Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

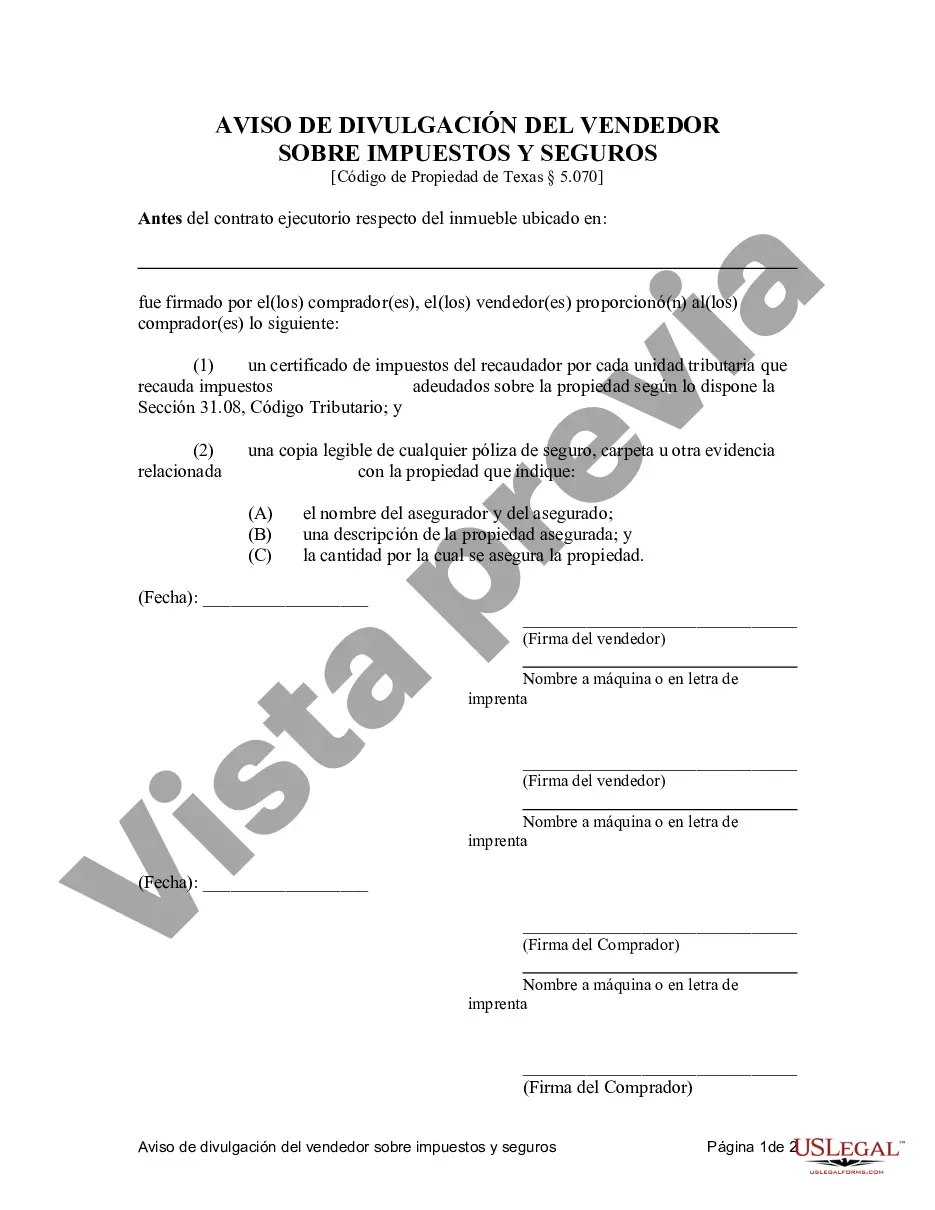

Amarillo, Texas, Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legally binding document that outlines the terms and conditions of purchasing a property through a contract for deed arrangement. This agreement is designed to protect both the buyer and the seller in the transaction and ensure transparency and understanding of tax payment and insurance responsibilities. The Amarillo, Texas, Contract for Deed Seller's Disclosure of Tax Payment and Insurance aims to disclose important information regarding the property taxes and insurance obligations to both parties involved. It is essential for sellers to provide accurate information about any outstanding taxes, assessments, or liens on the property, as well as any insurance coverage that may be in effect. This disclosure is crucial as it helps buyers make informed decisions about the property purchase and understand their potential financial obligations. In Amarillo, Texas, there may be variants of the Contract for Deed Seller's Disclosure of Tax Payment and Insurance to cater to specific situations. These variants could include: 1. Residential Contract for Deed Seller's Disclosure of Tax Payment and Insurance: This type of agreement is tailored for residential properties and covers the necessary disclosures related to tax payments and insurance. 2. Land Contract Seller's Disclosure of Tax Payment and Insurance: This type of contract applies specifically to land purchases made through a contract for deed arrangement. It encompasses the disclosure of tax and insurance obligations relevant to the land property. 3. Agreement for Deed Seller's Disclosure of Tax Payment and Insurance: This variant focuses on the disclosure of tax and insurance details for properties being sold through an agreement for deed, which is another term for a contract for deed. Regardless of the specific type of Amarillo, Texas, Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed, the document is intended to ensure transparency, protect both parties' interests, and clarify the tax and insurance responsibilities associated with the property purchase. To ensure compliance with local laws and regulations, it is advisable to consult with a qualified real estate attorney or professional when drafting or reviewing any contract for deed or related disclosures.Amarillo, Texas, Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legally binding document that outlines the terms and conditions of purchasing a property through a contract for deed arrangement. This agreement is designed to protect both the buyer and the seller in the transaction and ensure transparency and understanding of tax payment and insurance responsibilities. The Amarillo, Texas, Contract for Deed Seller's Disclosure of Tax Payment and Insurance aims to disclose important information regarding the property taxes and insurance obligations to both parties involved. It is essential for sellers to provide accurate information about any outstanding taxes, assessments, or liens on the property, as well as any insurance coverage that may be in effect. This disclosure is crucial as it helps buyers make informed decisions about the property purchase and understand their potential financial obligations. In Amarillo, Texas, there may be variants of the Contract for Deed Seller's Disclosure of Tax Payment and Insurance to cater to specific situations. These variants could include: 1. Residential Contract for Deed Seller's Disclosure of Tax Payment and Insurance: This type of agreement is tailored for residential properties and covers the necessary disclosures related to tax payments and insurance. 2. Land Contract Seller's Disclosure of Tax Payment and Insurance: This type of contract applies specifically to land purchases made through a contract for deed arrangement. It encompasses the disclosure of tax and insurance obligations relevant to the land property. 3. Agreement for Deed Seller's Disclosure of Tax Payment and Insurance: This variant focuses on the disclosure of tax and insurance details for properties being sold through an agreement for deed, which is another term for a contract for deed. Regardless of the specific type of Amarillo, Texas, Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed, the document is intended to ensure transparency, protect both parties' interests, and clarify the tax and insurance responsibilities associated with the property purchase. To ensure compliance with local laws and regulations, it is advisable to consult with a qualified real estate attorney or professional when drafting or reviewing any contract for deed or related disclosures.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.