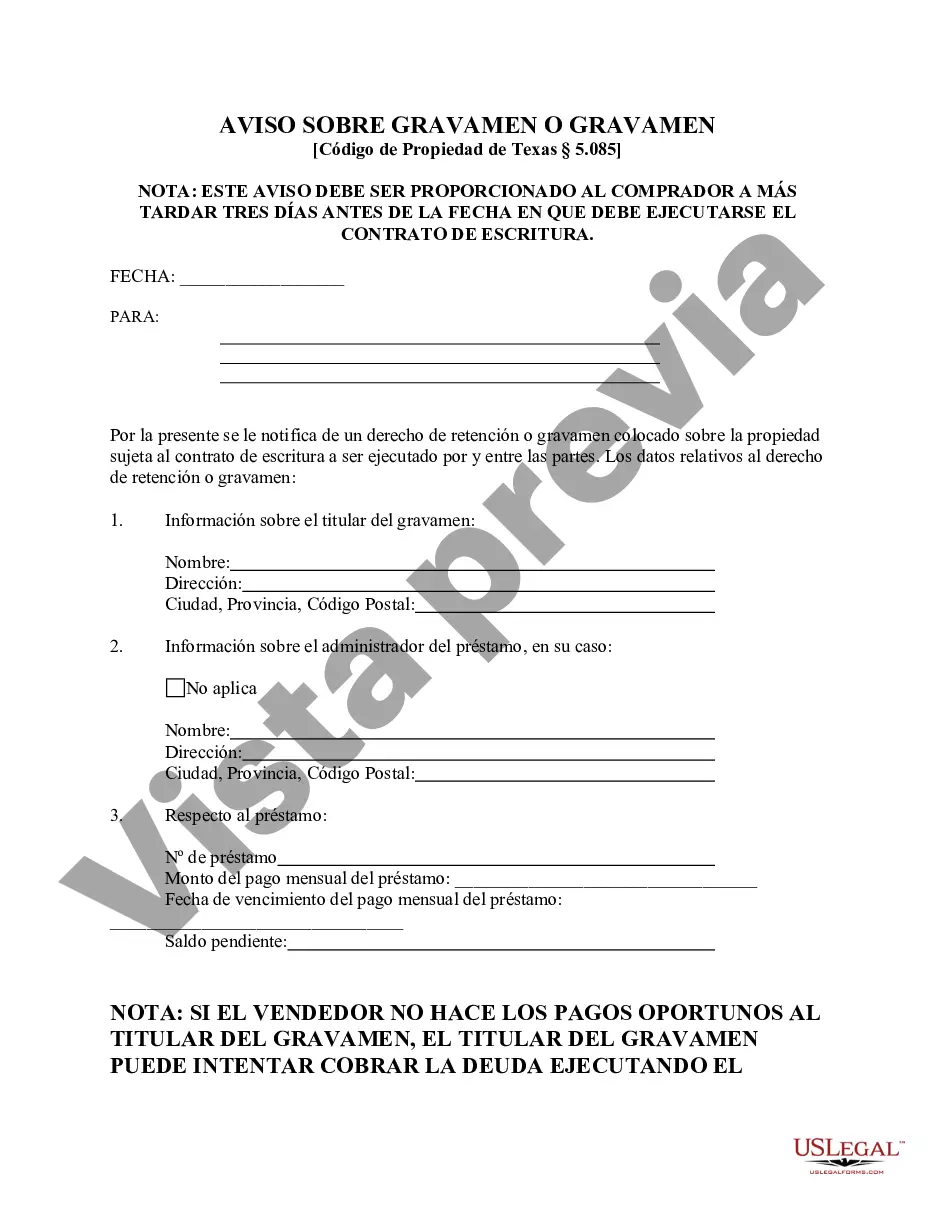

McKinney, Texas Notice Regarding Lien or Encumbrance: A Comprehensive Overview In McKinney, Texas, property owners and potential buyers need to be aware of the Notice Regarding Lien or Encumbrance, which plays a crucial role in property transactions. This legal notice ensures that any existing liens or encumbrances on a property are disclosed and properly addressed, protecting all parties involved. Understanding this process is essential for a smooth real estate transaction in McKinney, Texas. What is a Notice Regarding Lien or Encumbrance? A Notice Regarding Lien or Encumbrance is an official document filed in public records that notifies interested parties about any potential claims, liens, or encumbrances on a property. It serves as a warning to potential buyers or lenders that certain restrictions, legal claims, or outstanding debts may exist on the property in question. Purpose and Importance The purpose of the Notice Regarding Lien or Encumbrance is to provide transparency and protect the interests of all parties involved in a real estate transaction. This notice informs potential buyers about any existing claims, liens, or encumbrances before they make their purchase, allowing them to assess the risks and negotiate accordingly. It also ensures that all parties have a clear understanding of the property's legal and financial obligations, avoiding surprises or disputes down the road. Types of McKinney, Texas Notice Regarding Lien or Encumbrance 1. Mechanics' Liens: These are filed by contractors, subcontractors, or suppliers who haven't been paid for work or materials provided on a property. A mechanics' lien can affect the property's marketability until the debt is settled. 2. Tax Liens: When property owners fail to pay their property taxes, the local government may place a tax lien on the property. These liens must be resolved before a property sale can occur. 3. Homeowner Association Liens: If a property is part of a homeowner association (HOA), the HOA may file a lien for unpaid dues, fines, or assessments, indicating that the property is subject to certain restrictions and financial obligations. 4. Mortgage or Deed of Trust Liens: These are liens placed on the property by lenders to secure their interest in the property until the mortgage or loan is paid off. These liens usually take precedence over other types of liens. 