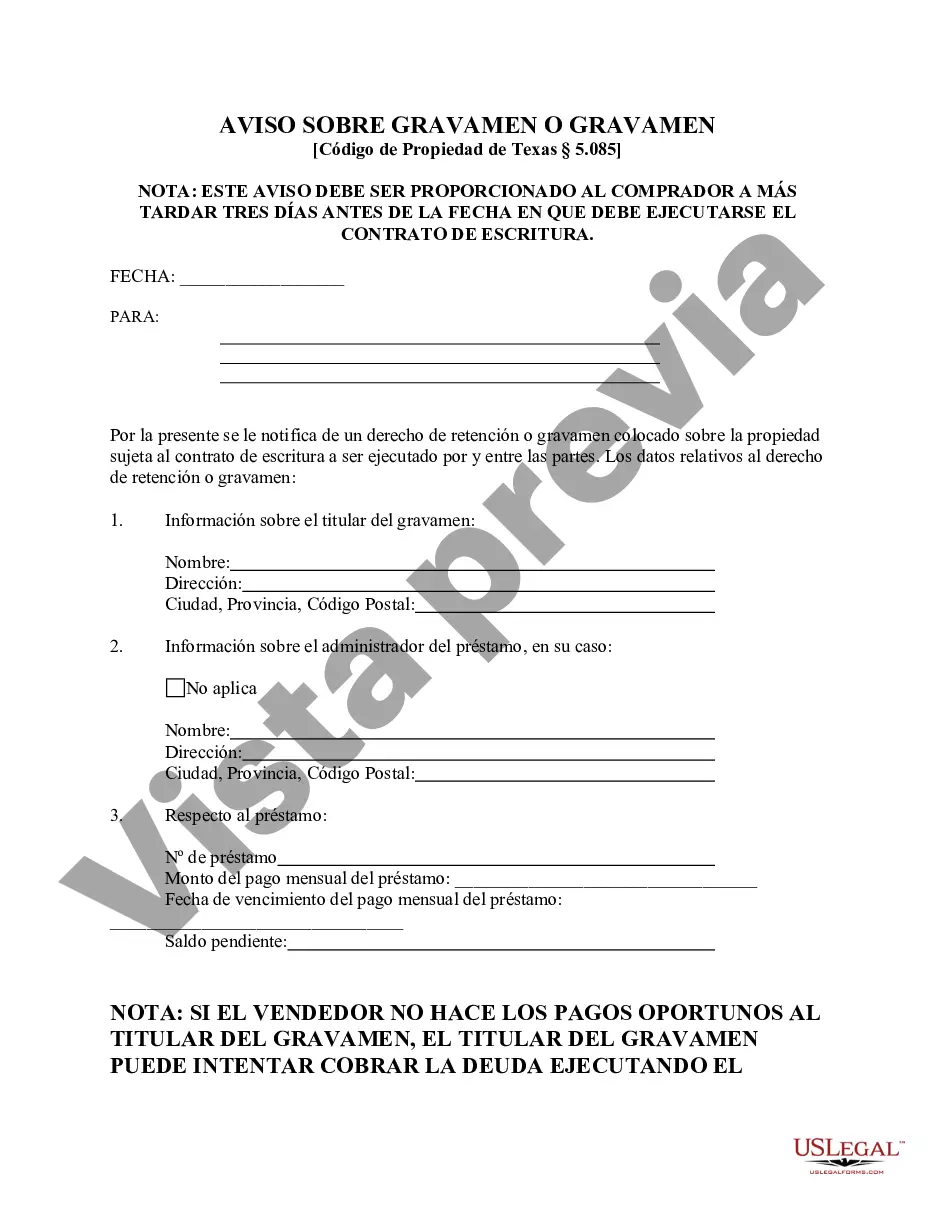

Arlington, Texas Notice Regarding Lien or Encumbrance: Understanding the Essentials Keywords: Arlington Texas, Notice, Lien, Encumbrance, Types Introduction: In the city of Arlington, Texas, property owners need to be familiar with the concept of a Notice Regarding Lien or Encumbrance. This notice serves as an essential document for both buyers and sellers to protect their property rights and ensure transparency in real estate transactions. This article aims to provide a comprehensive understanding of what this notice entails, its significance, and the different types that exist in Arlington, Texas. 1. What is a Notice Regarding Lien or Encumbrance? A Notice Regarding Lien or Encumbrance is a legal document filed with the appropriate authorities to inform the public about any existing or potential claims, liens, or encumbrances on a property. It intends to provide a clear record of a property's current status and alerts potential buyers, lenders, or interested parties about any potential issues that may affect the property's title or value. 2. Importance of Notice Regarding Lien or Encumbrance: The Notice Regarding Lien or Encumbrance holds immense importance in real estate transactions. This notice allows interested parties to make informed decisions based on accurate information about a property. By providing transparency, it helps protect buyers from purchasing property with hidden claims or debts and safeguards sellers' interests by affirming the legitimacy of their property ownership. 3. Different Types of Arlington Texas Notice Regarding Lien or Encumbrance: a) Mechanic's Lien Notice: This notice is filed by contractors, subcontractors, or suppliers who have performed work or supplied materials on a property. It serves as a claim against the property to secure payment for the services rendered, materials supplied, or unpaid debts. b) IRS Tax Lien Notice: The IRS (Internal Revenue Service) files this notice on a property when the owner has unpaid federal tax liabilities. It serves as a claim against the property, which the IRS may enforce to collect the outstanding taxes. c) HOA (Homeowners Association) Lien Notice: Homeowners associations may file this notice to enforce unpaid assessments, fees, or fines by claiming a lien against the property. The notice alerts potential buyers or lenders that the property is subject to these obligations. d) Mortgage Lien Notice: When a property owner obtains a mortgage loan to finance a property purchase, the lender files a mortgage lien notice. This notice indicates that the lender holds a security interest in the property and can enforce the lien if the borrower defaults on loan payments. e) Judgment Lien Notice: Judgment creditors who have obtained court judgments against a property owner can file this notice. It creates a lien on the property and provides public notice of the money judgment. Conclusion: In Arlington, Texas, property owners and buyers must be familiar with the Notice Regarding Lien or Encumbrance. Understanding the different types of notices, such as mechanic's liens, IRS tax liens, HOA liens, mortgage liens, and judgment liens, is crucial for making informed decisions in real estate transactions. By keeping oneself well-informed and seeking legal advice when necessary, property ownership rights can be protected and potential risks can be mitigated.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Arlington Texas Aviso sobre gravamen o gravamen - Texas Notice Regarding Lien or Encumbrance

