Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

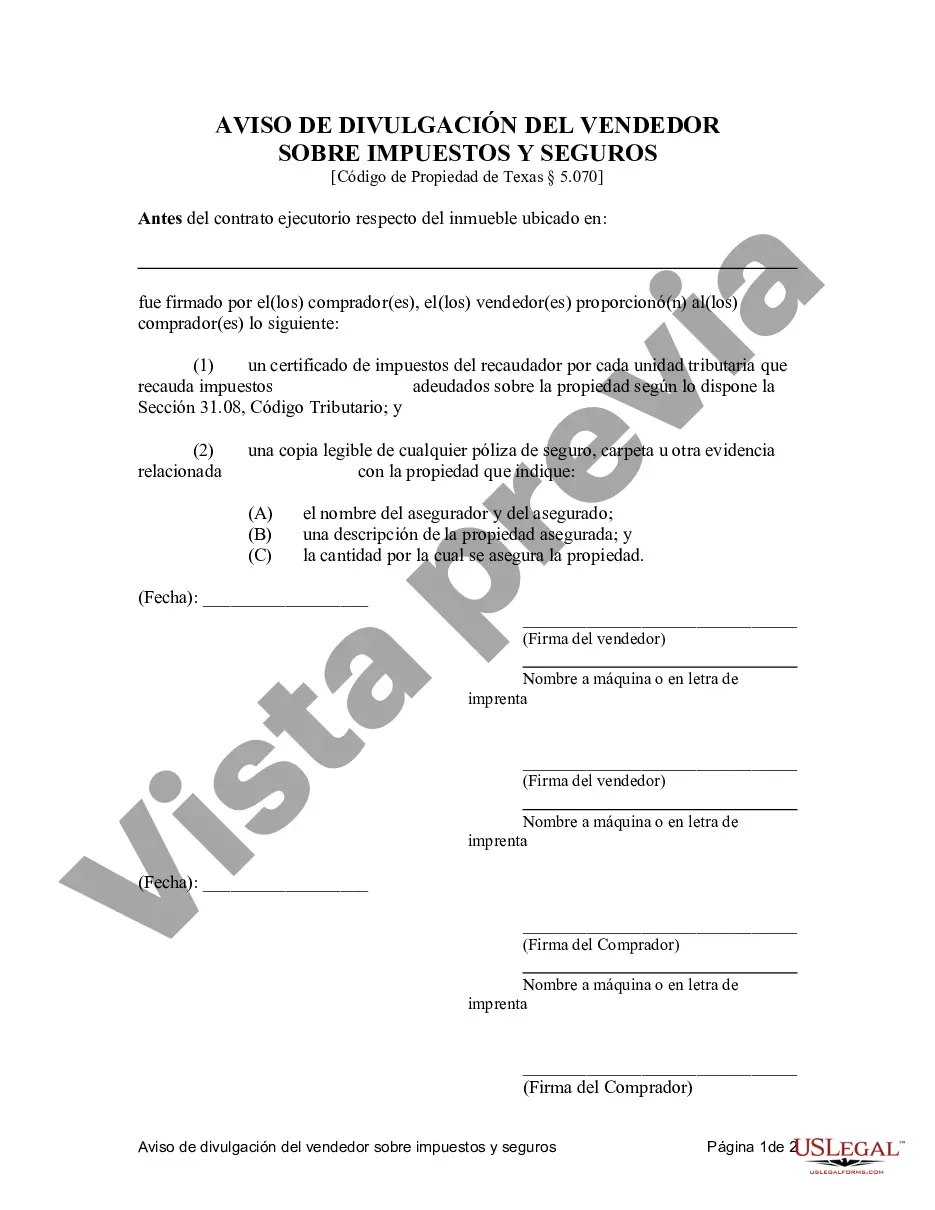

The Harris Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is an essential document used in real estate transactions in Harris County, Texas. This disclosure provides crucial information about tax payment and insurance obligations related to the property being sold under a contract for deed arrangement. Keywords: Harris Texas Contract for Deed, Seller's Disclosure, Tax Payment, Insurance, Residential, Land Contract, Agreement for Deed, Harris County, Texas, real estate transactions. Different types of Harris Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed can be categorized based on the following factors: 1. Residential Contract for Deed: This type of contract for deed is specifically designed for residential properties, such as single-family homes, townhouses, condominiums, or multi-family dwellings. 2. Commercial Contract for Deed: In contrast to the residential contract, the commercial contract for deed is used for commercial properties, including office buildings, retail spaces, warehouses, or industrial properties. 3. Vacant Land Contract for Deed: This type of contract for deed is used when selling vacant land or undeveloped property. It outlines the terms and conditions for the transfer of ownership and any specific disclosures related to the land. 4. Agricultural Contract for Deed: For transactions involving agricultural properties like farms or ranches, an agricultural contract for deed is utilized. This disclosure may include additional clauses specific to agricultural operations, water rights, or other related aspects. 5. Investment Property Contract for Deed: This type of contract for deed is used when selling investment properties, such as rental properties or properties intended for future development. It may include provisions relating to rent payments, property management responsibilities, or future development plans. Regardless of the type, the Harris Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed serves as a legal document that ensures transparency between the seller and the buyer regarding tax payment and insurance responsibilities associated with the property. It protects both parties' interests and helps prevent any potential disputes or misunderstandings in the future.The Harris Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is an essential document used in real estate transactions in Harris County, Texas. This disclosure provides crucial information about tax payment and insurance obligations related to the property being sold under a contract for deed arrangement. Keywords: Harris Texas Contract for Deed, Seller's Disclosure, Tax Payment, Insurance, Residential, Land Contract, Agreement for Deed, Harris County, Texas, real estate transactions. Different types of Harris Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed can be categorized based on the following factors: 1. Residential Contract for Deed: This type of contract for deed is specifically designed for residential properties, such as single-family homes, townhouses, condominiums, or multi-family dwellings. 2. Commercial Contract for Deed: In contrast to the residential contract, the commercial contract for deed is used for commercial properties, including office buildings, retail spaces, warehouses, or industrial properties. 3. Vacant Land Contract for Deed: This type of contract for deed is used when selling vacant land or undeveloped property. It outlines the terms and conditions for the transfer of ownership and any specific disclosures related to the land. 4. Agricultural Contract for Deed: For transactions involving agricultural properties like farms or ranches, an agricultural contract for deed is utilized. This disclosure may include additional clauses specific to agricultural operations, water rights, or other related aspects. 5. Investment Property Contract for Deed: This type of contract for deed is used when selling investment properties, such as rental properties or properties intended for future development. It may include provisions relating to rent payments, property management responsibilities, or future development plans. Regardless of the type, the Harris Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed serves as a legal document that ensures transparency between the seller and the buyer regarding tax payment and insurance responsibilities associated with the property. It protects both parties' interests and helps prevent any potential disputes or misunderstandings in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.