Dallas Texas Notice Regarding Lien or Encumbrance is a crucial legal document that property owners or potential buyers need to be aware of when dealing with real estate transactions in the Dallas area. This notice provides valuable information about any existing liens or encumbrances on a property, which could potentially affect its marketability and ownership. Liens and encumbrances are legal claims against a property by creditors or other parties, and they can have a significant impact on a property's value and its transferability. There are several types of liens and encumbrances that could be included in the notice, including: 1. Mechanic's Liens: This type of lien arises when a contractor or supplier is not paid for work or materials provided for the improvement of the property. It is important to be aware of any outstanding mechanic's liens, as they can result in legal action against the property and affect its marketability. 2. Mortgage Liens: These liens are created when a property owner takes out a mortgage loan against the property. The mortgage holder will have a legal claim on the property until the loan is paid off in full. It is important for potential buyers to know if there are existing mortgage liens on the property they are interested in, as it may affect their ability to secure financing or negotiate the purchase price. 3. Tax Liens: When property taxes are not paid, the local government can place a tax lien on the property. This type of lien is given priority over other liens and can result in the forced sale of the property to recover the unpaid taxes. Prospective buyers should be aware of any outstanding tax liens on a property, as they can become responsible for paying off the lien if they decide to purchase it. 4. Judgment Liens: These liens are usually the result of a court judgment against a property owner. They can arise from unpaid debts, child support obligations, or other legal judgments. Judgment liens can affect the property owner's ability to sell or refinance the property, and potential buyers need to be aware of any existing judgment liens before finalizing a purchase. The Dallas Texas Notice Regarding Lien or Encumbrance provides transparency and protects both buyers and sellers in real estate transactions. It is essential for property owners and potential buyers to thoroughly review this notice to ensure there are no surprises or legal issues surrounding a property's title. By being fully informed about any liens or encumbrances, parties can make more informed decisions and protect their interests during the property transfer process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Aviso sobre gravamen o gravamen - Texas Notice Regarding Lien or Encumbrance

State:

Texas

County:

Dallas

Control #:

TX-00470-11

Format:

