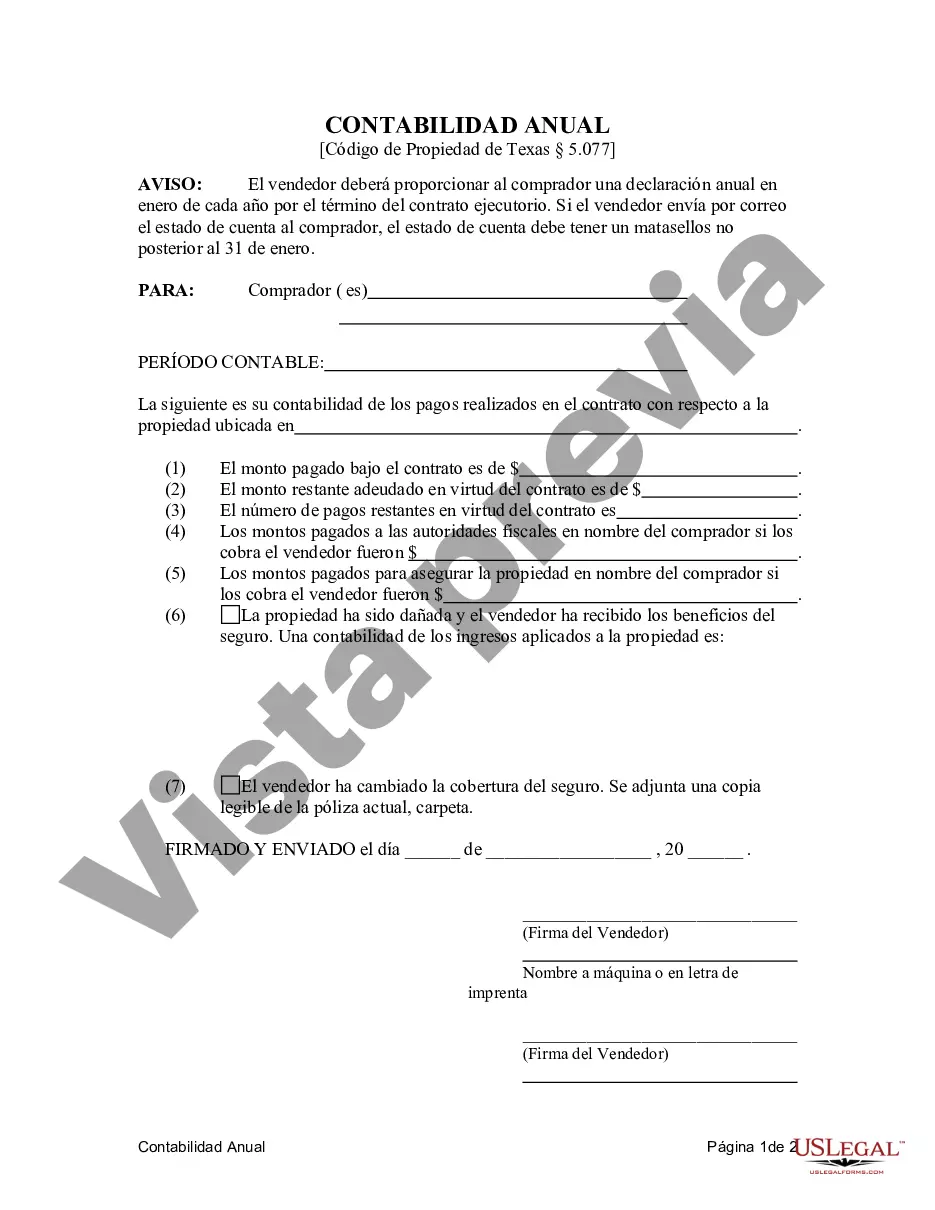

The Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract, serves as a crucial document in a real estate transaction. This comprehensive accounting statement provides important information to the purchaser regarding their financial obligations and the progress made towards full ownership of the property through a land contract or executory contract. This annual statement ensures transparency and facilitates the smooth functioning of the contractual agreement between the seller and the purchaser. Key Elements of the Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract: 1. Purchase Details: This section includes details about the property being sold, such as its address, legal description, and purchase price. 2. Payment Summary: The statement outlines the total payment made by the purchaser during the past year, including the amount paid towards the principal balance, interest, and any additional charges or fees. It also lists the outstanding balance left on the contract. 3. Interest Calculation: If the contract includes interest charges on the outstanding balance, this section demonstrates how the interest is calculated, the interest rate applied, and the resulting interest owed by the purchaser. 4. Escrow Account: In the case of an escrow account for payment of property taxes and insurance, the statement details the balance in the account, any changes due to adjustments, and any reimbursements made to the purchaser. 5. Property Tax Information: The statement provides information regarding property taxes, including the assessed value, tax rate, and any changes in tax payments, if applicable. 6. Insurance Coverage: If insurance premiums are being paid through the contract, the statement outlines the insurance coverage, premiums paid, and any adjustments made. 7. Other Charges and Credits: This section lists any additional charges or credits that may be relevant to the contract, such as late fees, penalties, or incentives. 8. Yearly Recap: The statement summarizes the purchaser's overall progress towards ownership, including the remaining balance, the number of payments made, and any applicable penalties or late fees. 9. Important Notices: This section includes any legal notices, disclosures, or updates that may affect the contractual agreement between the seller and the purchaser. Some different types of Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract, based on the specific terms and conditions, may include: 1. Fixed Interest Rate Contract: This contract maintains a constant interest rate throughout the term, ensuring a predictable payment schedule for the purchaser. 2. Adjustable Interest Rate Contract: In this contract, the interest rate fluctuates based on an agreed-upon index, which may cause variations in the payment amounts and total interest owed. 3. Balloon Payment Contract: This type of contract includes smaller periodic payments but requires a larger lump sum payment at the end of a specified term. 4. Rent-to-Own Contract: This contract allows the purchaser to rent the property for a specific period before finalizing the purchase, with a portion of the rental payments credited towards the eventual purchase price. 5. Lease Option Contract: This contract combines elements of a traditional lease agreement and an option to purchase the property at a later date. These variations ensure that a Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract, can cater to different financial situations, preferences, and legal considerations of both buyers and sellers.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mesquite Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

State:

Texas

City:

Mesquite

Control #:

TX-00470-4

Format:

Word

Instant download

Description

Declaración por escrito notificando al Comprador el número y monto de los pagos realizados hacia el contrato por el capital e intereses de la escritura.

The Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract, serves as a crucial document in a real estate transaction. This comprehensive accounting statement provides important information to the purchaser regarding their financial obligations and the progress made towards full ownership of the property through a land contract or executory contract. This annual statement ensures transparency and facilitates the smooth functioning of the contractual agreement between the seller and the purchaser. Key Elements of the Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract: 1. Purchase Details: This section includes details about the property being sold, such as its address, legal description, and purchase price. 2. Payment Summary: The statement outlines the total payment made by the purchaser during the past year, including the amount paid towards the principal balance, interest, and any additional charges or fees. It also lists the outstanding balance left on the contract. 3. Interest Calculation: If the contract includes interest charges on the outstanding balance, this section demonstrates how the interest is calculated, the interest rate applied, and the resulting interest owed by the purchaser. 4. Escrow Account: In the case of an escrow account for payment of property taxes and insurance, the statement details the balance in the account, any changes due to adjustments, and any reimbursements made to the purchaser. 5. Property Tax Information: The statement provides information regarding property taxes, including the assessed value, tax rate, and any changes in tax payments, if applicable. 6. Insurance Coverage: If insurance premiums are being paid through the contract, the statement outlines the insurance coverage, premiums paid, and any adjustments made. 7. Other Charges and Credits: This section lists any additional charges or credits that may be relevant to the contract, such as late fees, penalties, or incentives. 8. Yearly Recap: The statement summarizes the purchaser's overall progress towards ownership, including the remaining balance, the number of payments made, and any applicable penalties or late fees. 9. Important Notices: This section includes any legal notices, disclosures, or updates that may affect the contractual agreement between the seller and the purchaser. Some different types of Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract, based on the specific terms and conditions, may include: 1. Fixed Interest Rate Contract: This contract maintains a constant interest rate throughout the term, ensuring a predictable payment schedule for the purchaser. 2. Adjustable Interest Rate Contract: In this contract, the interest rate fluctuates based on an agreed-upon index, which may cause variations in the payment amounts and total interest owed. 3. Balloon Payment Contract: This type of contract includes smaller periodic payments but requires a larger lump sum payment at the end of a specified term. 4. Rent-to-Own Contract: This contract allows the purchaser to rent the property for a specific period before finalizing the purchase, with a portion of the rental payments credited towards the eventual purchase price. 5. Lease Option Contract: This contract combines elements of a traditional lease agreement and an option to purchase the property at a later date. These variations ensure that a Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract, can cater to different financial situations, preferences, and legal considerations of both buyers and sellers.

Free preview

How to fill out Mesquite Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

If you’ve already used our service before, log in to your account and download the Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it according to your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your document:

- Make sure you’ve located a suitable document. Read the description and use the Preview option, if any, to check if it meets your needs. If it doesn’t suit you, use the Search tab above to get the proper one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Create an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Mesquite Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract. Pick the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have purchased: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly find and save any template for your personal or professional needs!