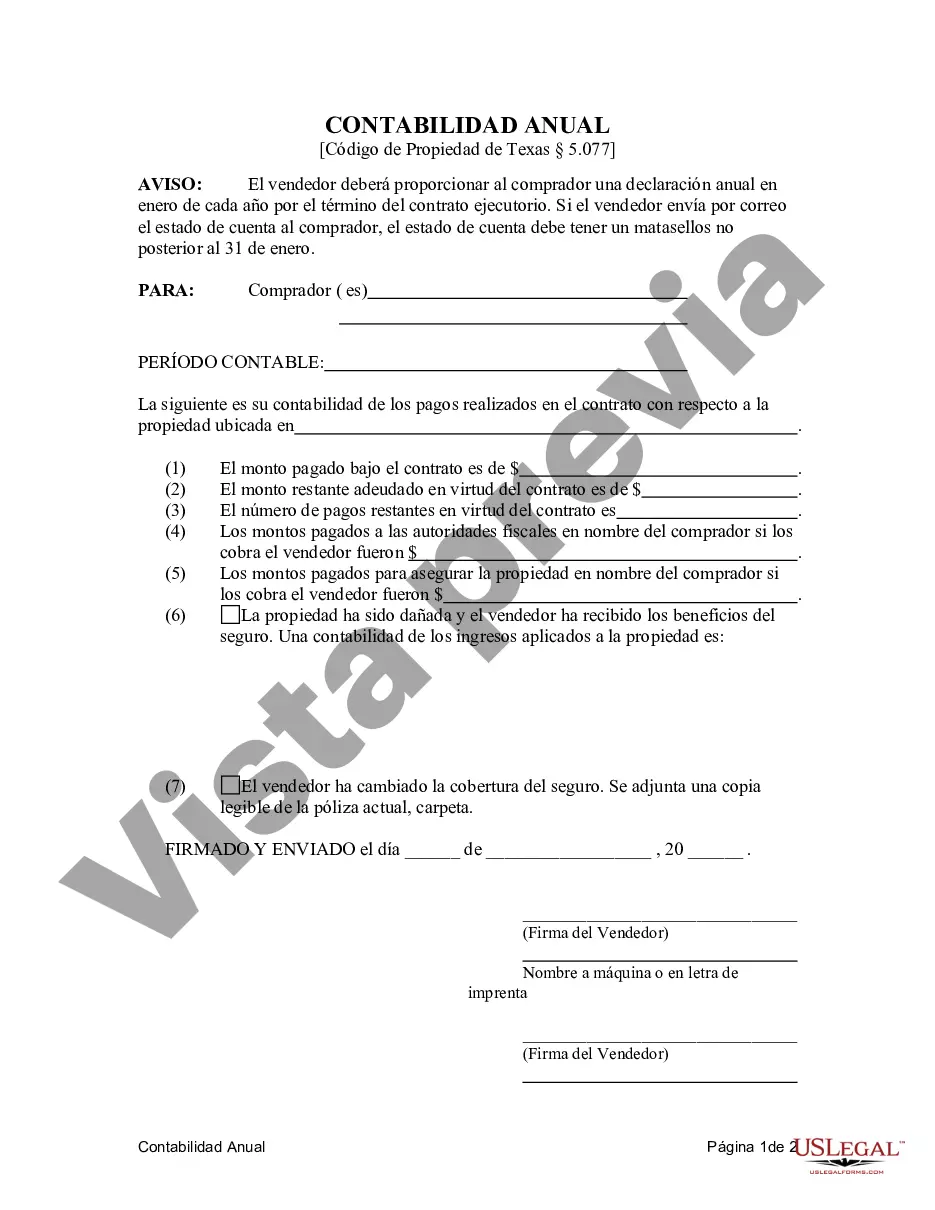

The Amarillo Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is an essential document associated with residential land contracts, also known as executory contracts. This annual statement is designed to provide a detailed breakdown of financial activities and transactions between the seller and purchaser of the property. It serves as a binding agreement that outlines the responsibilities of both parties regarding financial records and obligations. The Amarillo Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser covers various aspects of the land contract, highlighting the financial information necessary for transparency and mutual understanding: 1. Transaction Summary: This section offers a concise overview of all financial activities related to the land contract, including the purchase price, down payment, and any subsequent payments made by the purchaser throughout the year. 2. Payment Details: The annual statement elaborates on each payment made by the purchaser during the accounting period. It includes the payment date, amount, and a breakdown of how the payment is allocated (e.g., principal, interest, taxes, insurance, or other related fees). 3. Escrow Account: If the land contract includes an escrow account to cover property taxes and insurance, this section outlines the balance at the beginning and end of the accounting period. It also provides a breakdown of deposits and withdrawals made from the escrow account during the year. 4. Property Taxes: This section focuses on property tax payments and includes details such as the tax year, payment amount, and the entity or authority responsible for collecting property taxes. 5. Insurance Payments: Any insurance payments made by the purchaser are documented here. It includes the insurance provider, policy number, coverage period, and payment amount. 6. Maintenance and Repairs: In case the contract specifies the purchaser's responsibility for maintenance and repairs, this section records any expenditures related to repairs or improvements made to the property during the accounting period. 7. Other Expenses: This part provides an opportunity for additional expenses related to the contract to be documented, such as legal fees or administrative costs that may have been incurred. It is important to note that there may be different variations or types of Amarillo Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser, depending on specific contractual agreements or state laws. Some variations may include additional sections or details based on the circumstances of the land contract. Having a well-defined and comprehensive Amarillo Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser ensures transparency and accountability between the parties involved in a residential land contract, providing peace of mind for both the purchaser and seller.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Amarillo Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Amarillo Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so locating the Amarillo Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Amarillo Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract takes just a couple of clicks. All you need to do is log in to your account, pick the document, and click Download to save it on your device. The process will take just a few additional actions to complete for new users.

Follow the guidelines below to get started with the most extensive online form collection:

- Check the Preview mode and form description. Make certain you’ve selected the right one that meets your needs and fully corresponds to your local jurisdiction requirements.

- Search for another template, if needed. Once you see any inconsistency, utilize the Search tab above to obtain the right one. If it suits you, move to the next step.

- Purchase the document. Click on the Buy Now button and select the subscription plan you prefer. You should register an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the service.

- Download the Amarillo Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract. Save the template on your device to proceed with its completion and obtain access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Benefit from the US Legal Forms library to always have essential document templates for any needs just at your hand!