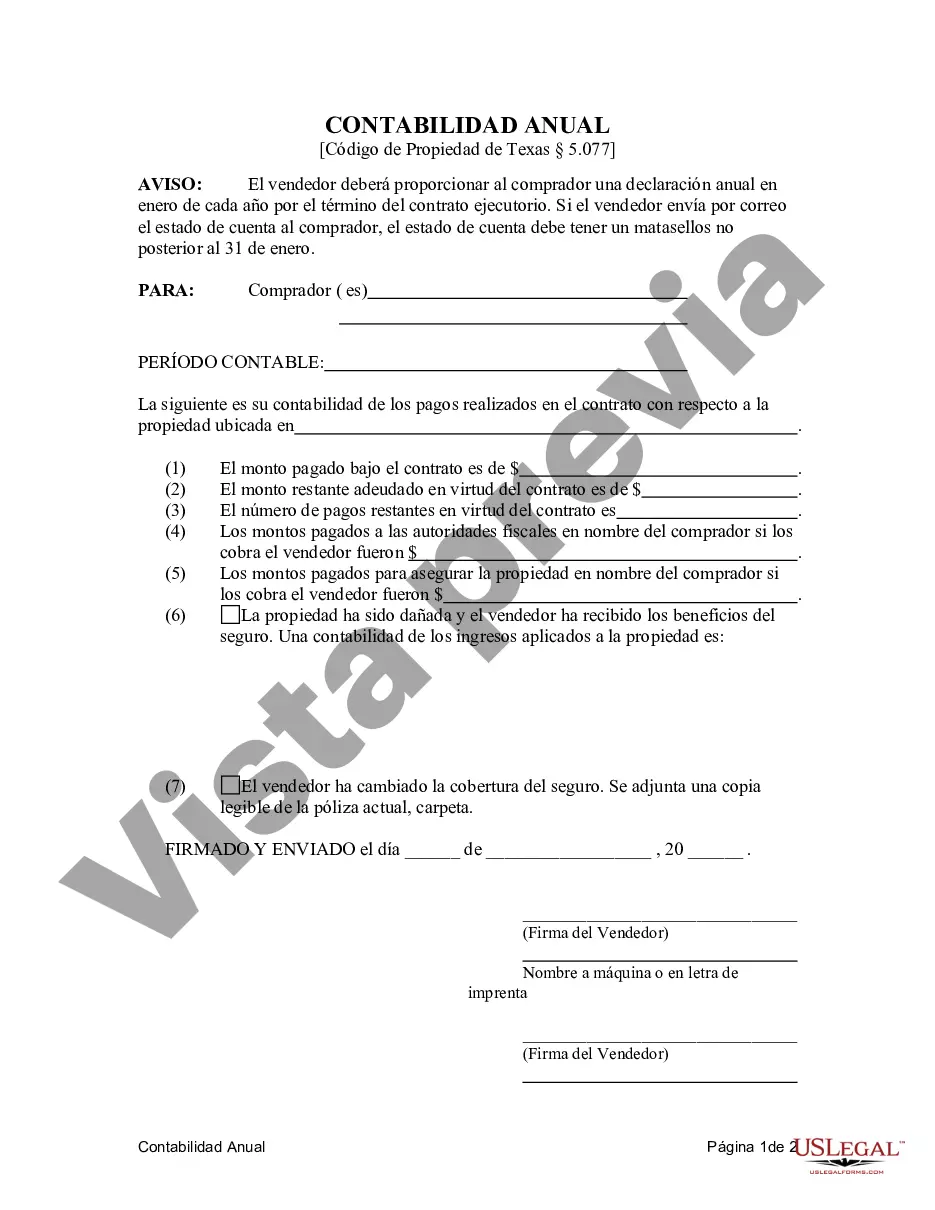

Title: Beaumont Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract Introduction: In Beaumont, Texas, the Contract for Deed Seller's Annual Accounting Statement plays a crucial role in the smooth execution of a Residential Land Contract or Executory Contract. This statement serves as a detailed financial report provided annually by the seller to the purchaser. It outlines the financial transactions and obligations related to the property under contract. Understanding the various types of Beaumont Texas Contract for Deed Seller's Annual Accounting Statements is vital for both sellers and purchasers involved in land contracts or executory contracts. 1. Residential Land Contract: The Residential Land Contract refers to an agreement between the seller and purchaser related to the transfer of ownership rights gradually, rather than through conventional mortgage financing. It typically involves a predetermined purchase price, a down payment, and equal installment payments over a specified period. The Contract for Deed Seller's Annual Accounting Statement serves as a reliable tool for monitoring financial transactions and keeping track of the property's ongoing obligations. 2. Executory Contract: An Executory Contract is a unique arrangement wherein the buyer gains equitable title and the right to possess the property while making installment payments to the seller. This contract details the terms of the agreement, such as the purchase price, interest rate, and payment schedule. The annual accounting statement allows both parties to review the financial standing of the agreement, ensuring transparency, and providing necessary documentation during the contract term. Key Contents of the Contract for Deed Seller's Annual Accounting Statement: 1. Opening Balance: The statement should begin with the opening balance reflecting the outstanding amount owed by the purchaser from the previous accounting period. 2. Payments Made: This section outlines all payments made by the purchaser during the specific annual period. It includes installment payments, property taxes, insurance premiums, and any other relevant expenses associated with the property. 3. Interest Calculations: If applicable, the statement incorporates interest calculations on the outstanding balance to determine the finance charges accumulated during the accounting period. 4. Principal Reductions: This part discloses the portion of the payment applied towards the principal balance, demonstrating the progress of the purchaser in reducing the overall debt. 5. Escrow Account: If an escrow account exists, details about the funds held in the account, including property taxes and insurance premiums, should be included. 6. Property Maintenance Costs: Any expenses incurred by the seller related to property maintenance should be itemized in this section. 