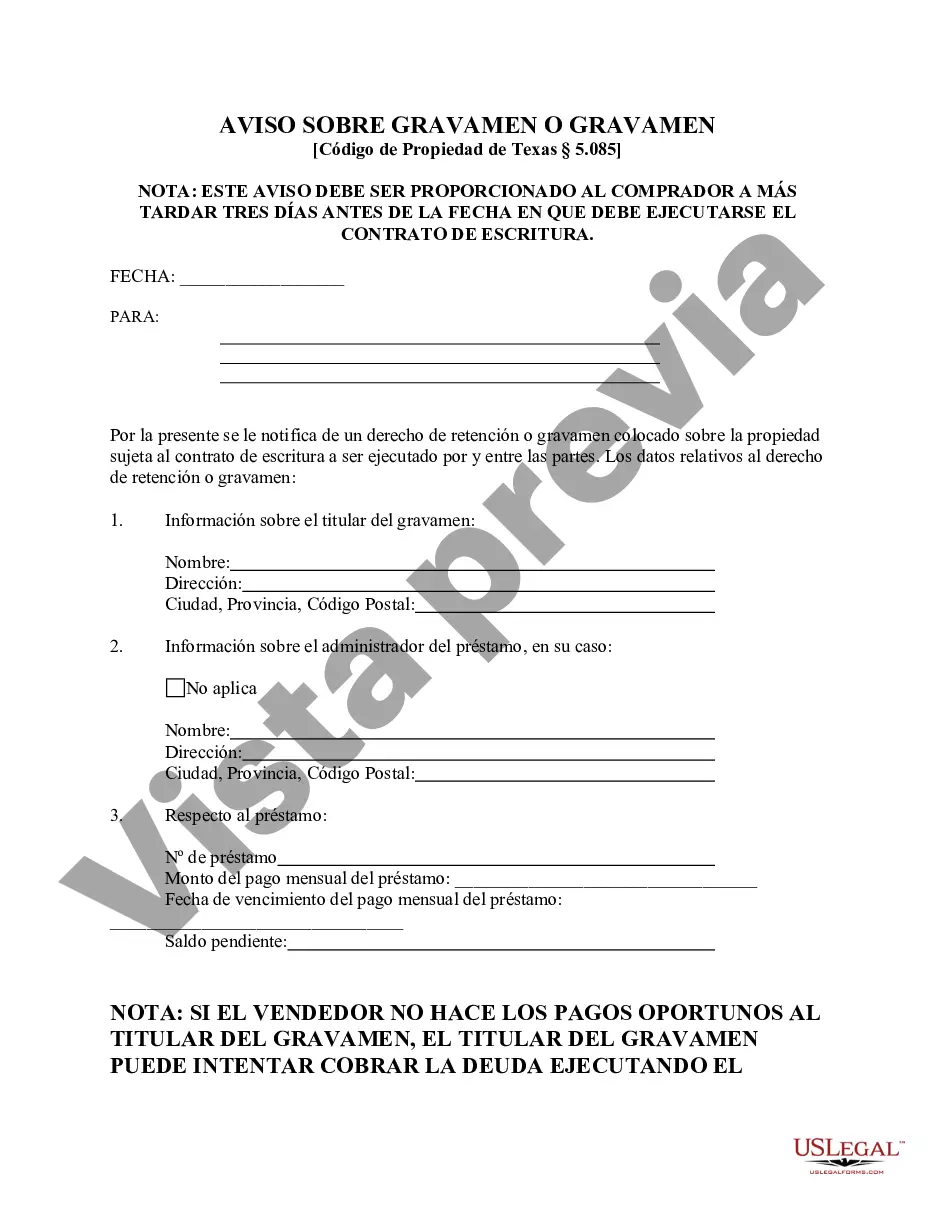

Collin Texas Notice Regarding Lien or Encumbrance is an important legal document designed to provide information about any existing liens or encumbrances on a property in Collin County, Texas. This notice is typically filed by a party with an interest in the property, such as a lender, to protect their rights and alert other interested parties about any claims or restrictions related to the property. The purpose of filing a Collin Texas Notice Regarding Lien or Encumbrance is to establish priority of claims and ensure transparency in real estate transactions. By recording this notice in the county's public records, it becomes accessible to anyone researching the property's title and can serve as a warning to potential buyers or lenders. It essentially acts as a legal safeguard against any disputes or challenges in the future. There can be several types of Collin Texas Notice Regarding Lien or Encumbrance, including: 1. Mechanic's Lien Notice: Construction professionals or contractors involved in property improvement projects may file this notice to secure their right to payment for labor, materials, or services. It serves as a claim against the property for the work performed. 2. Tax Lien Notice: The government, usually at the county or state level, may file a tax lien notice if the property owner has outstanding taxes or debts. This notice ensures that the government has the right to collect the owed taxes before any other creditors or lien holders. 3. Mortgage Lien Notice: When a property is used as collateral for a mortgage loan, the lender typically files a mortgage lien notice. This document notifies other potential lenders or buyers that the property has an existing mortgage, and the lender has a claim to the property until the loan is paid off. 4. Judgment Lien Notice: If a court awards a monetary judgment against a property owner, the winning party can file a judgment lien notice. This places a claim on the property, which means that if the owner tries to sell or refinance, the judgment lien must be satisfied before any other claims can be fulfilled. It is crucial to consult with a knowledgeable attorney or real estate professional when dealing with Collin Texas Notice Regarding Lien or Encumbrance. They can guide you through the process, ensuring all necessary paperwork is properly prepared and filed, and help protect your interests in the property.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Aviso sobre gravamen o gravamen - Texas Notice Regarding Lien or Encumbrance

Description

How to fill out Collin Texas Aviso Sobre Gravamen O Gravamen?

If you are searching for a valid form, it’s impossible to find a more convenient service than the US Legal Forms site – probably the most comprehensive libraries on the web. Here you can find a huge number of form samples for organization and individual purposes by types and regions, or keywords. With our advanced search option, finding the latest Collin Texas Notice Regarding Lien or Encumbrance is as easy as 1-2-3. In addition, the relevance of each and every file is proved by a team of expert lawyers that regularly check the templates on our website and update them in accordance with the latest state and county laws.

If you already know about our system and have a registered account, all you should do to receive the Collin Texas Notice Regarding Lien or Encumbrance is to log in to your account and click the Download option.

If you use US Legal Forms for the first time, just follow the instructions below:

- Make sure you have discovered the sample you require. Read its explanation and utilize the Preview feature (if available) to check its content. If it doesn’t meet your requirements, utilize the Search field near the top of the screen to find the appropriate document.

- Affirm your selection. Select the Buy now option. After that, choose your preferred subscription plan and provide credentials to sign up for an account.

- Process the financial transaction. Use your credit card or PayPal account to finish the registration procedure.

- Obtain the form. Pick the file format and download it to your system.

- Make changes. Fill out, revise, print, and sign the obtained Collin Texas Notice Regarding Lien or Encumbrance.

Each form you add to your account does not have an expiration date and is yours forever. It is possible to access them using the My Forms menu, so if you need to get an additional copy for enhancing or creating a hard copy, feel free to return and save it once more at any time.

Make use of the US Legal Forms extensive collection to get access to the Collin Texas Notice Regarding Lien or Encumbrance you were seeking and a huge number of other professional and state-specific samples on one platform!