Irving, Texas Notice Regarding Lien or Encumbrance: Exploring the Lien and Encumbrance Process in Irving, Texas Introduction: In the vibrant city of Irving, Texas, property owners may encounter situations where liens or encumbrances are placed on their property. Understanding the intricacies of the Irving Texas Notice Regarding Lien or Encumbrance is crucial to protect one's rights and navigate through these potential hurdles. In this comprehensive guide, we will delve into the details of the notice, its purpose, different types, and essential steps to address and resolve any issues related to liens or encumbrances. What is a Notice Regarding Lien or Encumbrance? A Notice Regarding Lien or Encumbrance is a formal legal notice filed by a person or entity claiming a financial interest in a property, thereby potentially restricting or encumbering its sale or transfer. It serves as public notification of the lien or encumbrance, informing interested parties, including potential buyers, lenders, and other stakeholders, about the outstanding claim on the property. Types of Irving Texas Notice Regarding Lien or Encumbrance: 1. Mechanic's Lien: A Mechanic's Lien is one type of lien frequently encountered in construction or renovation projects. It arises when a contractor, subcontractor, or supplier is not paid for their services, labor, or materials provided. Filing a Mechanic's Lien on the property ensures that the unpaid party has a legal right to seek payment and potentially foreclose the property to satisfy the debt. 2. Tax Lien: Tax Liens are imposed by tax authorities — typically the local county or cit— - on properties with delinquent property tax payments. These liens serve as a means to collect outstanding taxes owed. Failure to address tax liens may lead to foreclosure or auction of the property. 3. Judgment Lien: A Judgment Lien is created when a court grants a monetary judgment against a property owner due to an unpaid debt or legal judgment. This lien can be filed by creditors, suppliers, or other parties who have successfully obtained court judgments against the property owner. Addressing the Notice Regarding Lien or Encumbrance: Upon receiving a Notice Regarding Lien or Encumbrance, property owners in Irving, Texas, should carefully review the document and take appropriate steps to safeguard their rights. Here are some essential steps to consider: 1. Validity Verification: Property owners must validate the legitimacy of the lien or encumbrance by analyzing the documentation provided in the notice. It is crucial to ensure that all statutory requirements have been met, and any discrepancies are promptly addressed. 2. Seek Legal Advice: Given the complexities involved in dealing with liens or encumbrances, consulting with an experienced real estate attorney is recommended. Legal professionals can provide personalized guidance, assess potential courses of action, and help protect the property owner's interests throughout the process. 3. Negotiation or Resolution: Depending on the circumstances, property owners may opt to negotiate with the lien holder or the party responsible for the encumbrance to resolve the issue outside of court. This might involve payment plans, settlements, or other means of resolving the debt. 4. Judicial Actions: In some cases, property owners may need to pursue legal actions to protect their rights. This could include filing a lawsuit to contest the validity of the lien or encumbrance, seeking a release or discharge of the claim, or requesting the court's assistance in resolving the dispute. Conclusion: Understanding the intricacies of the Irving Texas Notice Regarding Lien or Encumbrance is essential for property owners to navigate through potential challenges effectively. By being familiar with the different types of liens and encumbrances and following the appropriate steps to address and resolve such matters, property owners can protect their rights and ensure a smooth real estate transaction process in Irving, Texas.

