Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

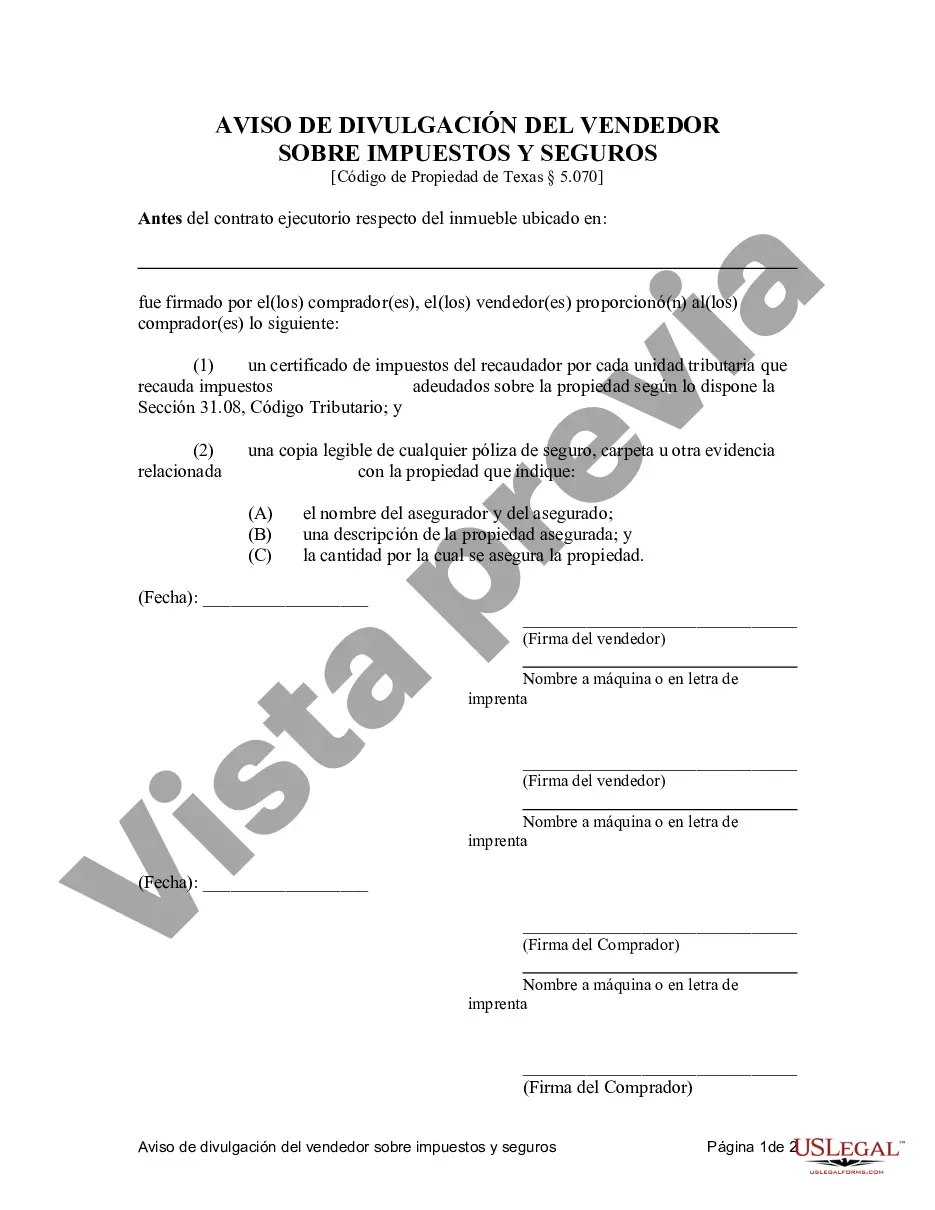

The Abilene Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a crucial document used in residential land contracts or agreement for deed transactions. In this detailed description, we will explore the key components of this document, highlighting its purpose and importance, along with relevant keywords related to various types of Abilene Texas Contract for Deed Seller's Disclosures in real estate. 1. Abilene Texas Contract for Deed Seller's Disclosure: This disclosure is a legal document focusing on tax payment and insurance matters related to residential land contracts or agreement for deed in Abilene, Texas. It ensures transparency by requiring the seller to provide detailed information about taxes and insurance related to the property being sold. 2. Tax Payment Disclosure: This component of the Abilene Texas Contract for Deed Seller's Disclosure highlights the seller's responsibility for property tax payment until the contract is fulfilled. It includes information about the current tax status, payment schedules, and any outstanding taxes that need to be addressed before completing the transaction. 3. Insurance Disclosure: The insurance disclosure section outlines the extent of insurance coverage obtained by the seller and highlights the buyer's obligations regarding insurance during the contract period. It may include details about homeowner's insurance, flood insurance, or any specific coverage required for the property. 4. Residential Land Contract: The residential land contract, also known as an agreement for deed, is a legal agreement between the seller and buyer for the sale of a property. It allows the buyer to possess and use the property while making payments over an agreed period. Consequently, the Abilene Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance serves as an essential document within this type of contract. Different Types of Abilene Texas Contract for Deed Seller's Disclosures: 1. Single-Family Residential Land Contract: This type of contract for deed disclosure applies to single-family homes or properties intended for residential use. It addresses tax payment and insurance matters specifically related to this type of property. 2. Multi-Unit Residential Land Contract: When dealing with multi-unit residential properties, such as duplexes, quadruplets, or apartment buildings, a separate version of the Abilene Texas Contract for Deed Seller's Disclosure may be necessary. This type of disclosure would consider the unique tax and insurance requirements associated with such properties. 3. Commercial Property Land Contract: For commercial properties like office buildings, retail spaces, or warehouses, another version of the Abilene Texas Contract for Deed Seller's Disclosure is applicable. It would focus on the specific tax and insurance considerations relevant to commercial real estate transactions. In conclusion, the Abilene Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a comprehensive document providing essential information about tax obligations and insurance coverage for residential land contract or agreement for deed transactions. The above descriptions and keywords illuminate the purpose and variations of this vital disclosure within the real estate market of Abilene, Texas, ensuring a clear understanding between sellers and buyers.The Abilene Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a crucial document used in residential land contracts or agreement for deed transactions. In this detailed description, we will explore the key components of this document, highlighting its purpose and importance, along with relevant keywords related to various types of Abilene Texas Contract for Deed Seller's Disclosures in real estate. 