Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

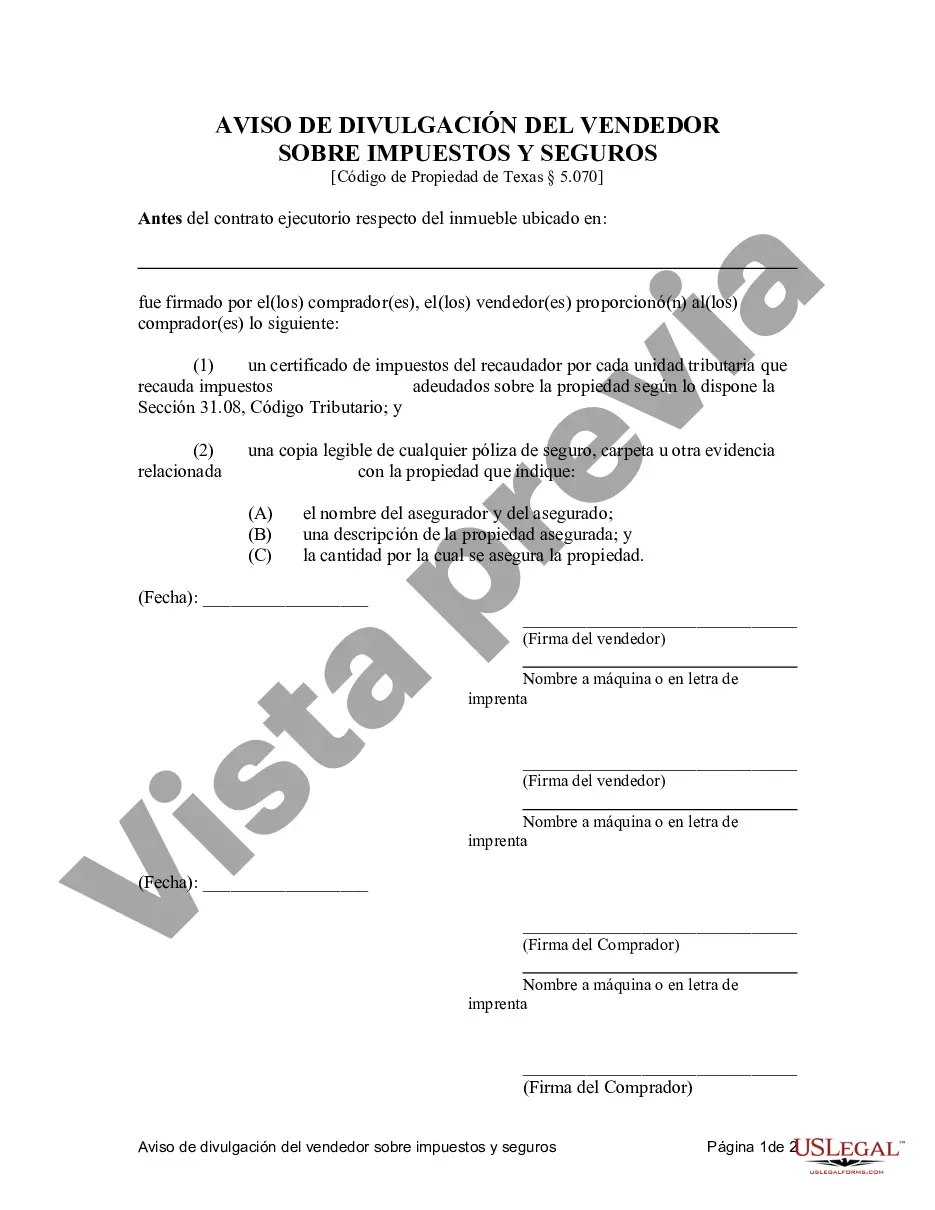

Edinburg Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legal document that outlines the responsibilities and obligations of both the seller and buyer in a real estate transaction. It includes important information related to tax payments and insurance coverage. Here are some relevant keywords related to this document: 1. Edinburg Texas: Refers to the geographical location where the contract is being used. 2. Contract for Deed: A type of real estate agreement where the seller finances the purchase of the property. 3. Seller's Disclosure: The information provided by the seller about the condition and history of the property being sold. 4. Tax Payment: Refers to the payment of property taxes by the buyer or the seller according to the terms stated in the contract. 5. Insurance: Indicates the requirement for insurance coverage on the property, such as homeowners insurance. 6. Residential: Specifies that the contract is applicable for residential properties. 7. Land Contract: Another term for a contract for deed, often used interchangeably. 8. Agreement for Deed: Similar to a land contract, where the seller provides financing to the buyer for the purchase of the property. Different types of Edinburg Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include variations in the terms and conditions based on the specific requirements of the parties involved. It is important to consult with a real estate attorney or professional to ensure that all legal and contractual obligations are properly addressed in the document.Edinburg Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legal document that outlines the responsibilities and obligations of both the seller and buyer in a real estate transaction. It includes important information related to tax payments and insurance coverage. Here are some relevant keywords related to this document: 1. Edinburg Texas: Refers to the geographical location where the contract is being used. 2. Contract for Deed: A type of real estate agreement where the seller finances the purchase of the property. 3. Seller's Disclosure: The information provided by the seller about the condition and history of the property being sold. 4. Tax Payment: Refers to the payment of property taxes by the buyer or the seller according to the terms stated in the contract. 5. Insurance: Indicates the requirement for insurance coverage on the property, such as homeowners insurance. 6. Residential: Specifies that the contract is applicable for residential properties. 7. Land Contract: Another term for a contract for deed, often used interchangeably. 8. Agreement for Deed: Similar to a land contract, where the seller provides financing to the buyer for the purchase of the property. Different types of Edinburg Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include variations in the terms and conditions based on the specific requirements of the parties involved. It is important to consult with a real estate attorney or professional to ensure that all legal and contractual obligations are properly addressed in the document.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.