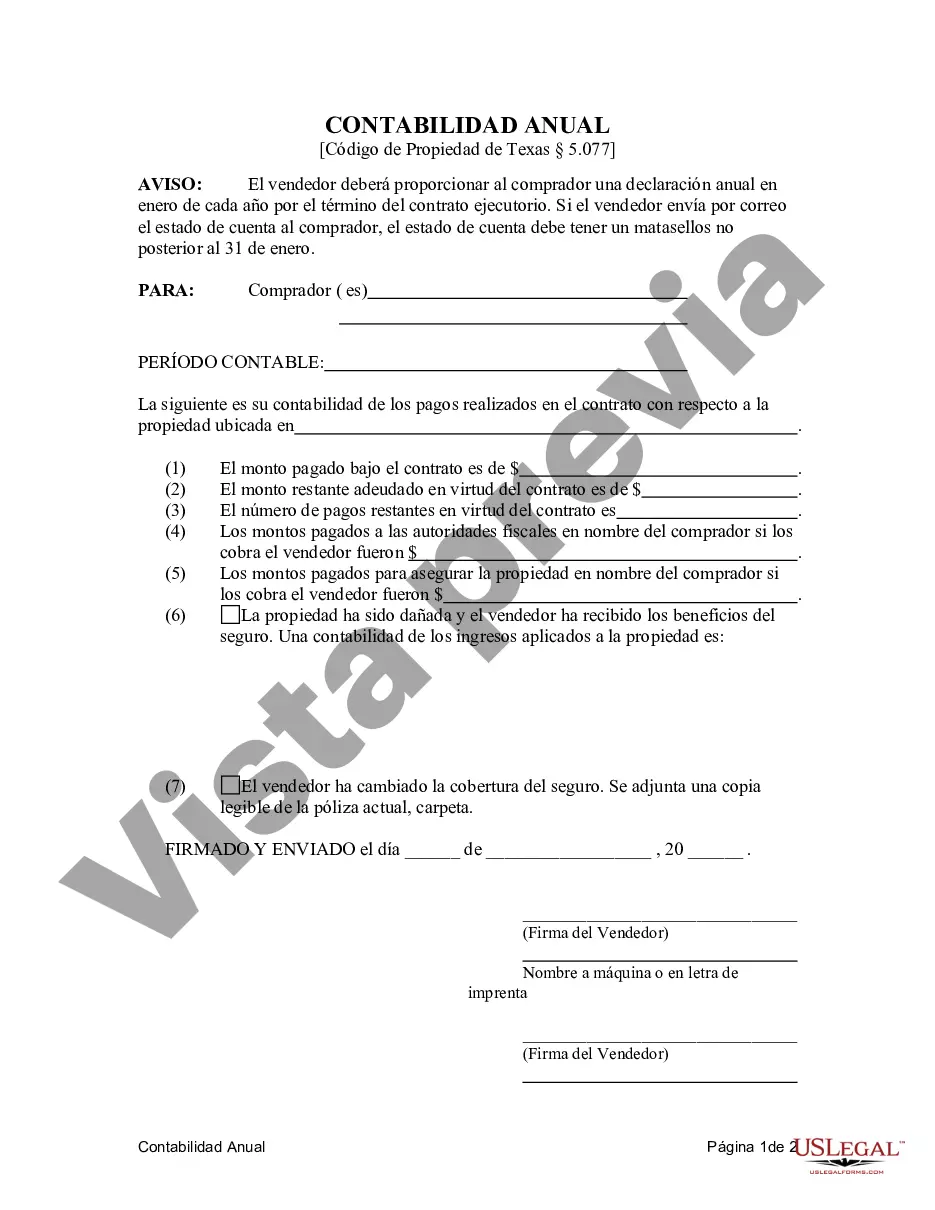

When engaging in an Irving Texas contract for deed, it is crucial for both the seller and purchaser to have a clear understanding of their rights and obligations. One crucial aspect of this process is the annual accounting statement that the seller provides to the buyer. This statement serves as an essential document that outlines the financial aspects of the agreement and ensures transparency and accountability between the parties involved. The Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract consists of several key elements. Firstly, it includes a detailed breakdown of all financial transactions related to the property during the past year. This includes the amount of the initial down payment, monthly installments, any interest paid, and any other associated fees or charges. In addition to the financial details, the accounting statement will also list any expenses incurred by the seller that are related to the property. This may include property taxes, insurance premiums, and maintenance costs. By providing a comprehensive overview of these expenses, the purchaser gains insight into the true cost of owning the property and can make informed decisions regarding their future financial obligations. The annual accounting statement may further outline any changes or adjustments to the contract terms, such as modifications in interest rates or adjustments to the payment schedule. This helps maintain transparency and ensures that both parties are aware of any alterations or updates that may affect their financial responsibilities. Moreover, if there are different types of Irving Texas Contract for Deed Seller's Annual Accounting Statement, they may vary based on specific circumstances or varying property agreements. For instance, variations may cater to commercial properties or multifamily residences, each requiring specific financial information relevant to their respective property types. In conclusion, the Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract is an essential document in maintaining transparency and accountability between a seller and purchaser involved in a contract for deed. By providing a detailed breakdown of financial transactions, property-related expenses, and any modifications to the contract terms, this statement ensures that both parties have a comprehensive understanding of their financial obligations and rights. It is crucial for sellers and purchasers to review and understand these statements thoroughly to avoid any misunderstandings or disputes in the future.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Irving Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Irving Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