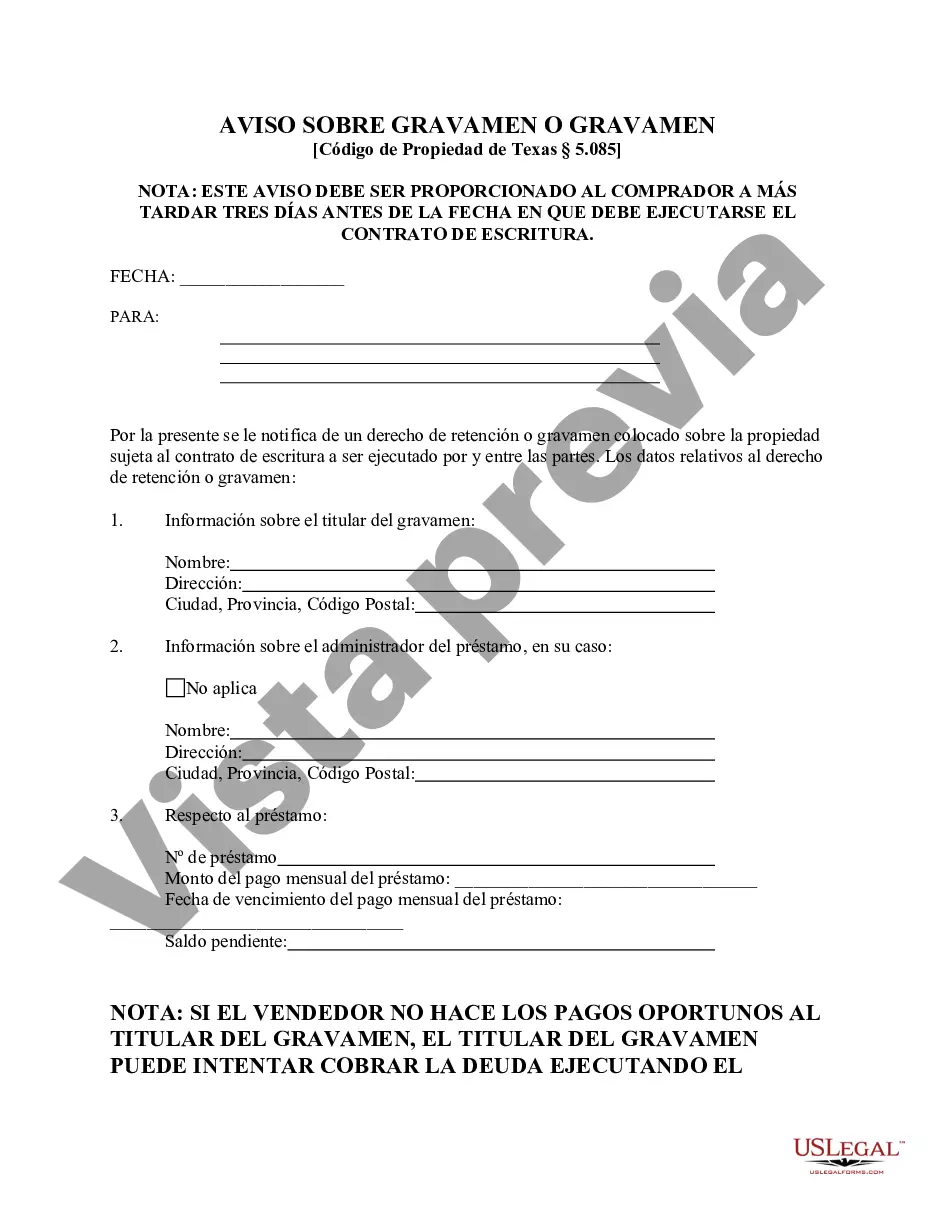

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Irving Texas Aviso sobre gravamen o gravamen - Texas Notice Regarding Lien or Encumbrance

Description

How to fill out Irving Texas Aviso Sobre Gravamen O Gravamen?

No matter what social or professional status, filling out legal forms is an unfortunate necessity in today’s world. Very often, it’s virtually impossible for someone without any law background to draft such papers cfrom the ground up, mainly due to the convoluted jargon and legal subtleties they entail. This is where US Legal Forms can save the day. Our platform offers a huge catalog with more than 85,000 ready-to-use state-specific forms that work for pretty much any legal situation. US Legal Forms also serves as an excellent asset for associates or legal counsels who want to to be more efficient time-wise using our DYI tpapers.

Whether you require the Irving Texas Notice Regarding Lien or Encumbrance or any other document that will be valid in your state or county, with US Legal Forms, everything is at your fingertips. Here’s how you can get the Irving Texas Notice Regarding Lien or Encumbrance in minutes using our trusted platform. In case you are presently a subscriber, you can go ahead and log in to your account to get the needed form.

Nevertheless, in case you are new to our platform, ensure that you follow these steps prior to obtaining the Irving Texas Notice Regarding Lien or Encumbrance:

- Be sure the form you have found is suitable for your area since the rules of one state or county do not work for another state or county.

- Preview the form and go through a brief outline (if provided) of cases the document can be used for.

- In case the one you chosen doesn’t suit your needs, you can start again and look for the necessary document.

- Click Buy now and pick the subscription option you prefer the best.

- Access an account {using your login information or create one from scratch.

- Choose the payment method and proceed to download the Irving Texas Notice Regarding Lien or Encumbrance once the payment is completed.

You’re all set! Now you can go ahead and print out the form or complete it online. In case you have any problems getting your purchased forms, you can easily access them in the My Forms tab.

Regardless of what situation you’re trying to solve, US Legal Forms has got you covered. Give it a try today and see for yourself.