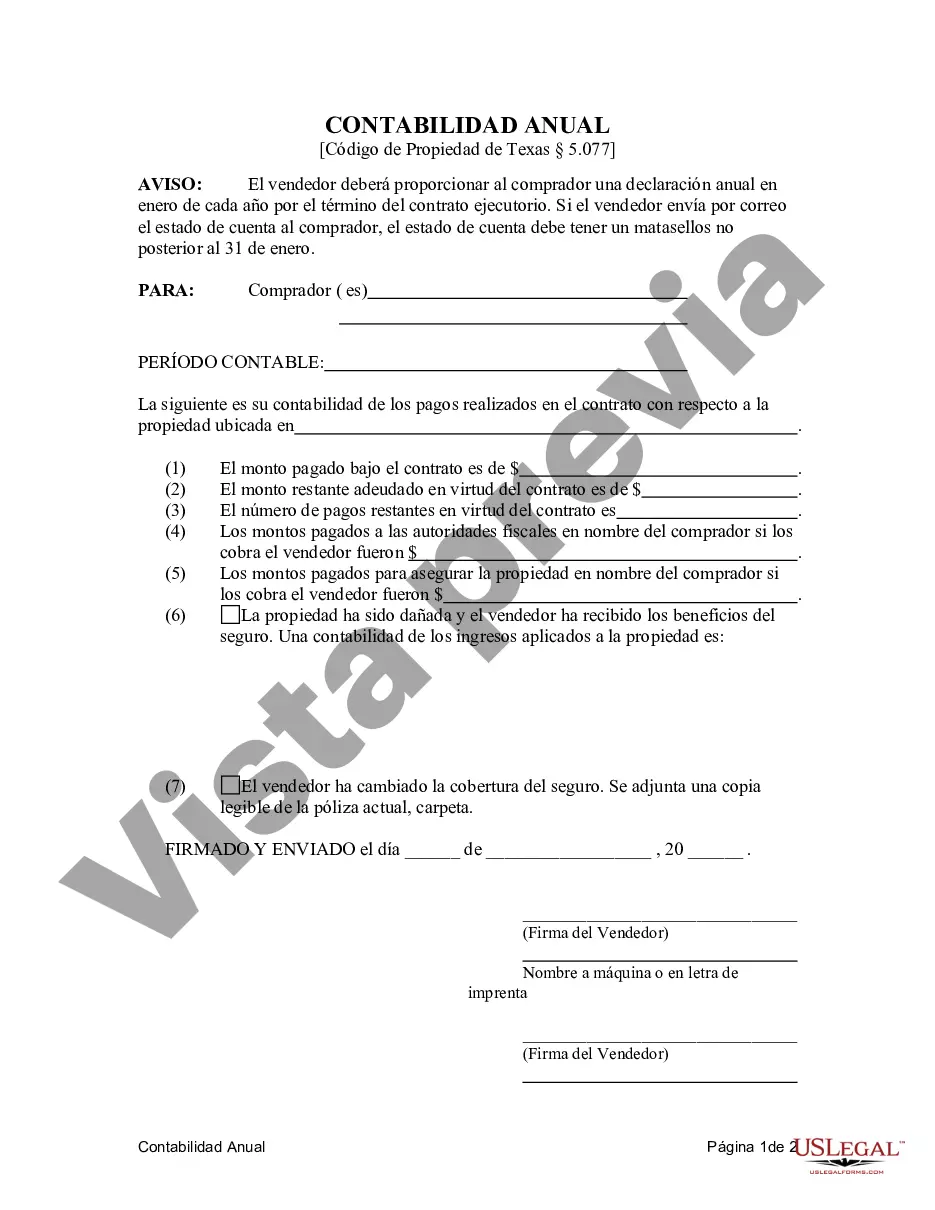

Collin Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract In Collin County, Texas, the Contract for Deed Seller's Annual Accounting Statement is a crucial document for both sellers and purchasers involved in residential land contracts or executory contracts. This statement outlines the financial details related to the agreement and ensures transparency and accountability between the parties involved. The Seller's Annual Accounting Statement provides a comprehensive overview of all the financial transactions and obligations for a specific period. It covers various aspects, including payments made by the purchaser, interest accrued, taxes paid, insurance expenses, and any other relevant costs. This document is typically generated annually, presenting a snapshot of the financial status between the seller and the purchaser. The Collin Texas Contract for Deed Seller's Annual Accounting Statement plays a vital role in maintaining a well-documented record of all financial activities related to the land contract or executory contract. It assists both parties in understanding their financial responsibilities and assists in resolving any disputes or discrepancies that may arise. Different types of Collin Texas Contract for Deed Seller's Annual Accounting Statements may include: 1. Residential Land Contract Accounting Statement: This specific statement is tailored to residential properties involved in contract sales or executory contracts. It covers all financial aspects related to the residential property, such as mortgage payments, property taxes, insurance costs, and any other relevant fees. 2. Commercial Land Contract Accounting Statement: If the land contract pertains to a commercial property in Collin County, Texas, this statement would focus on financial transactions and obligations specific to commercial real estate. It includes details about rent payments, property taxes, maintenance expenses, and other commercial property-related costs. 3. Multi-Property Land Contract Accounting Statement: In cases where multiple properties are involved in a single land contract or executory contract, this type of statement provides an overview of the financial activities related to all the properties within the contract. It consolidates the financial information for each property involved, allowing for better tracking and analysis. By utilizing the Collin Texas Contract for Deed Seller's Annual Accounting Statement, sellers and purchasers can ensure transparent and accurate financial reporting, ultimately fostering a healthy business relationship. This document serves as an essential tool for maintaining financial integrity and resolving any misunderstandings regarding payments or obligations within the land contract or executory contract.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Collin Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Collin Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

Take advantage of the US Legal Forms and obtain immediate access to any form you require. Our beneficial platform with a large number of templates simplifies the way to find and obtain almost any document sample you require. You are able to save, fill, and certify the Collin Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract in a matter of minutes instead of surfing the Net for hours seeking a proper template.

Utilizing our catalog is a superb way to raise the safety of your document submissions. Our experienced attorneys on a regular basis review all the records to make sure that the forms are appropriate for a particular state and compliant with new acts and polices.

How can you obtain the Collin Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract? If you already have a subscription, just log in to the account. The Download option will appear on all the documents you look at. In addition, you can get all the previously saved files in the My Forms menu.

If you don’t have a profile yet, stick to the instruction below:

- Find the form you need. Make certain that it is the form you were hoping to find: examine its name and description, and use the Preview feature if it is available. Otherwise, make use of the Search field to find the needed one.

- Start the saving process. Click Buy Now and choose the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Export the file. Indicate the format to get the Collin Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract and change and fill, or sign it for your needs.

US Legal Forms is probably the most significant and reliable document libraries on the web. Our company is always happy to assist you in virtually any legal procedure, even if it is just downloading the Collin Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract.

Feel free to take full advantage of our service and make your document experience as straightforward as possible!