A Waco Texas Contract for Deed is a legal agreement that involves a property purchase where the seller acts as the lender instead of a traditional financial institution. This type of arrangement is particularly beneficial for buyers with less-than-perfect credit, as it allows them to acquire the property without going through a mortgage loan process. However, in certain cases, when the buyer fails to meet the terms of the contract, the seller may issue a Notice of Default to initiate foreclosure proceedings. The notice is generally triggered when either 40% of the loan has been paid off or after the buyer has made 48 payments, depending on the specific terms outlined in the agreement. When receiving a Notice of Default, it is crucial for the buyer to take immediate action to rectify the default and avoid potential foreclosure. The notice serves as a warning sign that the buyer is at risk of losing their investment. It signifies that the buyer has not fulfilled their obligations in terms of either loan repayment or adherence to the agreed-upon payment schedule. Upon receiving a Notice of Default, a buyer should review the terms of the contract thoroughly and consult with a legal professional experienced in real estate matters. Different types of Waco Texas Contract for Deed Notice of Default can have varying consequences and additional clauses, depending on the specific agreement. Some agreements may allow a grace period for the buyer to rectify the default, while others may have more stringent conditions resulting in immediate foreclosure. To avoid the potential loss of the property, buyers in Waco, Texas, should be aware of their rights and obligations as outlined in the Contract for Deed. Repayment terms, payment schedules, and other pertinent details must be carefully reviewed and adhered to. This will help prevent default and the subsequent issuance of a Notice of Default. In summary, a Waco Texas Contract for Deed Notice of Default is an important legal document that outlines the consequences attached to defaulting on a contract for deed agreement. Buyers who have either paid off 40% of the loan or made 48 payments need to be cautious to honor their contractual obligations and seek immediate assistance if faced with a Notice of Default to safeguard their investment. Working with a real estate attorney can provide valuable guidance throughout the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Waco Texas Contrato de escritura Notificación de incumplimiento cuando se pagó el 40% del préstamo o se realizaron 48 pagos - Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made

State:

Texas

City:

Waco

Control #:

TX-00470-10

Format:

