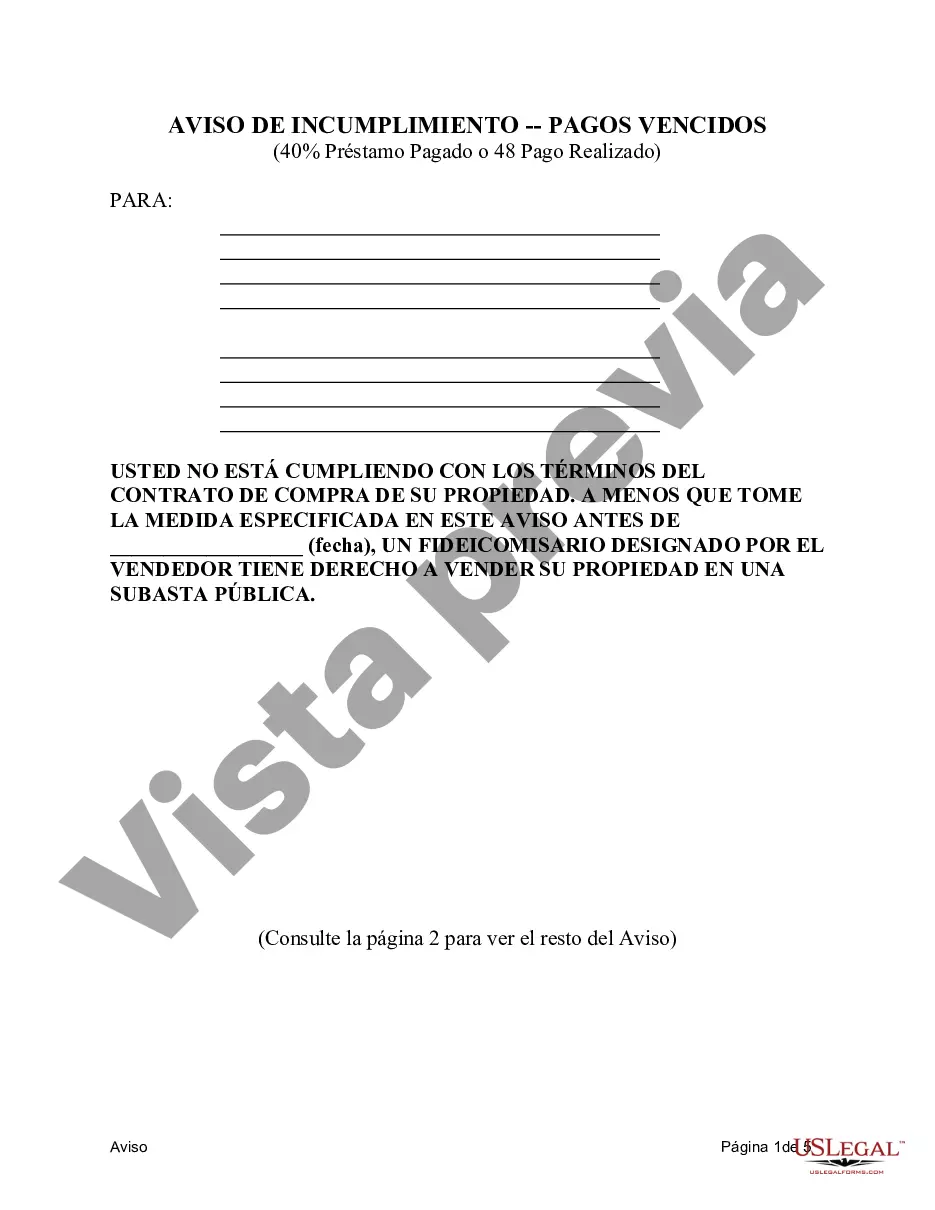

McKinney Texas Contract for Deed Notice of Default occurs when a buyer fails to meet specific terms outlined in the contract. This legal notice is issued when the buyer either fails to pay at least 40% of the loan amount or misses a total of 48 payments. A Contract for Deed, also known as a Land Contract or Installment Agreement, is a type of seller financing where the seller holds the title to the property until the buyer fulfills the agreed-upon payment terms. If the buyer in McKinney, Texas fails to pay at least 40% of the loan amount or misses a total of 48 payments, the seller can initiate the Notice of Default process. This critical event triggers various consequences and potential remedies available to the seller. The specifics of the default notice may vary depending on the terms outlined in the individual Contract for Deed. The Notice of Default typically notifies the buyer that their failure to meet the contractual obligations has resulted in default. It may outline the specific payment terms violated, including the amount owed or the number of missed payments. Additionally, it often informs the buyer of the potential consequences, such as the possibility of losing their equity in the property. McKinney Texas Contract for Deed Notice of Default may have different variations based on the specific conditions stated in the contract. These variations could include clauses regarding the payment timeline, interest rate, penalties for missed payments, and the rights of the buyers and sellers involved. It is crucial for both parties to carefully review and understand the terms outlined in the contract to avoid any misunderstandings or disputes. In summary, the McKinney Texas Contract for Deed Notice of Default is triggered when a buyer fails to meet the contractual obligations of paying at least 40% of the loan amount or missing a total of 48 payments. Each Contract for Deed may have different terms and conditions, so it's essential to review the specific contract to understand the implications of default.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.McKinney Texas Contrato de escritura Notificación de incumplimiento cuando se pagó el 40% del préstamo o se realizaron 48 pagos - Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made

Description

How to fill out McKinney Texas Contrato De Escritura Notificación De Incumplimiento Cuando Se Pagó El 40% Del Préstamo O Se Realizaron 48 Pagos?

We always want to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal services that, usually, are very costly. Nevertheless, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without the need of using services of an attorney. We provide access to legal document templates that aren’t always publicly accessible. Our templates are state- and area-specific, which significantly facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the McKinney Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made or any other document quickly and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always download it again from within the My Forms tab.

The process is just as straightforward if you’re unfamiliar with the platform! You can create your account within minutes.

- Make sure to check if the McKinney Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made complies with the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if available), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- As soon as you’ve ensured that the McKinney Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made is suitable for you, you can select the subscription option and proceed to payment.

- Then you can download the form in any available format.

For over 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save time and resources!