Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

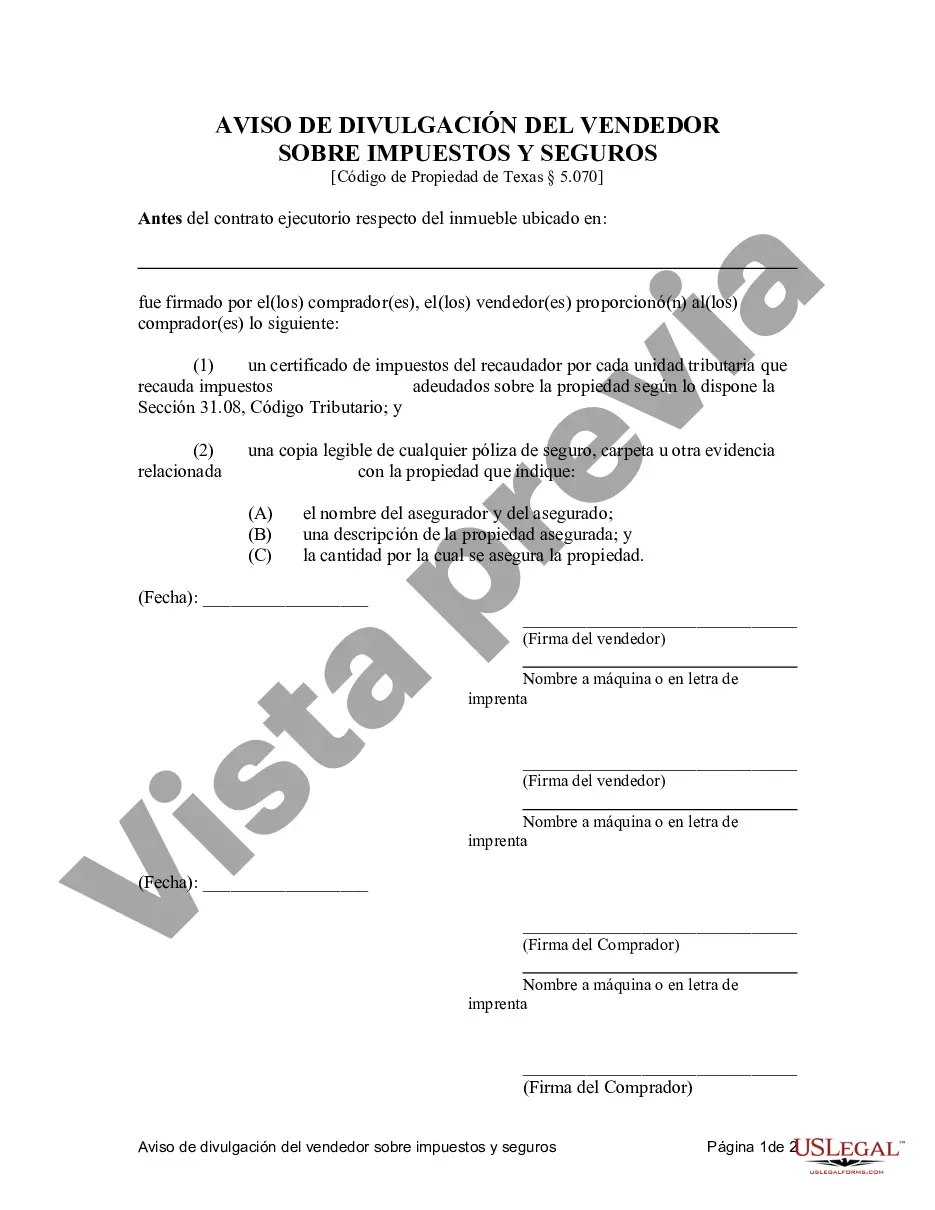

Collin Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legally binding document used in real estate transactions in Collin County, Texas. This disclosure statement serves to outline the seller's responsibilities regarding tax payment and insurance obligations associated with the property being sold under a contract for deed. In Collin County, Texas, there are different types of contracts for deed seller's disclosures related to tax payment and insurance in residential land transactions. These may vary based on the specific terms and conditions agreed upon by the parties involved. Some key types of Collin Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed include: 1. Tax Payment Disclosure: This disclosure aspect of the agreement stipulates the seller's responsibility to disclose the current tax status and any pending tax liabilities related to the property. It ensures that the buyer is aware of the tax payment responsibilities and any outstanding obligations they may inherit after acquiring the property under a contract for deed. 2. Insurance Disclosure: This component of the disclosure outlines the seller's duty to disclose information about the property's insurance coverage. It includes details on existing insurance policies, coverage limits, and any potential claims or issues related to the property's insurance history. This disclosure ensures that the buyer is informed about the insurability of the property and potential risks. 3. Residential Land Contract Disclosure: This section specifies the terms and conditions of the contract for deed, outlining the rights and obligations of both the buyer and the seller. It covers essential aspects such as the purchase price, payment terms, interest rates, default and remedies, and any special conditions agreed upon between the parties involved. 4. Agreement for Deed: This aspect of the disclosure outlines the agreement between the buyer and the seller regarding the transfer of the property. It includes details like the legal description of the property, purchase price, financial terms, default provisions, and other relevant clauses. This Collin Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed ensures transparency and clarity regarding tax payment and insurance obligations in real estate transactions. It protects the rights and interests of both the buyer and the seller, fostering a smooth and fair transaction process.Collin Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legally binding document used in real estate transactions in Collin County, Texas. This disclosure statement serves to outline the seller's responsibilities regarding tax payment and insurance obligations associated with the property being sold under a contract for deed. In Collin County, Texas, there are different types of contracts for deed seller's disclosures related to tax payment and insurance in residential land transactions. These may vary based on the specific terms and conditions agreed upon by the parties involved. Some key types of Collin Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed include: 1. Tax Payment Disclosure: This disclosure aspect of the agreement stipulates the seller's responsibility to disclose the current tax status and any pending tax liabilities related to the property. It ensures that the buyer is aware of the tax payment responsibilities and any outstanding obligations they may inherit after acquiring the property under a contract for deed. 2. Insurance Disclosure: This component of the disclosure outlines the seller's duty to disclose information about the property's insurance coverage. It includes details on existing insurance policies, coverage limits, and any potential claims or issues related to the property's insurance history. This disclosure ensures that the buyer is informed about the insurability of the property and potential risks. 3. Residential Land Contract Disclosure: This section specifies the terms and conditions of the contract for deed, outlining the rights and obligations of both the buyer and the seller. It covers essential aspects such as the purchase price, payment terms, interest rates, default and remedies, and any special conditions agreed upon between the parties involved. 4. Agreement for Deed: This aspect of the disclosure outlines the agreement between the buyer and the seller regarding the transfer of the property. It includes details like the legal description of the property, purchase price, financial terms, default provisions, and other relevant clauses. This Collin Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed ensures transparency and clarity regarding tax payment and insurance obligations in real estate transactions. It protects the rights and interests of both the buyer and the seller, fostering a smooth and fair transaction process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.