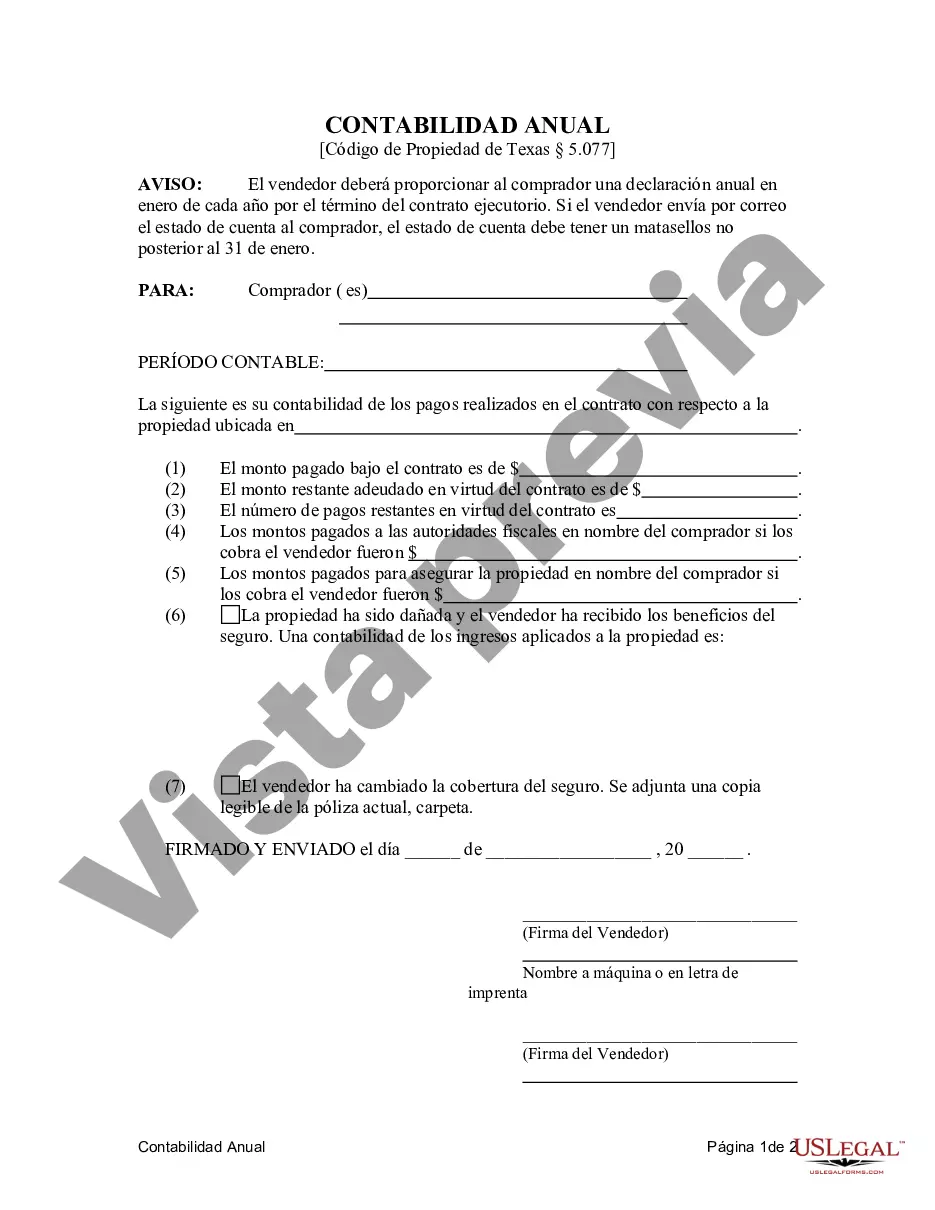

The Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a crucial document that outlines the financial obligations and responsibilities between the seller and purchaser in a residential land contract or executory contract. As per this contract, the seller is obligated to provide the purchaser with an annual accounting statement, which serves as a detailed record of all financial transactions and activities related to the property. Key elements included in the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may include: 1. Property information: This section provides details about the residential property involved in the contract, such as the address, legal description, and parcel number. 2. Purchase price and payments: The accounting statement will outline the original purchase price agreed upon by the parties and any subsequent payments made by the purchaser, including the principal amount, interest, and any additional fees. 3. Payment history: This section provides a comprehensive breakdown of all payments made by the purchaser to the seller, including the dates, amounts, and how they were applied (e.g., towards principal, interest, taxes, insurance, etc.). 4. Escrow account: If an escrow account was established, the statement will include a detailed summary of any funds deposited and disbursed from the account, including property taxes, insurance premiums, and any other authorized expenses. 5. Charges and fees: Any charges or fees imposed by the seller should be clearly outlined in the accounting statement, such as late payment fees, transaction fees, or administrative fees. 6. Maintenance and repair expenses: If the contract stipulates that the purchaser is responsible for maintaining or repairing the property, this section will detail any related expenses incurred, such as repairs, landscaping, or utilities. 7. Insurance and taxes: The accounting statement will provide information regarding property insurance payments made by the purchaser, as well as any property tax obligations and payments. It is important to note that variations of the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may exist, depending on the specific terms and conditions mutually agreed upon by both parties. These variations may address additional elements or emphasize certain aspects of the agreement. Potential variations of the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract may include: 1. Commercial properties: If the contract pertains to a commercial property, the accounting statement may include additional sections addressing revenue from tenants, expenses related to common areas, or the allocation of maintenance costs. 2. Agricultural land: In cases where the land contract involves agricultural land, the accounting statement may incorporate information on crop yields, irrigation expenses, or any income generated from farming activities. 3. Installment sales: If the contract is structured as an installment sale, wherein the purchaser pays off the purchase price in periodic installments, the accounting statement may focus on the outstanding balance, interest paid, and the remaining payment schedule. It is essential for both parties to review the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser thoroughly and ensure its compliance with state and local regulations. Seek legal advice and clarification, if necessary, to maintain a transparent and fair financial relationship throughout the duration of the land contract or executory contract.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Grand Prairie Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Grand Prairie Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

If you’ve already utilized our service before, log in to your account and download the Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple steps to get your file:

- Make sure you’ve found an appropriate document. Look through the description and use the Preview option, if available, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to obtain the proper one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Grand Prairie Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract. Opt for the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have regular access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily locate and save any template for your personal or professional needs!