Word

Instant download

Description

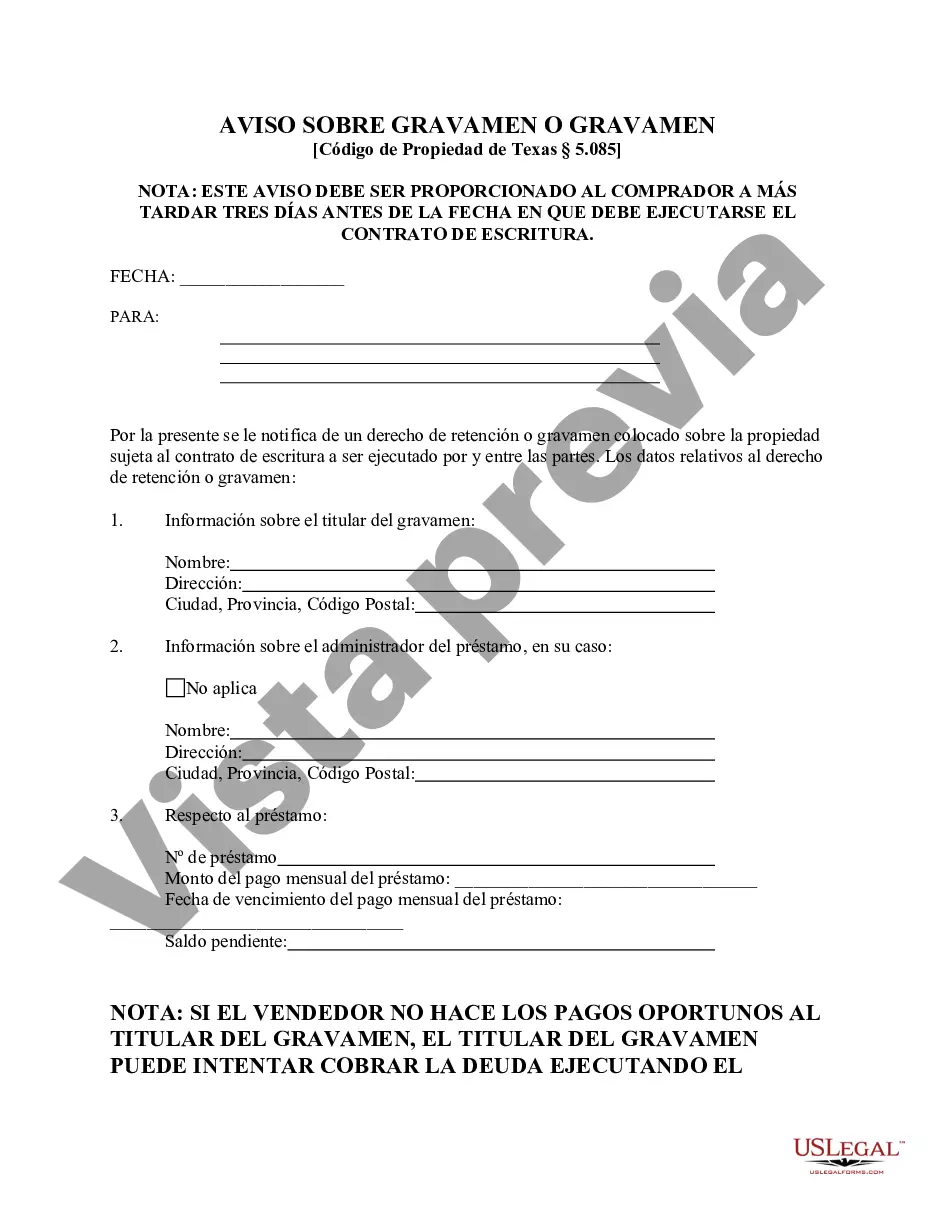

Notificación al Comprador antes de la ejecución del contrato de escritura con respecto a los detalles de un gravamen o gravamen sobre la propiedad.

Dallas Texas Notice Regarding Lien or Encumbrance is a crucial legal document that property owners or potential buyers need to be aware of when dealing with real estate transactions in the Dallas area. This notice provides valuable information about any existing liens or encumbrances on a property, which could potentially affect its marketability and ownership. Liens and encumbrances are legal claims against a property by creditors or other parties, and they can have a significant impact on a property's value and its transferability. There are several types of liens and encumbrances that could be included in the notice, including: 1. Mechanic's Liens: This type of lien arises when a contractor or supplier is not paid for work or materials provided for the improvement of the property. It is important to be aware of any outstanding mechanic's liens, as they can result in legal action against the property and affect its marketability. 2. Mortgage Liens: These liens are created when a property owner takes out a mortgage loan against the property. The mortgage holder will have a legal claim on the property until the loan is paid off in full. It is important for potential buyers to know if there are existing mortgage liens on the property they are interested in, as it may affect their ability to secure financing or negotiate the purchase price. 3. Tax Liens: When property taxes are not paid, the local government can place a tax lien on the property. This type of lien is given priority over other liens and can result in the forced sale of the property to recover the unpaid taxes. Prospective buyers should be aware of any outstanding tax liens on a property, as they can become responsible for paying off the lien if they decide to purchase it. 4. Judgment Liens: These liens are usually the result of a court judgment against a property owner. They can arise from unpaid debts, child support obligations, or other legal judgments. Judgment liens can affect the property owner's ability to sell or refinance the property, and potential buyers need to be aware of any existing judgment liens before finalizing a purchase. The Dallas Texas Notice Regarding Lien or Encumbrance provides transparency and protects both buyers and sellers in real estate transactions. It is essential for property owners and potential buyers to thoroughly review this notice to ensure there are no surprises or legal issues surrounding a property's title. By being fully informed about any liens or encumbrances, parties can make more informed decisions and protect their interests during the property transfer process.

Free preview

How to fill out Dallas Texas Aviso Sobre Gravamen O Gravamen?

If you’ve already used our service before, log in to your account and save the Dallas Texas Notice Regarding Lien or Encumbrance on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple actions to obtain your document:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t fit you, use the Search tab above to find the appropriate one.

- Buy the template. Click the Buy Now button and select a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the transaction.

- Get your Dallas Texas Notice Regarding Lien or Encumbrance. Select the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can find it in your profile within the My Forms menu anytime you need to reuse it again. Take advantage of the US Legal Forms service to quickly locate and save any template for your individual or professional needs!