Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

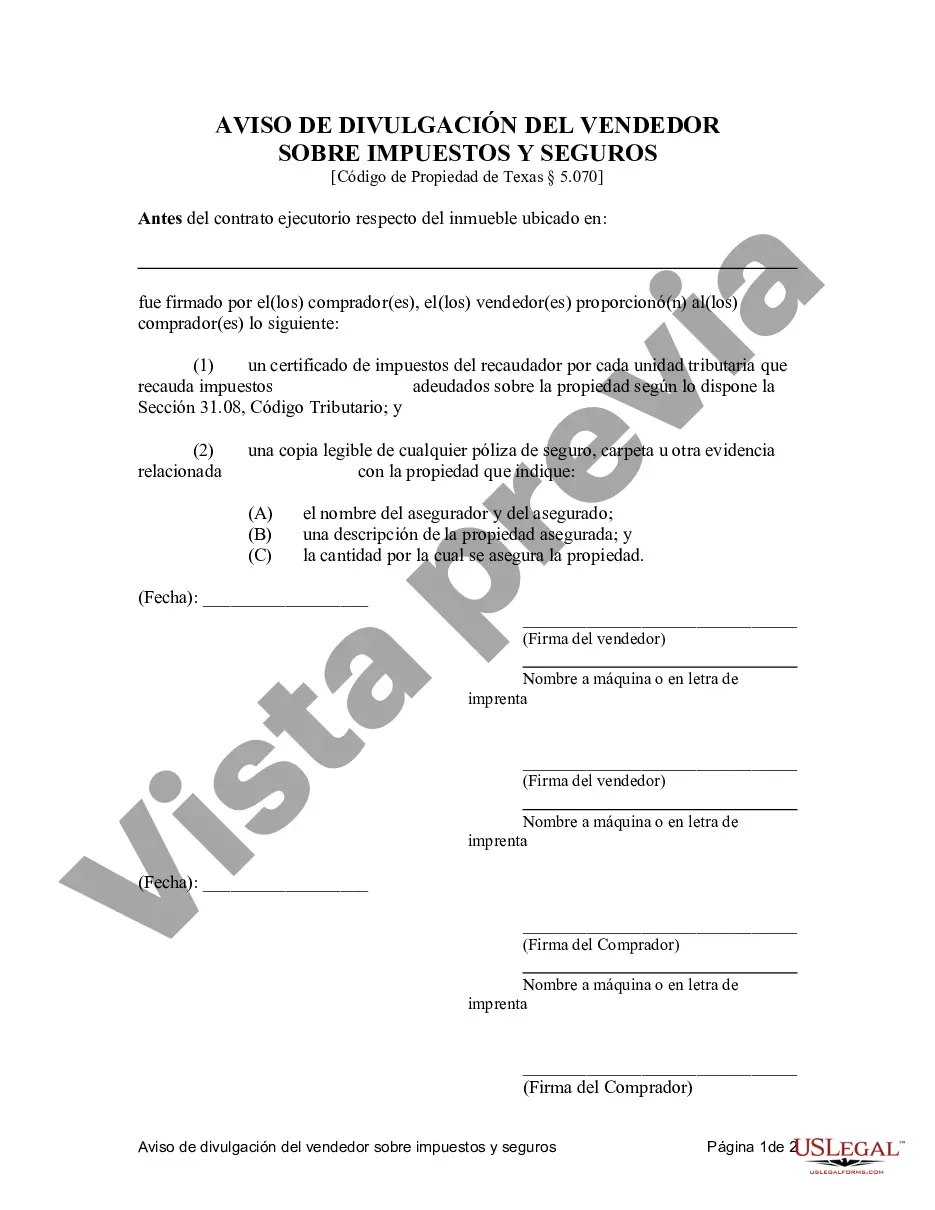

The San Antonio Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legal document used in the real estate transaction process in San Antonio, Texas. This disclosure is crucial for both the seller and buyer to understand the responsibilities and obligations associated with tax payment and insurance coverage. The purpose of this disclosure is to provide detailed information regarding the tax payments made by the seller, ensuring transparency and preventing any potential issues. It also covers the insurance coverage on the property, specifying the type of insurance policies held by the seller. In San Antonio, there are several types of Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed that can be relevant to specific situations. Some of these include: 1. Single-family Residential Contract for Deed: This type of contract specifically pertains to a single-family residential property, outlining the terms and conditions for the seller and buyer regarding tax payments and insurance coverage. 2. Multi-family Residential Contract for Deed: This variation of the contract applies to multi-family residential properties such as duplexes or apartment complexes. It includes provisions related to tax payments and insurance coverage that are specific to this type of property. 3. Commercial Contract for Deed: This contract is designed for commercial properties such as offices, retail spaces, or warehouses. It addresses the tax and insurance aspects relevant to commercial real estate transactions. 4. Vacant Land Contract for Deed: This type of contract is used when the property being sold is undeveloped land. It outlines the responsibilities of tax payments and insurance coverage while taking into account the unique nature of vacant land. Regardless of the specific type, all San Antonio Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed documents include essential information such as the address of the property, the parties involved, the terms of the agreement, and the disclosure of tax payments and insurance coverage. In summary, the San Antonio Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a comprehensive legal document that ensures transparency and clarity in tax payment and insurance responsibilities during a real estate transaction.The San Antonio Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legal document used in the real estate transaction process in San Antonio, Texas. This disclosure is crucial for both the seller and buyer to understand the responsibilities and obligations associated with tax payment and insurance coverage. The purpose of this disclosure is to provide detailed information regarding the tax payments made by the seller, ensuring transparency and preventing any potential issues. It also covers the insurance coverage on the property, specifying the type of insurance policies held by the seller. In San Antonio, there are several types of Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed that can be relevant to specific situations. Some of these include: 1. Single-family Residential Contract for Deed: This type of contract specifically pertains to a single-family residential property, outlining the terms and conditions for the seller and buyer regarding tax payments and insurance coverage. 2. Multi-family Residential Contract for Deed: This variation of the contract applies to multi-family residential properties such as duplexes or apartment complexes. It includes provisions related to tax payments and insurance coverage that are specific to this type of property. 3. Commercial Contract for Deed: This contract is designed for commercial properties such as offices, retail spaces, or warehouses. It addresses the tax and insurance aspects relevant to commercial real estate transactions. 4. Vacant Land Contract for Deed: This type of contract is used when the property being sold is undeveloped land. It outlines the responsibilities of tax payments and insurance coverage while taking into account the unique nature of vacant land. Regardless of the specific type, all San Antonio Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed documents include essential information such as the address of the property, the parties involved, the terms of the agreement, and the disclosure of tax payments and insurance coverage. In summary, the San Antonio Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a comprehensive legal document that ensures transparency and clarity in tax payment and insurance responsibilities during a real estate transaction.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.