Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

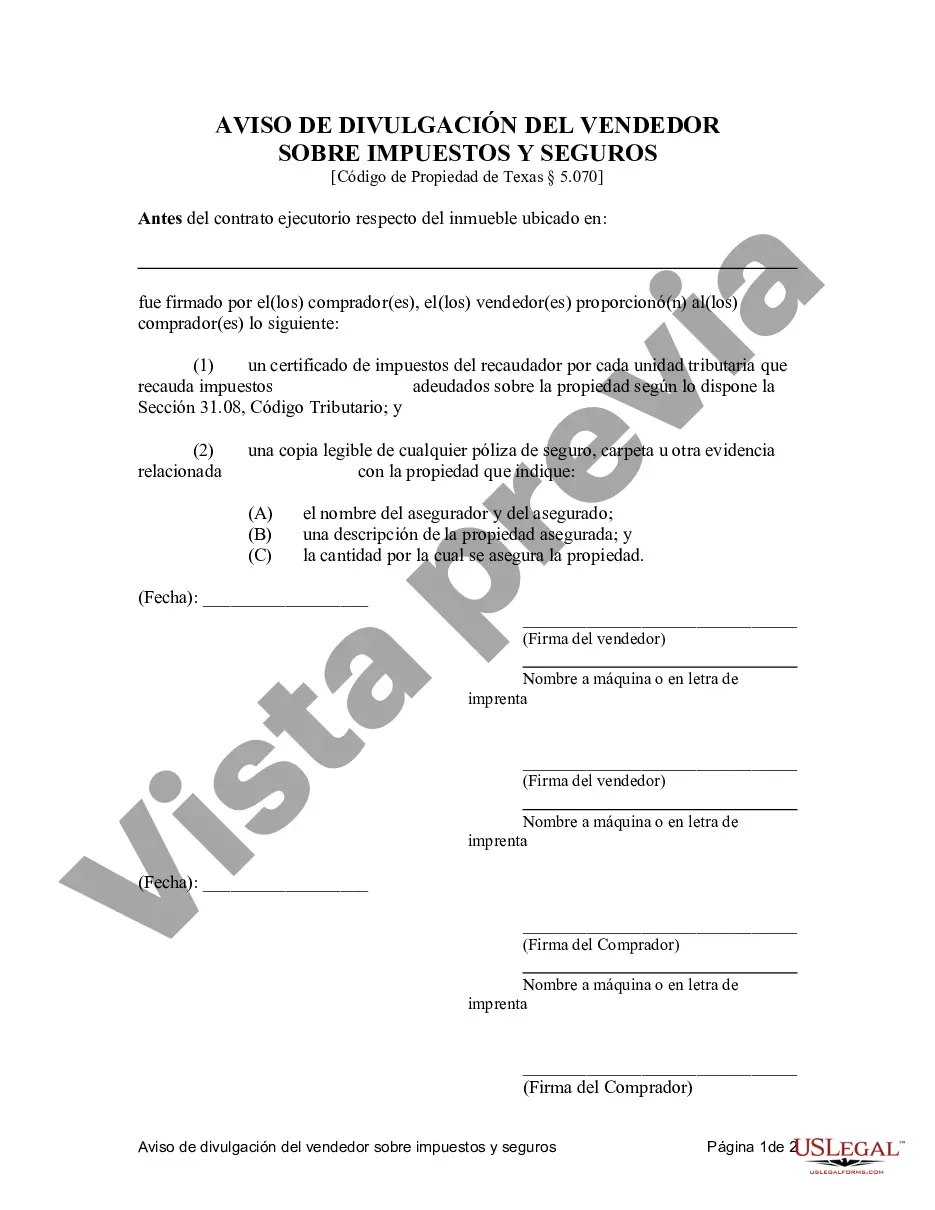

The Odessa Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a crucial document in any residential land contract or agreement for deed transaction. This disclosure serves to inform potential buyers about the seller's responsibilities, ensuring transparency throughout the real estate transaction process. In Odessa, Texas, there are various types of Contracts for Deed Seller's Disclosure of Tax Payment and Insurance available, including: 1. Residential Contract for Deed Seller's Disclosure: This type of disclosure specifically caters to residential properties, outlining the seller's obligations regarding tax payment and insurance. It highlights key details related to property taxes, insurance coverage, and any outstanding or delinquent payments. 2. Land Contract Seller's Disclosure: This type of contract is applicable when purchasing undeveloped land in Odessa, Texas. The disclosure outlines the seller's obligations and responsibilities regarding tax payment and insurance for a land contract transaction. It includes details about any current or past tax liabilities and insurance coverage related to the property. 3. Agreement for Deed Seller's Disclosure: This disclosure is typically used when buying property through an agreement for deed, which is a financing option where the buyer makes installment payments to the seller until the property is paid in full. The seller's disclosure in this case entails vital information concerning tax payment and insurance obligations unique to agreement for deed transactions. The Odessa Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance encompasses several key points. It provides details about the seller's responsibilities related to property tax payment, including any delinquency or pending tax liens. The disclosure also includes information on the property's insurance coverage, specifying whether the seller has maintained adequate coverage and if any claims have been filed in the past. Moreover, the disclosure may outline the buyer's responsibilities, such as assuming tax and insurance responsibilities upon completion of the contract or deed agreement. This ensures that both parties are aware of their respective obligations and helps prevent any potential disputes or misunderstandings regarding taxes and insurance during the duration of the contract. It is essential for both buyers and sellers to thoroughly review and understand the Odessa Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance before entering into any real estate agreement. This disclosure helps establish a transparent and legally sound transaction while protecting the rights and interests of both parties involved.The Odessa Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a crucial document in any residential land contract or agreement for deed transaction. This disclosure serves to inform potential buyers about the seller's responsibilities, ensuring transparency throughout the real estate transaction process. In Odessa, Texas, there are various types of Contracts for Deed Seller's Disclosure of Tax Payment and Insurance available, including: 1. Residential Contract for Deed Seller's Disclosure: This type of disclosure specifically caters to residential properties, outlining the seller's obligations regarding tax payment and insurance. It highlights key details related to property taxes, insurance coverage, and any outstanding or delinquent payments. 2. Land Contract Seller's Disclosure: This type of contract is applicable when purchasing undeveloped land in Odessa, Texas. The disclosure outlines the seller's obligations and responsibilities regarding tax payment and insurance for a land contract transaction. It includes details about any current or past tax liabilities and insurance coverage related to the property. 3. Agreement for Deed Seller's Disclosure: This disclosure is typically used when buying property through an agreement for deed, which is a financing option where the buyer makes installment payments to the seller until the property is paid in full. The seller's disclosure in this case entails vital information concerning tax payment and insurance obligations unique to agreement for deed transactions. The Odessa Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance encompasses several key points. It provides details about the seller's responsibilities related to property tax payment, including any delinquency or pending tax liens. The disclosure also includes information on the property's insurance coverage, specifying whether the seller has maintained adequate coverage and if any claims have been filed in the past. Moreover, the disclosure may outline the buyer's responsibilities, such as assuming tax and insurance responsibilities upon completion of the contract or deed agreement. This ensures that both parties are aware of their respective obligations and helps prevent any potential disputes or misunderstandings regarding taxes and insurance during the duration of the contract. It is essential for both buyers and sellers to thoroughly review and understand the Odessa Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance before entering into any real estate agreement. This disclosure helps establish a transparent and legally sound transaction while protecting the rights and interests of both parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.