Del Préstamo O Se Realizaron 48 Pagos?

Do you need a reliable and inexpensive legal forms provider to buy the Harris Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made? US Legal Forms is your go-to solution.

No matter if you need a simple arrangement to set rules for cohabitating with your partner or a set of forms to move your separation or divorce through the court, we got you covered. Our platform offers more than 85,000 up-to-date legal document templates for personal and company use. All templates that we offer aren’t universal and framed based on the requirements of particular state and county.

To download the form, you need to log in account, find the required form, and click the Download button next to it. Please keep in mind that you can download your previously purchased form templates anytime in the My Forms tab.

Is the first time you visit our platform? No worries. You can set up an account with swift ease, but before that, make sure to do the following:

- Check if the Harris Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made conforms to the regulations of your state and local area.

- Read the form’s details (if available) to find out who and what the form is good for.

- Start the search over in case the form isn’t suitable for your specific scenario.

Now you can create your account. Then select the subscription option and proceed to payment. As soon as the payment is completed, download the Harris Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made in any available format. You can return to the website when you need and redownload the form without any extra costs.

Finding up-to-date legal forms has never been easier. Give US Legal Forms a try today, and forget about wasting hours learning about legal papers online for good.