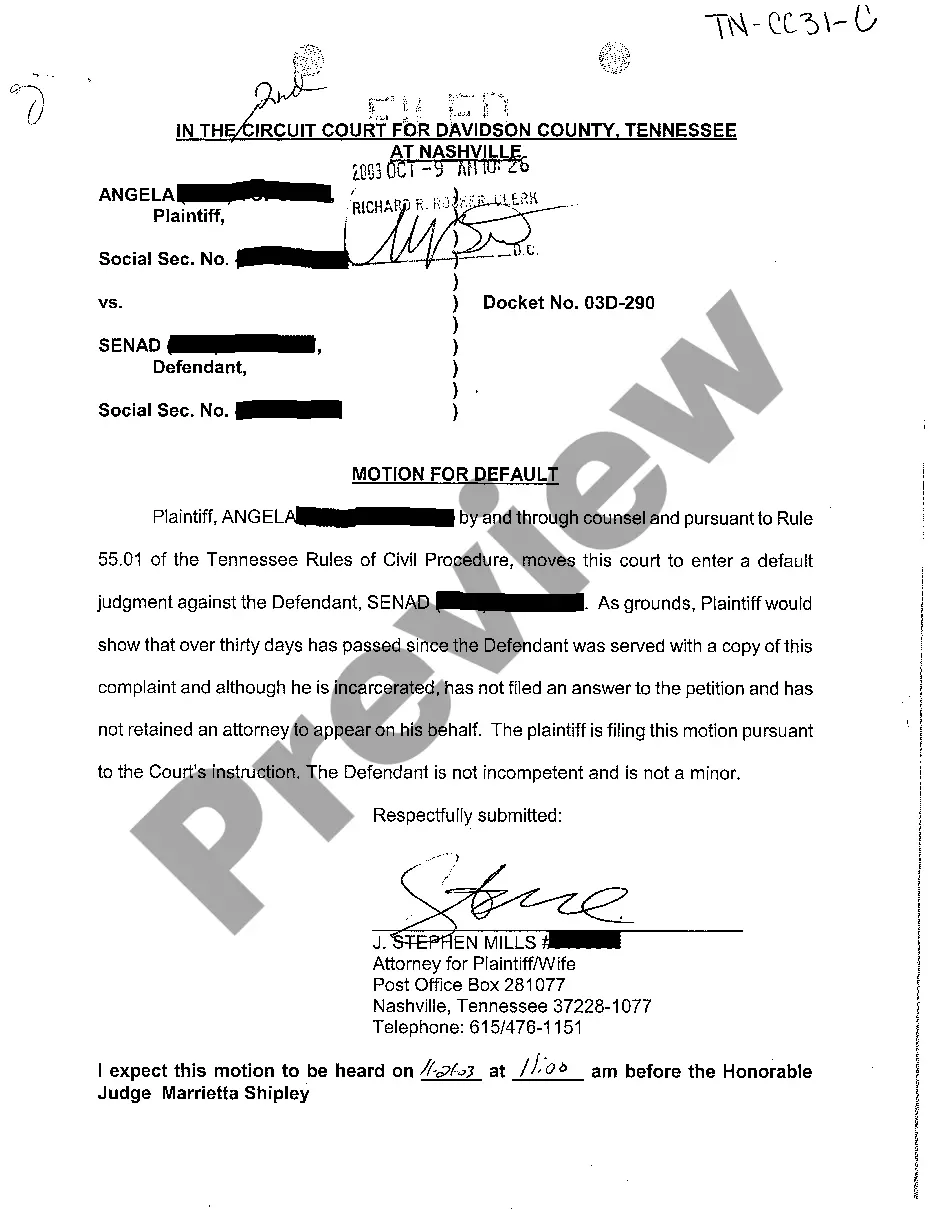

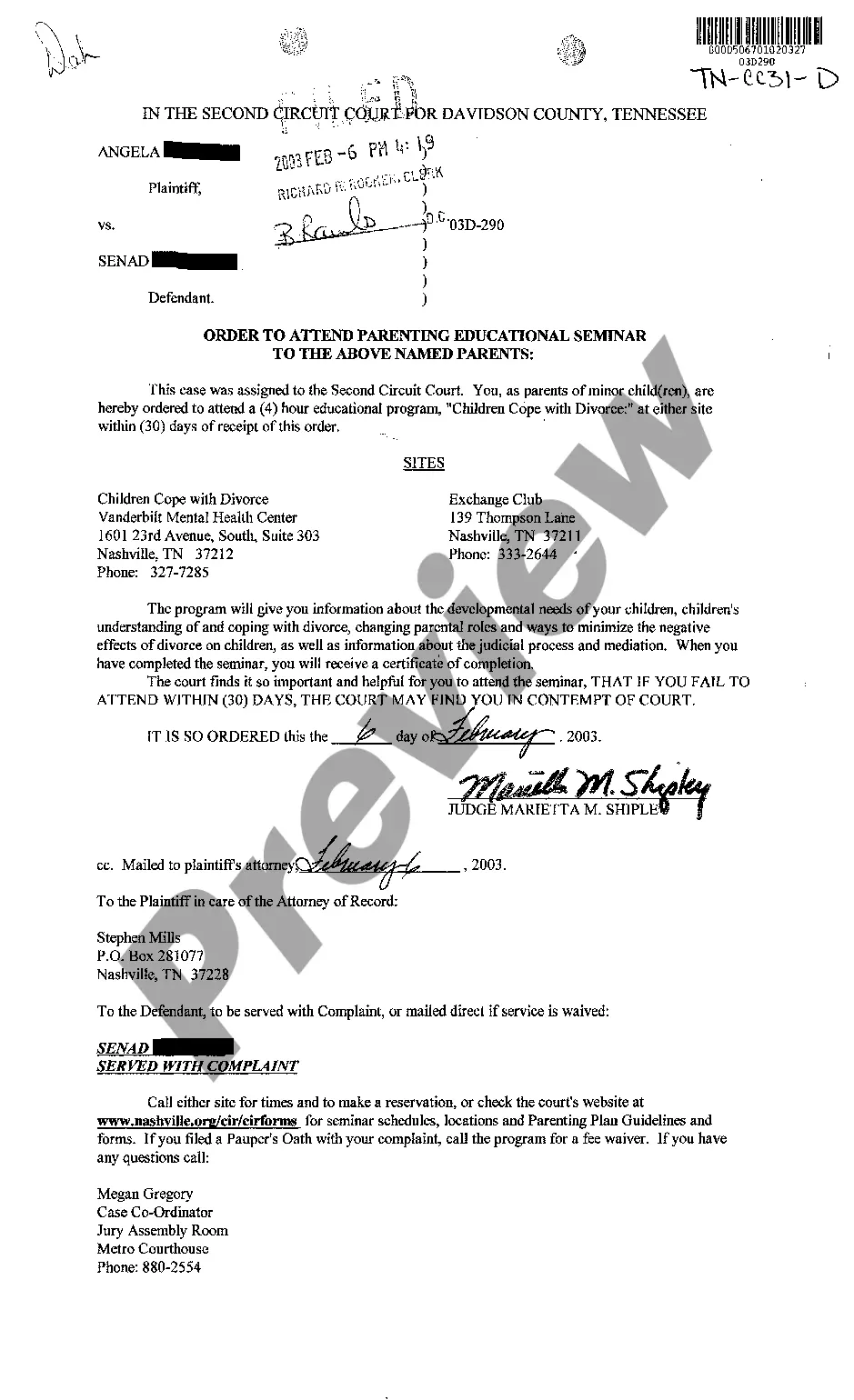

The San Antonio Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made is a legal document that outlines the conditions under which a borrower may be considered in default of their contract for deed in San Antonio, Texas. This notice is triggered when either 40% of the loan has been paid off or when the borrower has made 48 consecutive payments. A contract for deed, also known as a land contract or installment sale agreement, is a type of financing arrangement where the seller retains legal title to the property until the buyer fulfills their financial obligations. In this case, the notice of default serves as a warning to the buyer that they are at risk of losing their rights to the property if they do not rectify the default within a specified period. The notice of default typically includes important information such as the name and contact details of the seller, the legal description of the property, the loan repayment terms, and the specific conditions that have triggered the default. It also outlines the steps that the buyer must take to cure the default, such as paying any outstanding amounts or rectifying any other breach of contract. Failure to comply with these requirements within a specific timeframe may result in the seller terminating the contract. There may be different types of San Antonio Texas Contract for Deed Notice of Defaults based on variations in specific contract terms. For instance, some contracts may require the buyer to pay off 40% of the loan amount to avoid default, while others may have a different threshold. Additionally, the number of payments required to be made may vary depending on the agreement. Therefore, potential types may include the San Antonio Texas Contract for Deed Notice of Default When 30% of Loan Paid or 36 Payments Made, or the San Antonio Texas Contract for Deed Notice of Default When 50% of Loan Paid or 60 Payments Made, among others. It is crucial for both buyers and sellers involved in a contract for deed agreement in San Antonio, Texas, to thoroughly read and understand the terms and conditions stated in the contract, including the provisions related to default and notice requirements. Seeking legal counsel may be advisable to ensure compliance with relevant laws and to protect their rights and interests.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Contrato de escritura Notificación de incumplimiento cuando se pagó el 40% del préstamo o se realizaron 48 pagos - Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made

Description

How to fill out San Antonio Texas Contrato De Escritura Notificación De Incumplimiento Cuando Se Pagó El 40% Del Préstamo O Se Realizaron 48 Pagos?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online pool of more than 85,000 legal forms for both personal and professional needs and any real-life scenarios. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the San Antonio Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made gets as quick and easy as ABC.

For everyone already familiar with our catalogue and has used it before, obtaining the San Antonio Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made takes just a few clicks. All you need to do is log in to your account, select the document, and click Download to save it on your device. The process will take just a few additional steps to make for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve chosen the right one that meets your needs and totally corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, use the Search tab above to find the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the San Antonio Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!