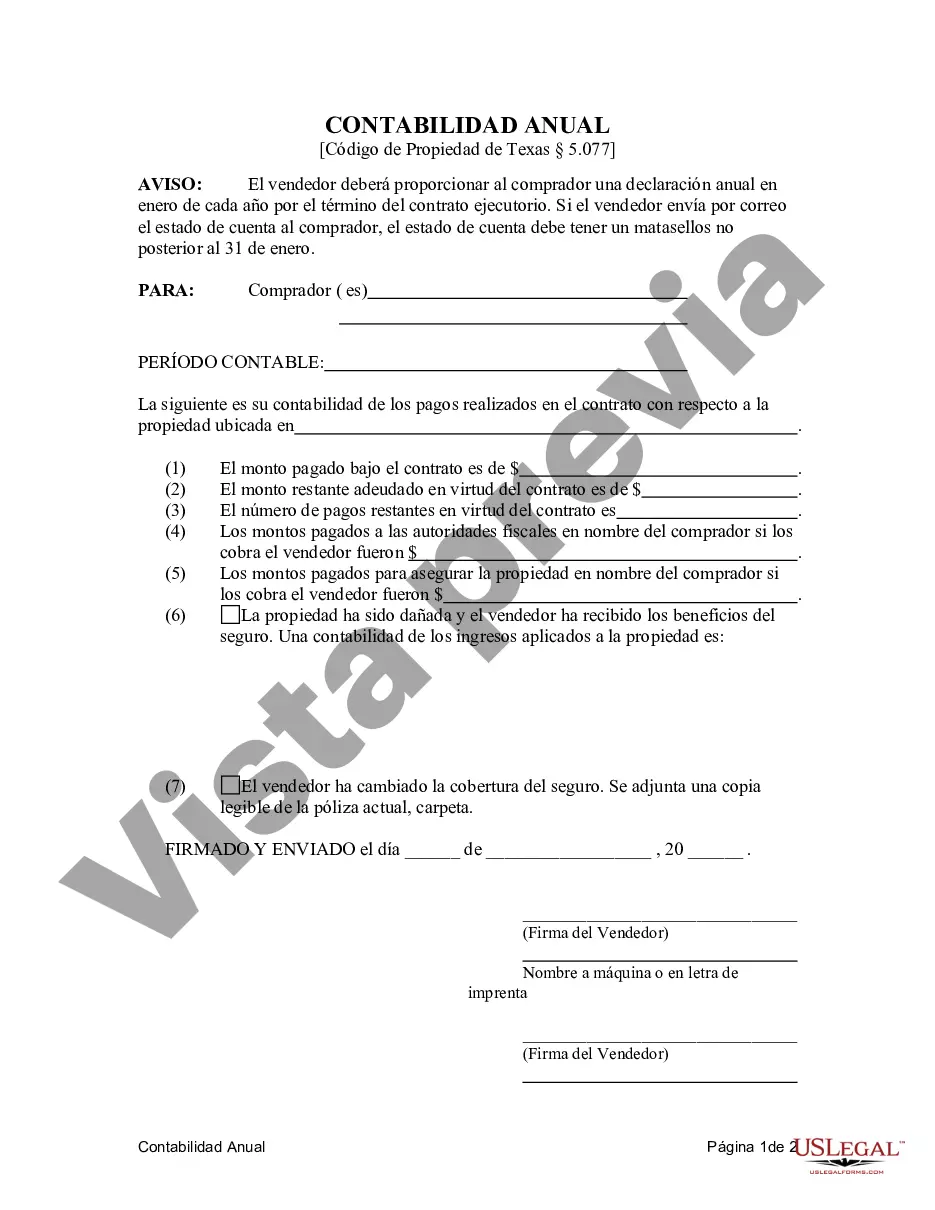

The Harris Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is an essential document in residential real estate transactions. This statement is specifically designed for land contracts and executory contracts, serving as a comprehensive annual report of the financial transactions between the seller (vendor) and the purchaser (Vendée). The Harris Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser provides a detailed breakdown of all financial activities related to the land contract or executory contract during the year. It ensures transparency and accountability between both parties involved, helping them stay informed about the monetary aspects of their agreement. The statement typically includes the following key elements: 1. Identification Information: — Names and addresses of the seller (vendor) and the purchaser (Vendée).—- Description of the property, including its legal address and any particulars or restrictions. 2. Financial Summary: — A consolidated summary of the total payments made by the purchaser to the seller during the accounting period. — Detailed calculation of principal, interest, and any other charges or fees associated with the contract. — Balance calculation of the principal owed by the purchaser. 3. Payment Breakdown: — Monthly breakdown of payments made by the purchaser, specifying the amount allocated to principal, interest, and other expenses. — Any penalties or late fees incurred by the purchaser, if applicable. 4. Expenses: — Itemized list of expenses incurred by the seller that are relevant to the contract, such as property taxes, insurance, or maintenance costs. — Total expenses paid by the seller, categorized and clearly stated. 5. Escrow Account Details: — If an escrow account is utilized, the statement should include a separate section disclosing any funds held in the escrow account and their purpose. 6. Amendments or Modifications: — In case the contract has undergone any amendments or modifications during the accounting period, these changes should be clearly documented, indicating the effective dates and the reasons behind the adjustments. It's important to note that the Harris Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may have some variations or alternate versions, depending on specific contractual terms or legal requirements. It is recommended to consult with a qualified real estate attorney or local real estate association for accurate and up-to-date templates relevant to Harris County, Texas, to ensure compliance with local regulations. By providing comprehensive and detailed financial information, the Harris Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser promotes a transparent and trustworthy relationship between the seller and the purchaser. It helps both parties track and evaluate their financial positions and obligations, making it an indispensable document in land contract or executory contract transactions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Harris Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

We always strive to reduce or avoid legal issues when dealing with nuanced law-related or financial affairs. To accomplish this, we sign up for legal solutions that, usually, are extremely expensive. However, not all legal issues are equally complex. Most of them can be taken care of by ourselves.

US Legal Forms is an online library of up-to-date DIY legal documents covering anything from wills and powers of attorney to articles of incorporation and petitions for dissolution. Our library helps you take your affairs into your own hands without turning to legal counsel. We offer access to legal document templates that aren’t always openly accessible. Our templates are state- and area-specific, which considerably facilitates the search process.

Take advantage of US Legal Forms whenever you need to get and download the Harris Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract or any other document easily and securely. Simply log in to your account and click the Get button next to it. In case you lose the document, you can always download it again from within the My Forms tab.

The process is equally effortless if you’re unfamiliar with the platform! You can register your account within minutes.

- Make sure to check if the Harris Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract adheres to the laws and regulations of your your state and area.

- Also, it’s imperative that you go through the form’s description (if provided), and if you notice any discrepancies with what you were looking for in the first place, search for a different form.

- Once you’ve ensured that the Harris Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract would work for you, you can pick the subscription option and proceed to payment.

- Then you can download the document in any suitable file format.

For more than 24 years of our existence, we’ve helped millions of people by providing ready to customize and up-to-date legal documents. Take advantage of US Legal Forms now to save time and resources!