If you are looking for an authentic form template, it’s unfeasible to select a more user-friendly platform than the US Legal Forms website – likely the most comprehensive repositories on the web.

With this collection, you can discover countless form examples for business and personal use by categories and jurisdictions, or keywords.

Utilizing our premium search capability, locating the latest Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract is as straightforward as 1-2-3.

Complete the transaction. Utilize your credit card or PayPal account to finalize the registration process.

Obtain the template. Specify the file format and download it to your device.

- Furthermore, the applicability of each document is validated by a group of experienced attorneys who routinely assess the templates on our site and update them in accordance with the latest state and county regulations.

- If you are already familiar with our platform and have an established account, all you need to obtain the Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract is to Log In to your user profile and click the Download button.

- If you are utilizing US Legal Forms for the first time, simply adhere to the guidelines outlined below.

- Ensure you have located the form you require. Review its description and utilize the Preview feature (if available) to examine its contents. If it doesn’t meet your requirements, use the Search option at the top of the page to find the suitable document.

- Validate your choice. Select the Buy now button. After that, choose your desired subscription plan and provide your details to create an account.

Form popularity

FAQ

A deed is considered valid in Texas when it contains essential elements, including identification of parties, a valid description of the property, and the signature of the grantor. Additionally, it should be delivered to the grantee to complete the transfer of ownership. For those involved in contracts for deeds, it is vital to comply with these requirements to ensure a smooth transaction. Rely on the Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract to guide you through this process.

In a contract for deed in Texas, the purchaser typically pays property taxes. This arrangement is often outlined in the contract, where the buyer assumes financial responsibility for taxes while making installment payments. It is crucial for both parties to clarify this in the Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract. Doing so prevents misunderstandings and ensures proper management of tax obligations.

The contract for deed statute in Texas governs the relationship between buyer and seller in such agreements. Under Texas law, sellers must provide an annual accounting statement to the purchaser detailing payments made and any additional terms. This ensures both parties understand their obligations and any outstanding balances. It is essential to leverage the Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract to comply with these legal requirements.

An example of an executory contract is a contract for deed, often referred to as a land contract. In this arrangement, the seller retains legal title to the property while the buyer makes payments over time. Once the buyer fulfills the terms of the contract, they will receive the deed to the property. This structure is common in Irving, Texas, where sellers utilize an Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract for transparency.

In Texas, it is not mandatory to record a contract for deed. However, recording can provide additional protection for both the seller and purchaser. By documenting the agreement, especially in an Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract, you safeguard your interests and establish a public record. For assistance with recording and compliance, uslegalforms offers valuable resources.

Yes, anyone can write a letter of agreement, but it's crucial that the terms are clear and understood by both parties. This type of document can outline terms related to an Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract to ensure all parties are aligned. For a more formal approach, consider using uslegalforms to create a comprehensive and legally binding letter.

Writing your own land contract is possible, but there are key elements to include for it to be valid. A well-structured contract can prevent future disputes and ensure both parties are on the same page. For specific structures, such as an Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract, you might find templates and guidance on uslegalforms beneficial when drafting your agreement.

Yes, you can write your own real estate contract in Texas. However, it is essential to understand the legal implications involved. Having a clear and thorough contract can protect both the buyer and seller, especially in situations like an Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract. Consider using resources from uslegalforms to ensure compliance with state laws.

The unlimited hours rule typically applies to labor laws and may affect independent contractors or employees. It’s crucial for sellers and buyers to understand their specific obligations regarding payment structures and time worked. In the context of contracts like the Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract, clarity in terms can help protect everyone's interests.

Yes, you can execute a contract for deed in Texas. This arrangement allows the buyer to take possession of the property while making payments to the seller, ultimately leading to ownership. Such transactions should be documented clearly, including annual accounting statements for transparency, as seen in the Irving Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract.