Texas Contract for Deed related forms. These forms comply with the Texas law, and deal with matters related to Contract for Deed.

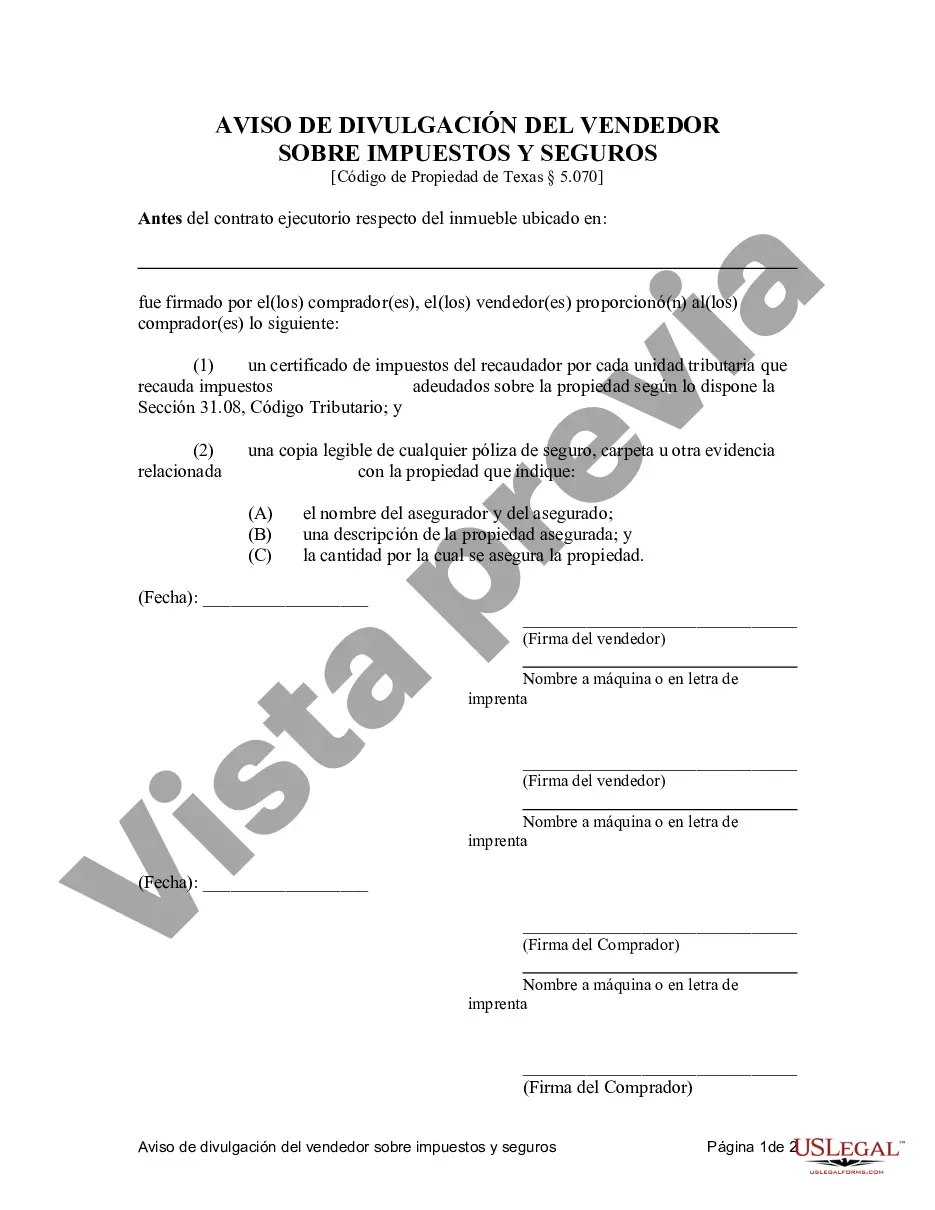

Wichita Falls, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed: In Wichita Falls, Texas, a Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a legal document used in residential real estate transactions. This disclosure is essential in a Land Contract or Agreement for Deed arrangement, offering important information related to tax payment and insurance obligations. The purpose of the Contract for Deed Seller's Disclosure of Tax Payment and Insurance is to outline the responsibilities and obligations of the seller and buyer regarding property taxes and insurance. It ensures transparency and safeguards both parties involved in the transaction. This document discloses the specific terms and conditions agreed upon regarding tax payments and insurance coverage for the property being sold. It protects the buyer from any hidden financial burdens and allows them to accurately budget for property-related expenses. Different types of Wichita Falls Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed can include: 1. Tax Payment Disclosure: This section provides details of the current property tax status, including any outstanding tax liabilities and whether the seller will clear them before the closing. The buyer can assess their potential tax obligations and plan accordingly. 2. Insurance Disclosure: This part discloses the insurance coverage on the property. It outlines the types of insurance in place, such as homeowner's insurance or flood insurance, along with their coverage limits. The disclosure also indicates whether any claims have been filed in the past and whether the property is in a recognized hazard zone. 3. Escrow Arrangements: Some Contract for Deed agreements may specify an escrow arrangement for tax and insurance payments. This provision ensures that the buyer makes monthly installments to an escrow account, from which property taxes and insurance premiums are paid. Such an arrangement assists in budgeting and ensures compliance with tax and insurance obligations. 4. Deed Transfer and Ownership: This disclosure confirms that ownership of the property will transfer to the buyer upon fulfilling the terms of the agreement. It also outlines any restrictions on selling or transferring the property while the Land Contract or Agreement for Deed is still active. 5. Breach of Contract: This section highlights the consequences of breaching the terms of the Contract for Deed, such as failure to pay property taxes or maintain insurance coverage. It may include penalties, potential legal actions, and the buyer's rights to cure any defaults within a specified timeframe. It is crucial for buyers and sellers to carefully review the Wichita Falls, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed to ensure mutual understanding and compliance with all obligations. Consulting with a real estate attorney or professional can help navigate the complexities and ensure a smooth