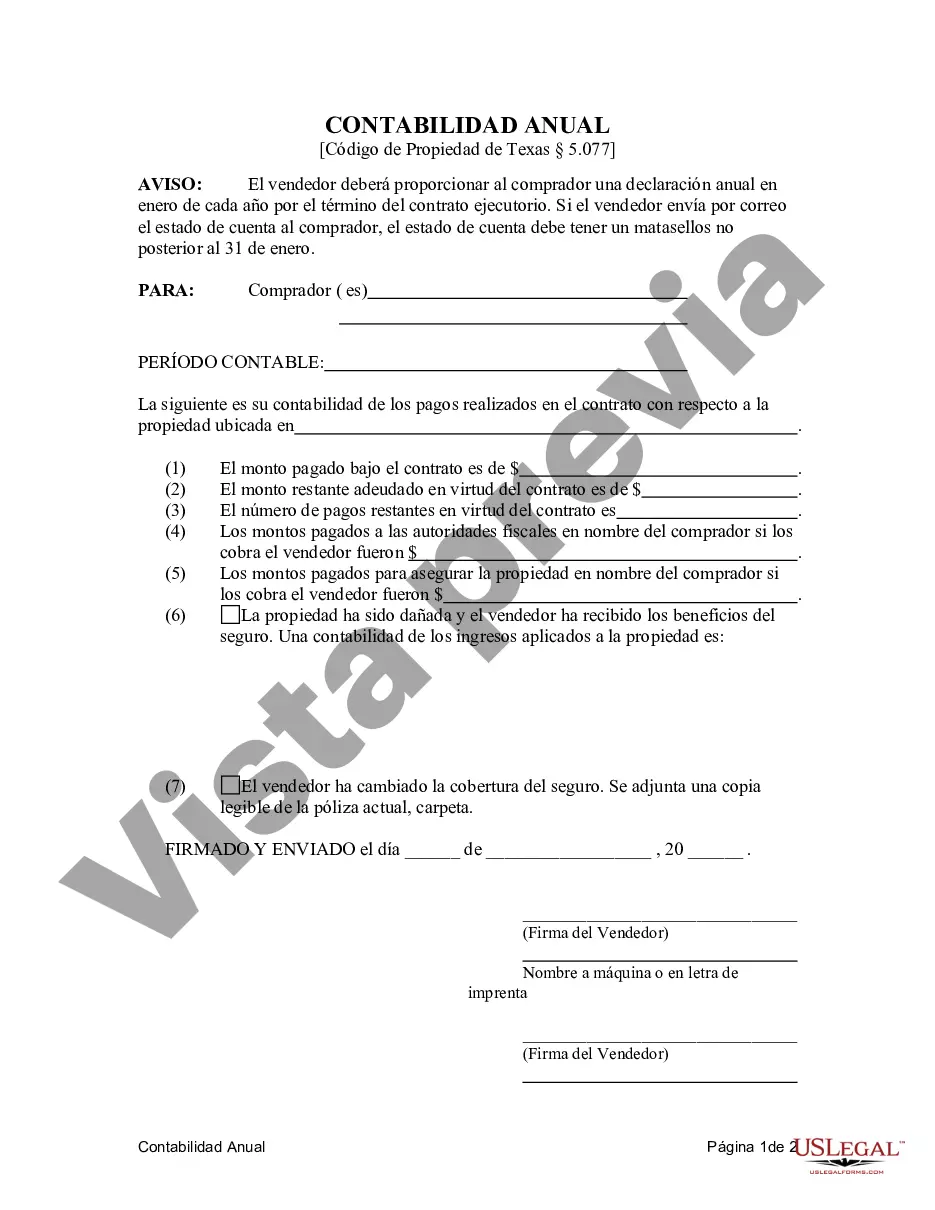

The Abilene Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a crucial document that outlines the financial details of a residential land contract or executory contract between the seller and the purchaser. This statement provides a comprehensive account of the financial transactions, including income and expenses, throughout the year. It ensures transparency and helps both parties in maintaining accurate records and understanding the financial position of the contract. Keywords: Abilene Texas, Contract for Deed, Seller's Annual Accounting Statement, Purchaser, Residential, Land Contract, Executory Contract. There are several variations of the Abilene Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser, depending on the specific type of contract: 1. Residential Land Contract: This type of contract outlines the sale of residential real estate, where the seller finances the purchase, and the buyer agrees to make regular payments until the full purchase price is paid. The Annual Accounting Statement provides an overview of the financial transactions related to this contract. 2. Executory Contract: An executory contract is a legally binding agreement where one party commits to future actions while the other party remains obligated to fulfill their part of the contract. The Annual Accounting Statement for an executory contract includes details of the financial transactions and obligations of both parties involved. The Abilene Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser includes the following key components: 1. Parties Involved: The statement clearly identifies the seller and the purchaser under the contract. 2. Property Details: It states the specific residential property subject to the contract, including its address, legal description, and any other significant details. 3. Financial Summary: The statement provides a comprehensive overview of the financial transactions during the stated year, including all the payments made by the purchaser, interest accrued, and any expenses incurred by the seller. 4. Income and Expense Breakdown: The statement lists all the income received by the seller, which primarily includes the regular payments made by the purchaser. It also outlines any additional income, such as property-related revenues or reimbursements received. 5. Expenses and Fees: This section details all the expenses incurred by the seller, such as property taxes, insurance premiums, repairs, maintenance costs, and any other fees associated with the contract. 6. Account Balance: The statement calculates the remaining balance after considering all the payments, income, expenses, and fees. It reflects the outstanding amount the purchaser owes to the seller. 7. Relevant Dates: The Annual Accounting Statement includes the reporting period covered, typically spanning one year, along with the date of the statement's preparation. In conclusion, the Abilene Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a vital tool for both parties involved in a residential land contract or an executory contract. It offers a comprehensive overview of the financial transactions, income, expense breakdown, and the outstanding balance. This document facilitates transparency and ensures a complete understanding of the financial aspects of the contract.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Abilene Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Abilene Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

Take advantage of the US Legal Forms and have instant access to any form template you want. Our useful platform with a large number of templates makes it easy to find and obtain almost any document sample you want. You can download, fill, and sign the Abilene Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract in just a couple of minutes instead of browsing the web for many hours attempting to find a proper template.

Utilizing our library is an excellent strategy to raise the safety of your document filing. Our professional legal professionals on a regular basis check all the documents to make certain that the forms are relevant for a particular state and compliant with new acts and regulations.

How do you get the Abilene Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract? If you already have a subscription, just log in to the account. The Download button will be enabled on all the samples you look at. In addition, you can get all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction listed below:

- Open the page with the form you need. Ensure that it is the template you were seeking: verify its title and description, and utilize the Preview feature when it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the downloading procedure. Click Buy Now and choose the pricing plan you prefer. Then, sign up for an account and pay for your order using a credit card or PayPal.

- Save the file. Indicate the format to obtain the Abilene Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract and change and fill, or sign it according to your requirements.

US Legal Forms is among the most extensive and reliable form libraries on the internet. We are always ready to assist you in virtually any legal procedure, even if it is just downloading the Abilene Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract.

Feel free to benefit from our platform and make your document experience as convenient as possible!