Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

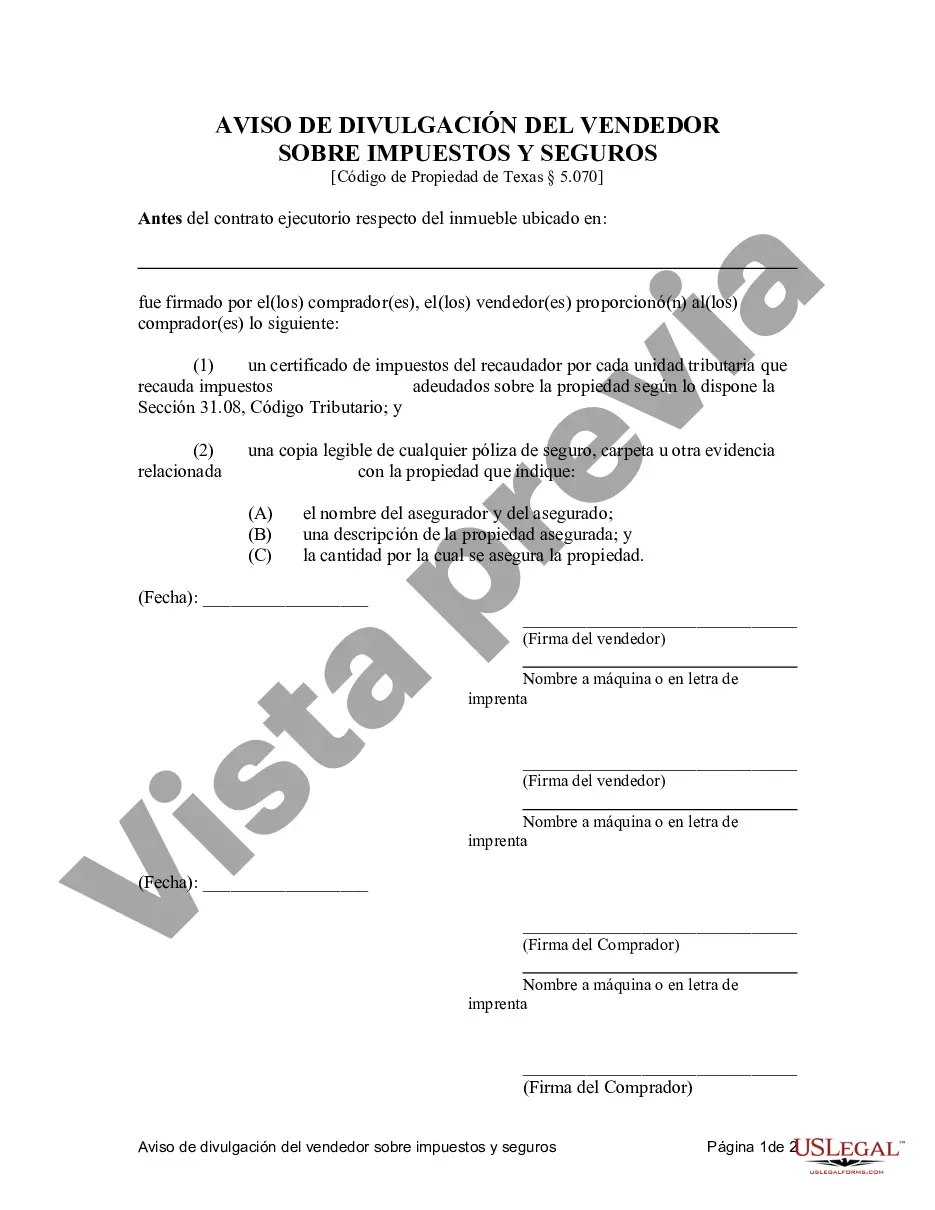

Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is an important legal document that outlines the seller's disclosure obligations regarding tax payments and insurance for residential properties. This agreement, commonly used in real estate transactions, ensures transparency and protects the interests of both the seller and buyer. The Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed typically covers several key aspects: 1. Tax payment disclosure: This section requires the seller to disclose any unpaid property taxes or special assessments related to the property. It ensures that the buyer is aware of any outstanding tax liabilities, allowing them to make informed decisions about the purchase. 2. Insurance disclosure: This section requires the seller to provide details about the property's insurance coverage, including any existing policies, claims, or financial obligations. It aims to safeguard the buyer from potential insurance-related issues and helps them assess the property's insurability. 3. Land contract agreement: The Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance may also include a land contract agreement. This agreement sets forth the terms and conditions of the land contract, specifying the buyer's rights and responsibilities as they assume partial ownership of the property while making installment payments. Different types of Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include: 1. Residential property contracts: These agreements are specifically tailored for residential properties, including single-family homes, condominiums, townhouses, or duplexes. 2. Commercial property contracts: Alternatively, there may be specific contracts for commercial properties, such as office buildings, retail spaces, or industrial facilities. These contracts may have additional clauses and considerations related to commercial leasing and business use. 3. Vacant land contracts: In cases where the property is undeveloped or vacant land, the contract may have provisions related to zoning regulations, environmental studies, and potential use restrictions. Safeguards are put in place to address any concerns regarding development feasibility and potential liabilities. 4. Multi-unit property contracts: If the property consists of multiple residential units, such as apartment buildings or multi-family homes, the contract may include provisions related to rental income, tenant rights, and management responsibilities. This type of contract ensures clarity and addresses the unique considerations of multi-unit properties. 5. Contract addendums or amendments: Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance agreements can be customized using addendums or amendments to address any specific concerns or conditions agreed upon by the parties involved. These additional documents become integral parts of the overall contract, ensuring comprehensive disclosure and protection. In summary, the Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legal document designed to provide transparent disclosure regarding tax payments and insurance for various types of properties. The agreement protects the interests of both sellers and buyers, ensuring a smoother and more reliable real estate transaction process.Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is an important legal document that outlines the seller's disclosure obligations regarding tax payments and insurance for residential properties. This agreement, commonly used in real estate transactions, ensures transparency and protects the interests of both the seller and buyer. The Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed typically covers several key aspects: 1. Tax payment disclosure: This section requires the seller to disclose any unpaid property taxes or special assessments related to the property. It ensures that the buyer is aware of any outstanding tax liabilities, allowing them to make informed decisions about the purchase. 2. Insurance disclosure: This section requires the seller to provide details about the property's insurance coverage, including any existing policies, claims, or financial obligations. It aims to safeguard the buyer from potential insurance-related issues and helps them assess the property's insurability. 3. Land contract agreement: The Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance may also include a land contract agreement. This agreement sets forth the terms and conditions of the land contract, specifying the buyer's rights and responsibilities as they assume partial ownership of the property while making installment payments. Different types of Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed may include: 1. Residential property contracts: These agreements are specifically tailored for residential properties, including single-family homes, condominiums, townhouses, or duplexes. 2. Commercial property contracts: Alternatively, there may be specific contracts for commercial properties, such as office buildings, retail spaces, or industrial facilities. These contracts may have additional clauses and considerations related to commercial leasing and business use. 3. Vacant land contracts: In cases where the property is undeveloped or vacant land, the contract may have provisions related to zoning regulations, environmental studies, and potential use restrictions. Safeguards are put in place to address any concerns regarding development feasibility and potential liabilities. 4. Multi-unit property contracts: If the property consists of multiple residential units, such as apartment buildings or multi-family homes, the contract may include provisions related to rental income, tenant rights, and management responsibilities. This type of contract ensures clarity and addresses the unique considerations of multi-unit properties. 5. Contract addendums or amendments: Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance agreements can be customized using addendums or amendments to address any specific concerns or conditions agreed upon by the parties involved. These additional documents become integral parts of the overall contract, ensuring comprehensive disclosure and protection. In summary, the Sugar Land Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed is a legal document designed to provide transparent disclosure regarding tax payments and insurance for various types of properties. The agreement protects the interests of both sellers and buyers, ensuring a smoother and more reliable real estate transaction process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.