transaction process.Wichita Falls, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed: In Wichita Falls, Texas, a Contract for Deed Seller's Disclosure of Tax Payment and Insurance is a legal document used in residential real estate transactions. This disclosure is essential in a Land Contract or Agreement for Deed arrangement, offering important information related to tax payment and insurance obligations. The purpose of the Contract for Deed Seller's Disclosure of Tax Payment and Insurance is to outline the responsibilities and obligations of the seller and buyer regarding property taxes and insurance. It ensures transparency and safeguards both parties involved in the transaction. This document discloses the specific terms and conditions agreed upon regarding tax payments and insurance coverage for the property being sold. It protects the buyer from any hidden financial burdens and allows them to accurately budget for property-related expenses. Different types of Wichita Falls Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed can include: 1. Tax Payment Disclosure: This section provides details of the current property tax status, including any outstanding tax liabilities and whether the seller will clear them before the closing. The buyer can assess their potential tax obligations and plan accordingly. 2. Insurance Disclosure: This part discloses the insurance coverage on the property. It outlines the types of insurance in place, such as homeowner's insurance or flood insurance, along with their coverage limits. The disclosure also indicates whether any claims have been filed in the past and whether the property is in a recognized hazard zone. 3. Escrow Arrangements: Some Contract for Deed agreements may specify an escrow arrangement for tax and insurance payments. This provision ensures that the buyer makes monthly installments to an escrow account, from which property taxes and insurance premiums are paid. Such an arrangement assists in budgeting and ensures compliance with tax and insurance obligations. 4. Deed Transfer and Ownership: This disclosure confirms that ownership of the property will transfer to the buyer upon fulfilling the terms of the agreement. It also outlines any restrictions on selling or transferring the property while the Land Contract or Agreement for Deed is still active. 5. Breach of Contract: This section highlights the consequences of breaching the terms of the Contract for Deed, such as failure to pay property taxes or maintain insurance coverage. It may include penalties, potential legal actions, and the buyer's rights to cure any defaults within a specified timeframe. It is crucial for buyers and sellers to carefully review the Wichita Falls, Texas Contract for Deed Seller's Disclosure of Tax Payment and Insurance Residentialia— - Land Contract - Agreement for Deed to ensure mutual understanding and compliance with all obligations. Consulting with a real estate attorney or professional can help navigate the complexities and ensure a smooth transaction process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.