1. Abilene Texas Contract for Deed Seller's Disclosure: This disclosure is a legal document focusing on tax payment and insurance matters related to residential land contracts or agreement for deed in Abilene, Texas. It ensures transparency by requiring the seller to provide detailed information about taxes and insurance related to the property being sold. 2. Tax Payment Disclosure: This component of the Abilene Texas Contract for Deed Seller's Disclosure highlights the seller's responsibility for property tax payment until the contract is fulfilled. It includes information about the current tax status, payment schedules, and any outstanding taxes that need to be addressed before completing the transaction. 3. Insurance Disclosure: The insurance disclosure section outlines the extent of insurance coverage obtained by the seller and highlights the buyer's obligations regarding insurance during the contract period. It may include details about homeowner's insurance, flood insurance, or any specific coverage required for the property. 4. Residential Land Contract: The residential land contract, also known as an agreement for deed, is a legal agreement between the seller and buyer for the sale of a property. It allows the buyer to possess and use the property while making payments over an agreed period. Consequently, the Abilene Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance serves as an essential document within this type of contract. Different Types of Abilene Texas Contract for Deed Seller's Disclosures: 1. Single-Family Residential Land Contract: This type of contract for deed disclosure applies to single-family homes or properties intended for residential use. It addresses tax payment and insurance matters specifically related to this type of property. 2. Multi-Unit Residential Land Contract: When dealing with multi-unit residential properties, such as duplexes, quadruplets, or apartment buildings, a separate version of the Abilene Texas Contract for Deed Seller's Disclosure may be necessary. This type of disclosure would consider the unique tax and insurance requirements associated with such properties. 3. Commercial Property Land Contract: For commercial properties like office buildings, retail spaces, or warehouses, another version of the Abilene Texas Contract for Deed Seller's Disclosure is applicable. It would focus on the specific tax and insurance considerations relevant to commercial real estate transactions. In conclusion, the Abilene Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a comprehensive document providing essential information about tax obligations and insurance coverage for residential land contract or agreement for deed transactions. The above descriptions and keywords illuminate the purpose and variations of this vital disclosure within the real estate market of Abilene, Texas, ensuring a clear understanding between sellers and buyers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.