Description

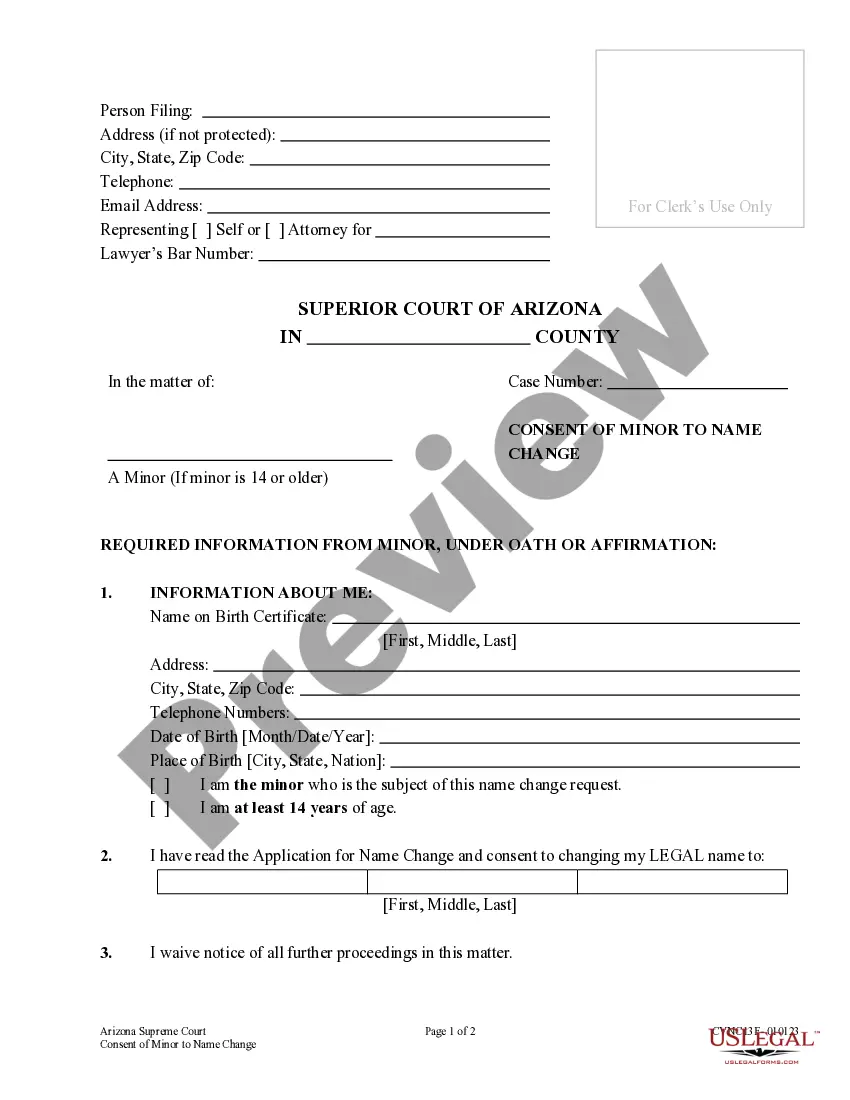

How to fill out Arlington Texas Aviso Sobre Gravamen O Gravamen?

We always strive to minimize or prevent legal issues when dealing with nuanced legal or financial matters. To accomplish this, we apply for legal services that, usually, are very costly. Nevertheless, not all legal matters are as just complex. Most of them can be taken care of by ourselves.

US Legal Forms is a web-based catalog of updated DIY legal forms addressing anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our platform helps you take your matters into your own hands without the need of using services of a lawyer. We provide access to legal document templates that aren’t always publicly available. Our templates are state- and area-specific, which considerably facilitates the search process.

Benefit from US Legal Forms whenever you need to find and download the Arlington Texas Notice Regarding Lien or Encumbrance or any other document easily and safely. Simply log in to your account and click the Get button next to it. In case you lose the form, you can always re-download it from within the My Forms tab.

The process is just as effortless if you’re unfamiliar with the website! You can register your account in a matter of minutes.

- Make sure to check if the Arlington Texas Notice Regarding Lien or Encumbrance adheres to the laws and regulations of your your state and area.

- Also, it’s crucial that you go through the form’s description (if available), and if you spot any discrepancies with what you were looking for in the first place, search for a different template.

- As soon as you’ve made sure that the Arlington Texas Notice Regarding Lien or Encumbrance would work for your case, you can pick the subscription option and proceed to payment.

- Then you can download the form in any suitable file format.

For more than 24 years of our presence on the market, we’ve helped millions of people by offering ready to customize and up-to-date legal forms. Take advantage of US Legal Forms now to save efforts and resources!