Word

Instant download

Description

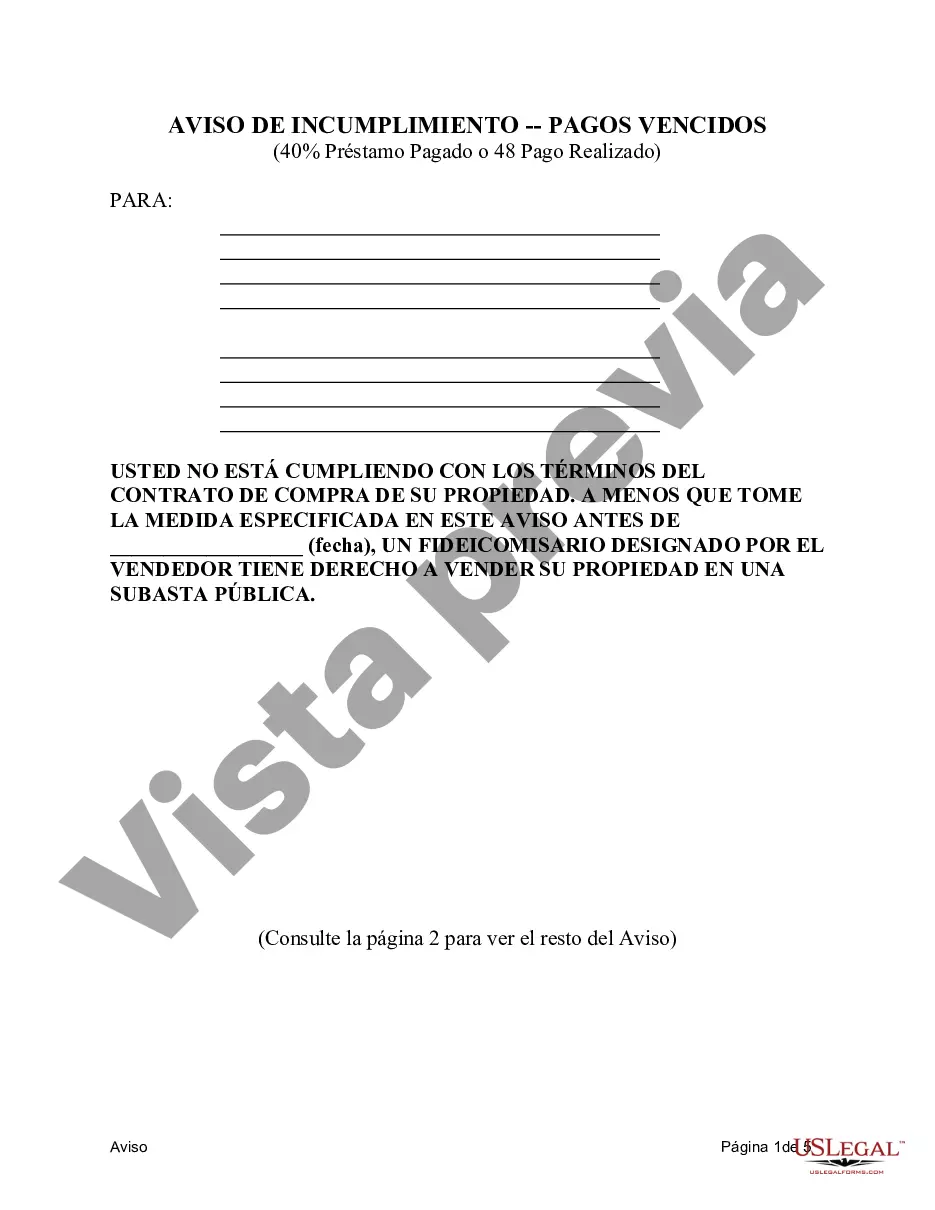

Este es un Aviso de Incumplimiento y proporciona al Comprador los detalles sobre el incumplimiento y las medidas correctivas necesarias para evitar la ejecución hipotecaria. Este formulario en particular se utiliza cuando el Comprador ha pagado el 40% del precio del contrato o ha realizado 48 o más pagos en virtud del contrato.

A Waco Texas Contract for Deed is a legal agreement that involves a property purchase where the seller acts as the lender instead of a traditional financial institution. This type of arrangement is particularly beneficial for buyers with less-than-perfect credit, as it allows them to acquire the property without going through a mortgage loan process. However, in certain cases, when the buyer fails to meet the terms of the contract, the seller may issue a Notice of Default to initiate foreclosure proceedings. The notice is generally triggered when either 40% of the loan has been paid off or after the buyer has made 48 payments, depending on the specific terms outlined in the agreement. When receiving a Notice of Default, it is crucial for the buyer to take immediate action to rectify the default and avoid potential foreclosure. The notice serves as a warning sign that the buyer is at risk of losing their investment. It signifies that the buyer has not fulfilled their obligations in terms of either loan repayment or adherence to the agreed-upon payment schedule. Upon receiving a Notice of Default, a buyer should review the terms of the contract thoroughly and consult with a legal professional experienced in real estate matters. Different types of Waco Texas Contract for Deed Notice of Default can have varying consequences and additional clauses, depending on the specific agreement. Some agreements may allow a grace period for the buyer to rectify the default, while others may have more stringent conditions resulting in immediate foreclosure. To avoid the potential loss of the property, buyers in Waco, Texas, should be aware of their rights and obligations as outlined in the Contract for Deed. Repayment terms, payment schedules, and other pertinent details must be carefully reviewed and adhered to. This will help prevent default and the subsequent issuance of a Notice of Default. In summary, a Waco Texas Contract for Deed Notice of Default is an important legal document that outlines the consequences attached to defaulting on a contract for deed agreement. Buyers who have either paid off 40% of the loan or made 48 payments need to be cautious to honor their contractual obligations and seek immediate assistance if faced with a Notice of Default to safeguard their investment. Working with a real estate attorney can provide valuable guidance throughout the process.

Free preview

How to fill out Waco Texas Contrato De Escritura Notificación De Incumplimiento Cuando Se Pagó El 40% Del Préstamo O Se Realizaron 48 Pagos?

If you’ve already used our service before, log in to your account and download the Waco Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make certain you’ve located the right document. Read the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, utilize the Search tab above to find the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Waco Texas Contract for Deed Notice of Default When 40% of Loan Paid or 48 Payments Made. Pick the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to each piece of paperwork you have purchased: you can find it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to quickly find and save any template for your personal or professional needs!