7. Late Fees or Penalties: If there were any late payments or penalties assessed during the accounting period, they should be recorded, along with explanations for transparency purposes. 8. Final Balance: The statement concludes with the remaining principal balance owed by the purchaser after accounting for all the payments, credits, and charges. By comprehensively understanding the Beaumont Texas Contract for Deed Seller's Annual Accounting Statement's purpose and its significance within Residential Land Contracts and Executory Contracts, both sellers and purchasers can ensure a fair and transparent relationship throughout the contract tenure. Regularly reviewing and providing this statement contributes to a clear financial understanding, promoting trust and accountability between the involved parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Beaumont Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Beaumont Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

Locating verified templates specific to your local regulations can be difficult unless you use the US Legal Forms library. It’s an online collection of more than 85,000 legal forms for both personal and professional needs and any real-life situations. All the documents are properly grouped by area of usage and jurisdiction areas, so searching for the Beaumont Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract gets as quick and easy as ABC.

For everyone already acquainted with our catalogue and has used it before, getting the Beaumont Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract takes just a couple of clicks. All you need to do is log in to your account, opt for the document, and click Download to save it on your device. This process will take just a few more actions to complete for new users.

Adhere to the guidelines below to get started with the most extensive online form collection:

- Look at the Preview mode and form description. Make certain you’ve picked the correct one that meets your requirements and totally corresponds to your local jurisdiction requirements.

- Look for another template, if needed. Once you find any inconsistency, use the Search tab above to obtain the correct one. If it suits you, move to the next step.

- Buy the document. Click on the Buy Now button and choose the subscription plan you prefer. You should sign up for an account to get access to the library’s resources.

- Make your purchase. Provide your credit card details or use your PayPal account to pay for the subscription.

- Download the Beaumont Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract. Save the template on your device to proceed with its completion and get access to it in the My Forms menu of your profile anytime you need it again.

Keeping paperwork neat and compliant with the law requirements has major importance. Take advantage of the US Legal Forms library to always have essential document templates for any needs just at your hand!