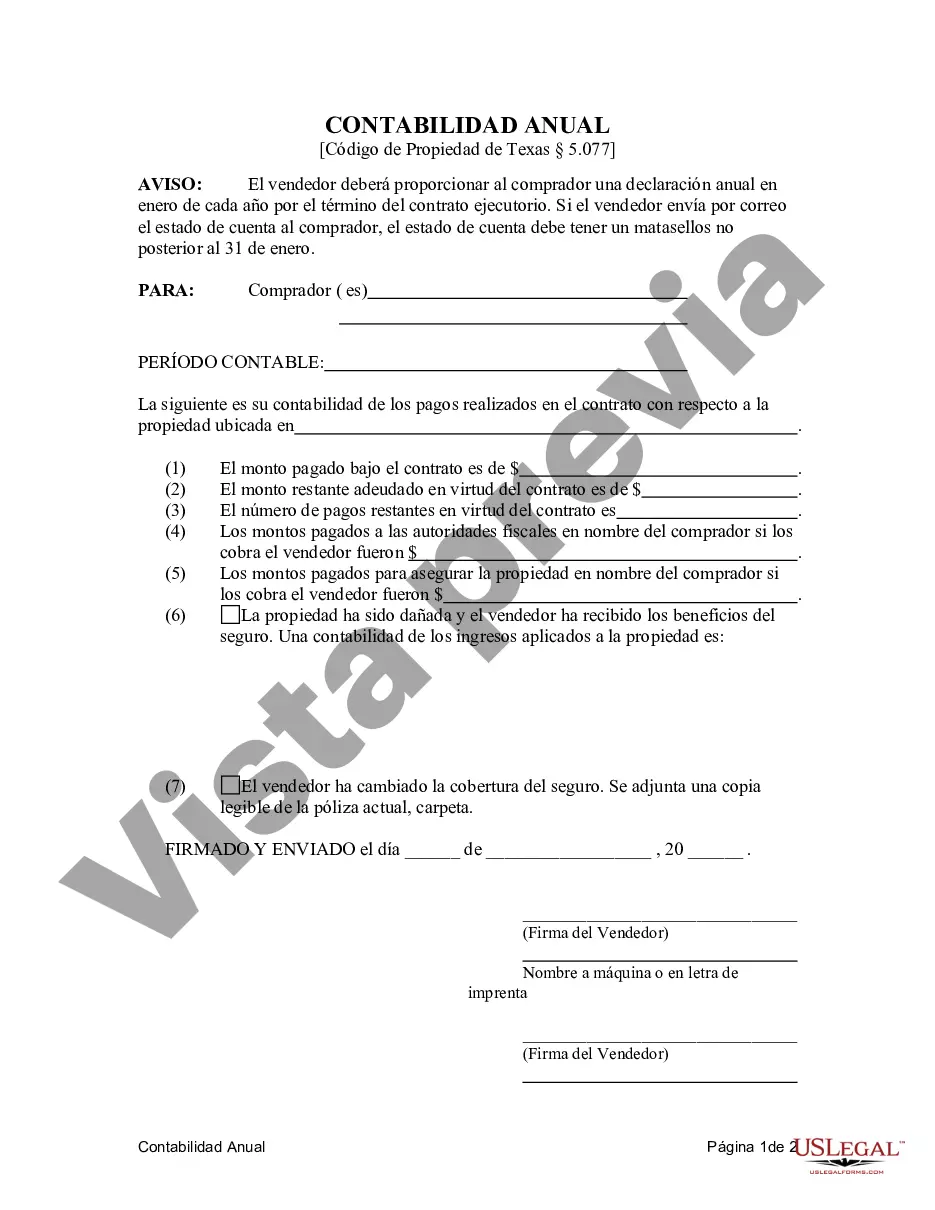

A Killeen Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser, specifically for residential land contracts and executory contracts, serves as a crucial document outlining the financial details and obligations between the seller and purchaser. This statement highlights the annual breakdown of payments made by the purchaser, as well as various expenses and credits associated with the property transfer. It ensures transparency and accountability in the contractual agreement. The Killeen Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser typically includes the following: 1. Identification Details: This section outlines the basic information of both the seller and purchaser, such as their legal names, addresses, contact information, and contract date. 2. Property Description: A concise description of the residential property subject to the contract is provided, including the address, legal description, and any specific boundaries or details crucial for identification. 3. Annual Payment Summary: This part presents a comprehensive breakdown of the total annual payment made by the purchaser. It includes principal payments, interest charges, any additional charges or fees related to the contract, and the total amount paid. 4. Escrow Account Summary: If the contract requires the establishment of an escrow account to cover property taxes, insurance, or maintenance expenses, this section outlines the contributions made by the purchaser and any reimbursements or adjustments made in the fiscal year. 5. Property Tax Expenses: In case the property taxes are the sole responsibility of the purchaser, this part details the specific amount paid and the period covered, along with any associated credits or adjustments. 6. Insurance Expenses: The insurance section provides a comprehensive overview of all insurance-related costs incurred during the year, including premiums paid, coverage dates, and any refunds or adjustments. 7. Maintenance Expenses: If maintenance expenses, such as repairs or renovations, have been incurred by the seller or purchaser, this section highlights the details. It includes the total expenses, dates of expenditure, and any reimbursements or credits applicable. 8. Remaining Balance: This section summarizes the remaining balance due on the contract after accounting for the annual payments, escrow adjustments, property taxes, insurance expenses, and maintenance costs. It is important to note that different variations of the Killeen Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser may exist based on specific contractual arrangements, property types, or additional clauses agreed upon by the parties involved. These variations may include specific sections related to late fees, prepayment penalties, or other financial aspects tailored according to the agreement. Overall, the Killeen Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract is a comprehensive document that outlines the financial transactions and obligations between the seller and purchaser. It promotes transparency and ensures that both parties have a complete understanding of the annual financial status of the property under contract.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Killeen Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Killeen Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

Take advantage of the US Legal Forms and get instant access to any form you require. Our helpful platform with thousands of document templates allows you to find and get almost any document sample you require. You are able to download, complete, and certify the Killeen Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract in just a couple of minutes instead of browsing the web for many hours looking for a proper template.

Utilizing our collection is an excellent strategy to increase the safety of your record filing. Our professional lawyers on a regular basis check all the records to make certain that the templates are appropriate for a particular region and compliant with new laws and polices.

How do you obtain the Killeen Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract? If you have a profile, just log in to the account. The Download button will be enabled on all the documents you look at. Moreover, you can get all the previously saved documents in the My Forms menu.

If you haven’t registered an account yet, follow the instructions listed below:

- Find the template you need. Make certain that it is the form you were hoping to find: examine its headline and description, and take take advantage of the Preview feature if it is available. Otherwise, use the Search field to find the appropriate one.

- Launch the saving process. Select Buy Now and select the pricing plan that suits you best. Then, create an account and pay for your order utilizing a credit card or PayPal.

- Download the document. Pick the format to get the Killeen Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract and change and complete, or sign it for your needs.

US Legal Forms is probably the most significant and trustworthy document libraries on the web. We are always happy to assist you in any legal process, even if it is just downloading the Killeen Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract.

Feel free to take full advantage of our platform and make your document experience as efficient as possible!