Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

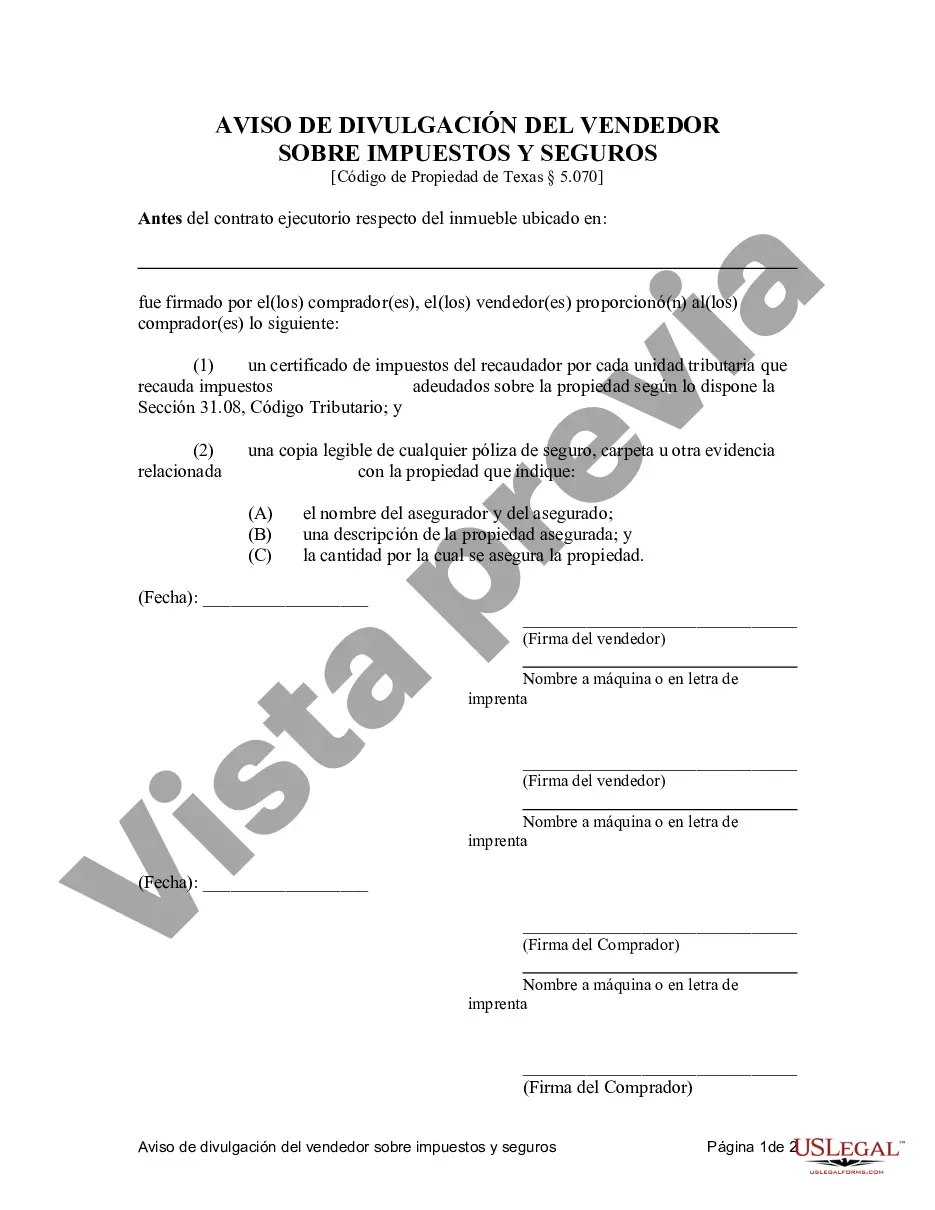

Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is an important legal document used in real estate transactions. It serves as a disclosure statement that outlines the responsibilities and obligations of the seller and buyer in relation to tax payments and insurance coverage. This document aims to provide transparency and protection for both parties involved in the sale of a property under a land contract or agreement for deed. The Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance typically includes relevant keywords such as: 1. Carrollton Texas: This indicates that the document is specifically designed for real estate transactions in Carrollton, Texas. 2. Contract for Deed: Also known as an installment land contract or a bond for title, this refers to a type of agreement where the seller retains legal title to the property until the buyer fulfills the payment obligations. It allows buyers with limited credit or financial resources to acquire a property. 3. Seller's Disclosure: This refers to the act of the seller providing relevant information about the property's condition, history, and any known issues that may affect its value or desirability. 4. Tax Payment: This term highlights the seller's responsibility to disclose any outstanding property tax obligations or tax liens on the property. It also clarifies how these payments should be handled during the contract period. 5. Insurance: This section outlines the type and amount of insurance coverage required for the property during the contract period. It may include homeowner's insurance, hazard insurance, or any other relevant policies to protect against potential risks and losses. 6. Residential: This indicates that the contract is specifically designed for residential properties, such as single-family homes, townhouses, or condominiums. Possible variations of the Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include: — Carrollton Texas Commercial Contract for Deed Seller's Disclosure of Tax Payment and Insurance Commercialia— - Land Contract - Agreement for Deed: This version is tailored for commercial properties, such as office buildings, retail spaces, or industrial facilities. — Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance — VacanLANan— - Land Contract - Agreement for Deed: This variation focuses on land contracts and agreement for deeds related to vacant land or undeveloped properties. — Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Multifamilyil— - Land Contract - Agreement for Deed: This version is specific to multi-family properties, such as duplexes, apartment buildings, or condominium complexes. In summary, the Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is an essential document that outlines the responsibilities and expectations regarding tax payments and insurance coverage in real estate transactions. It helps ensure transparency, protect both parties, and specify the terms of the land contract or agreement for deed.Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is an important legal document used in real estate transactions. It serves as a disclosure statement that outlines the responsibilities and obligations of the seller and buyer in relation to tax payments and insurance coverage. This document aims to provide transparency and protection for both parties involved in the sale of a property under a land contract or agreement for deed. The Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance typically includes relevant keywords such as: 1. Carrollton Texas: This indicates that the document is specifically designed for real estate transactions in Carrollton, Texas. 2. Contract for Deed: Also known as an installment land contract or a bond for title, this refers to a type of agreement where the seller retains legal title to the property until the buyer fulfills the payment obligations. It allows buyers with limited credit or financial resources to acquire a property. 3. Seller's Disclosure: This refers to the act of the seller providing relevant information about the property's condition, history, and any known issues that may affect its value or desirability. 4. Tax Payment: This term highlights the seller's responsibility to disclose any outstanding property tax obligations or tax liens on the property. It also clarifies how these payments should be handled during the contract period. 5. Insurance: This section outlines the type and amount of insurance coverage required for the property during the contract period. It may include homeowner's insurance, hazard insurance, or any other relevant policies to protect against potential risks and losses. 6. Residential: This indicates that the contract is specifically designed for residential properties, such as single-family homes, townhouses, or condominiums. Possible variations of the Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include: — Carrollton Texas Commercial Contract for Deed Seller's Disclosure of Tax Payment and Insurance Commercialia— - Land Contract - Agreement for Deed: This version is tailored for commercial properties, such as office buildings, retail spaces, or industrial facilities. — Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance — VacanLANan— - Land Contract - Agreement for Deed: This variation focuses on land contracts and agreement for deeds related to vacant land or undeveloped properties. — Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Multifamilyil— - Land Contract - Agreement for Deed: This version is specific to multi-family properties, such as duplexes, apartment buildings, or condominium complexes. In summary, the Carrollton Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is an essential document that outlines the responsibilities and expectations regarding tax payments and insurance coverage in real estate transactions. It helps ensure transparency, protect both parties, and specify the terms of the land contract or agreement for deed.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.