5. Judgment Liens: A court judgment against a property owner for unpaid debts can result in a judgment lien. These liens can hinder the property's transfer until the outstanding debt is satisfied. Conclusion When dealing with real estate transactions in McKinney, Texas, understanding and complying with the Notice Regarding Lien or Encumbrance is vital. It ensures that all parties involved are aware of any existing liens or encumbrances on the property, ultimately protecting their interests. By addressing these issues beforehand, buyers can make informed decisions, and sellers can minimize potential legal disputes. Whether it is a mechanics' lien, tax lien, HOA lien, mortgage or deed of trust lien, or judgment lien, knowing the specific type of lien is crucial for a successful transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.McKinney Texas Aviso sobre gravamen o gravamen - Texas Notice Regarding Lien or Encumbrance

Description

How to fill out McKinney Texas Aviso Sobre Gravamen O Gravamen?

If you are looking for a relevant form, it’s difficult to find a better platform than the US Legal Forms website – probably the most extensive libraries on the web. Here you can get a huge number of templates for organization and personal purposes by types and regions, or keywords. Using our high-quality search option, discovering the newest McKinney Texas Notice Regarding Lien or Encumbrance is as easy as 1-2-3. Additionally, the relevance of each file is confirmed by a group of skilled attorneys that regularly review the templates on our website and revise them in accordance with the latest state and county demands.

If you already know about our system and have a registered account, all you need to receive the McKinney Texas Notice Regarding Lien or Encumbrance is to log in to your profile and click the Download option.

If you utilize US Legal Forms the very first time, just follow the instructions listed below:

- Make sure you have found the form you require. Look at its information and utilize the Preview feature to explore its content. If it doesn’t meet your needs, utilize the Search field at the top of the screen to find the needed file.

- Confirm your selection. Click the Buy now option. Next, pick your preferred subscription plan and provide credentials to register an account.

- Make the financial transaction. Make use of your credit card or PayPal account to finish the registration procedure.

- Get the template. Select the format and download it to your system.

- Make changes. Fill out, revise, print, and sign the obtained McKinney Texas Notice Regarding Lien or Encumbrance.

Each and every template you save in your profile has no expiration date and is yours forever. You always have the ability to access them via the My Forms menu, so if you want to receive an additional copy for modifying or creating a hard copy, you can return and save it once more whenever you want.

Take advantage of the US Legal Forms extensive catalogue to get access to the McKinney Texas Notice Regarding Lien or Encumbrance you were looking for and a huge number of other professional and state-specific samples on one platform!