Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

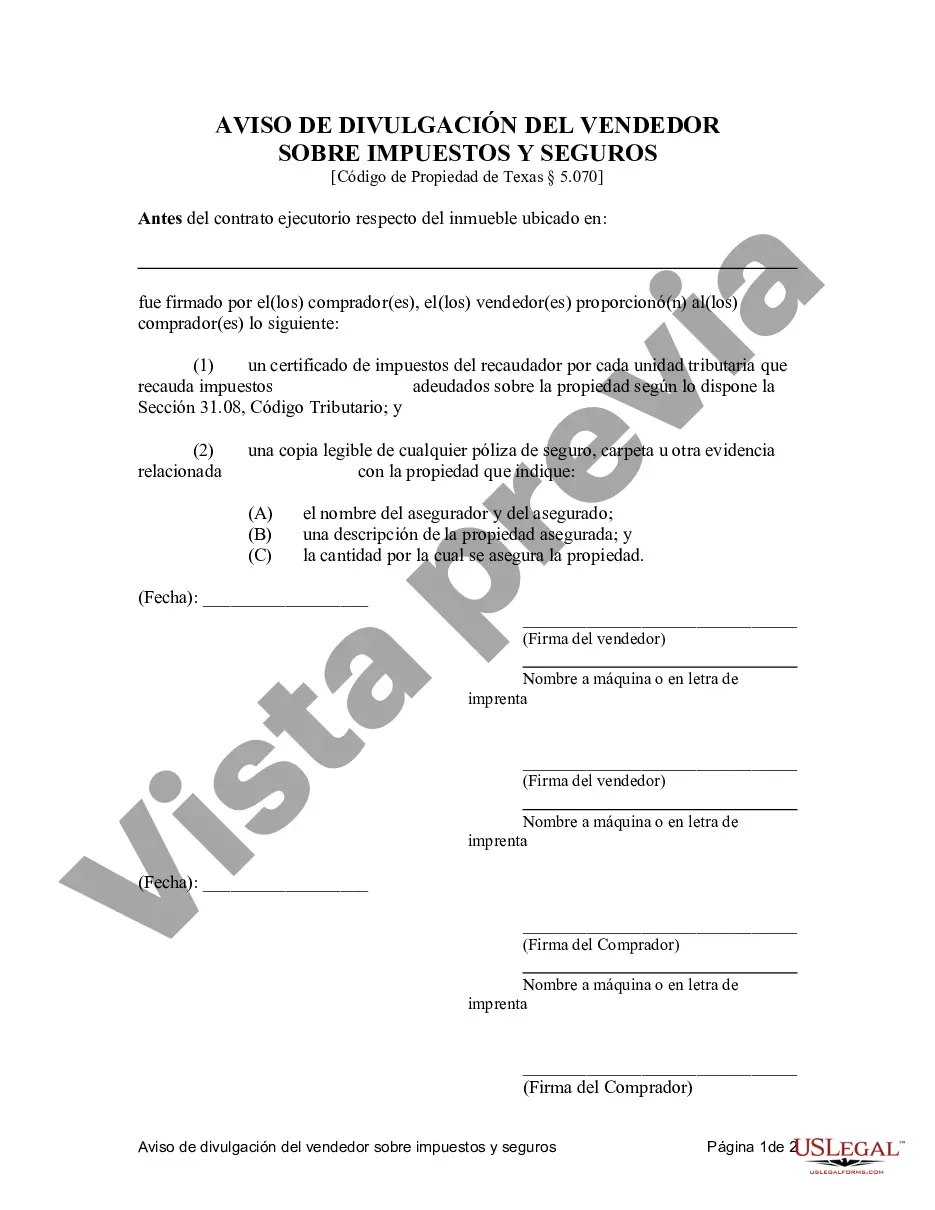

The Irving Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legally binding document outlining important details between the seller and buyer in a real estate transaction. It aims to protect both parties' interests by disclosing crucial information regarding tax payments and insurance. Below are different types of Irving Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed: 1. General Contract for Deed Seller's Disclosure: This type of contract provides a comprehensive disclosure of the seller's responsibilities regarding tax payments and insurance coverage on the property being sold in the Irving, Texas area. 2. Residential Contract for Deed Seller's Disclosure: This type of agreement is specifically tailored for residential properties. It provides detailed information regarding the seller's tax payment history and any existing insurance policies on the property. 3. Land Contract Seller's Disclosure of Tax Payment and Insurance: This type of disclosure is designed for land contracts, which involve the purchase of vacant land or lots. It includes specific provisions related to tax payment obligations and insurance requirements pertaining to the land. 4. Agreement for Deed Seller's Disclosure of Tax Payment and Insurance: This type of disclosure outlines the seller's responsibility to disclose any delinquent tax payments and insurance-related matters before entering into an agreement for deed. This type of contract is typically used when the buyer will not receive legal title until fulfilling certain terms and conditions. Keywords: Irving Texas, Contract for Deed, Seller's Disclosure, Tax Payment, Insurance, Residential, Land Contract, Agreement for Deed, real estate transaction, seller's responsibilities, tax payment history, insurance policies, vacant land, land contract, delinquent tax payments, legal title.The Irving Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legally binding document outlining important details between the seller and buyer in a real estate transaction. It aims to protect both parties' interests by disclosing crucial information regarding tax payments and insurance. Below are different types of Irving Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed: 1. General Contract for Deed Seller's Disclosure: This type of contract provides a comprehensive disclosure of the seller's responsibilities regarding tax payments and insurance coverage on the property being sold in the Irving, Texas area. 2. Residential Contract for Deed Seller's Disclosure: This type of agreement is specifically tailored for residential properties. It provides detailed information regarding the seller's tax payment history and any existing insurance policies on the property. 3. Land Contract Seller's Disclosure of Tax Payment and Insurance: This type of disclosure is designed for land contracts, which involve the purchase of vacant land or lots. It includes specific provisions related to tax payment obligations and insurance requirements pertaining to the land. 4. Agreement for Deed Seller's Disclosure of Tax Payment and Insurance: This type of disclosure outlines the seller's responsibility to disclose any delinquent tax payments and insurance-related matters before entering into an agreement for deed. This type of contract is typically used when the buyer will not receive legal title until fulfilling certain terms and conditions. Keywords: Irving Texas, Contract for Deed, Seller's Disclosure, Tax Payment, Insurance, Residential, Land Contract, Agreement for Deed, real estate transaction, seller's responsibilities, tax payment history, insurance policies, vacant land, land contract, delinquent tax payments, legal title.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.