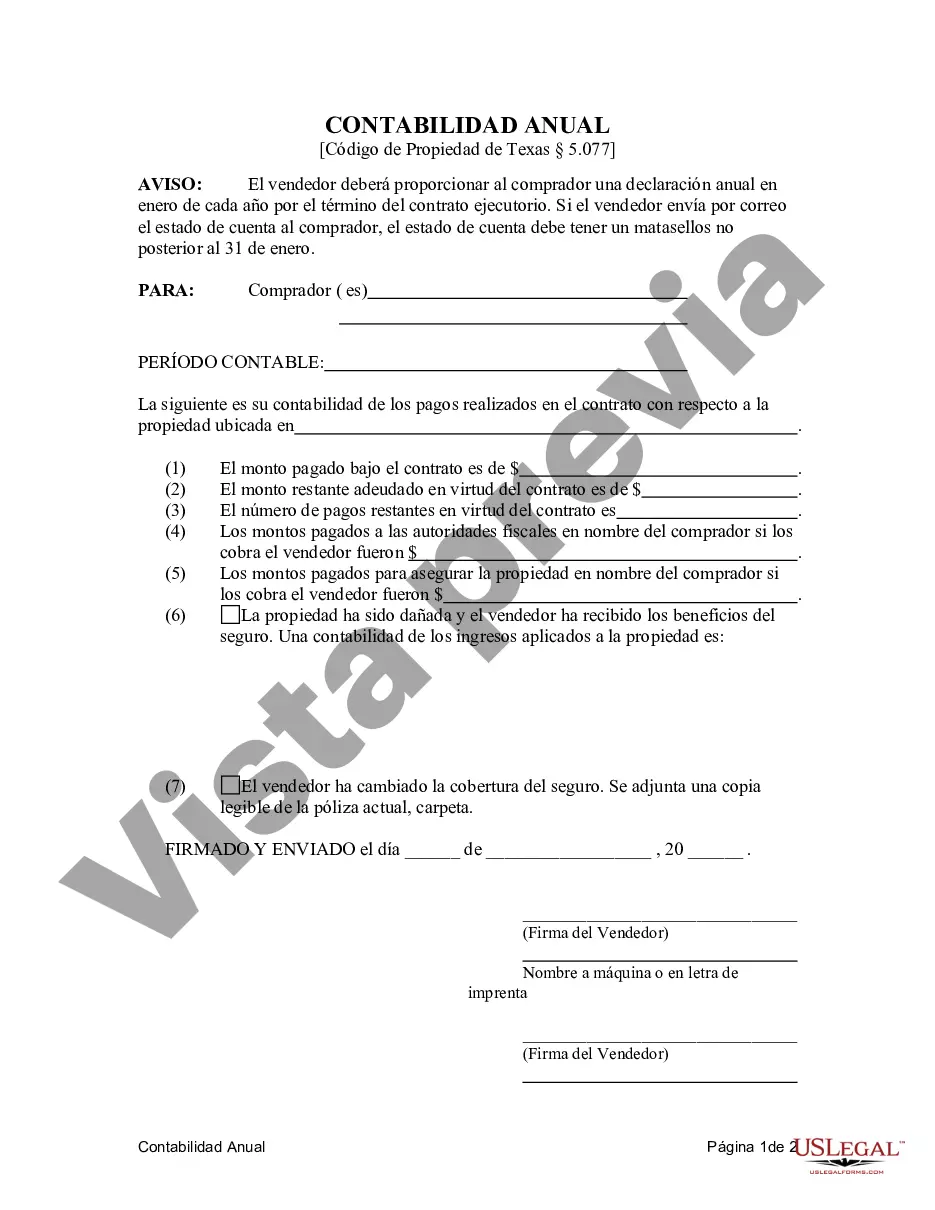

A Pasadena Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is a crucial document in residential land contracts or executory contracts, providing a detailed summary of financial transactions between the seller and the purchaser throughout the year. This statement serves as a transparent record of the financial obligations and responsibilities of both parties involved. The purpose of the Pasadena Texas Contract for Deed Seller's Annual Accounting Statement is to ensure transparency and accountability between the seller and purchaser, allowing both parties to track and verify financial transactions. This annual statement outlines all relevant information related to payments made by the purchaser, such as principal, interest, taxes, and insurance payments. The seller's annual accounting statement includes essential information such as the property address, the names of the parties involved, and the effective date of the contract. It covers a detailed breakdown of principal payments made by the purchaser, ensuring a clear understanding of the amount owed and any changes in the outstanding balance. Moreover, this statement also provides an overview of the interest accrued throughout the year, typically calculated based on the agreed-upon interest rate stated in the contract. This calculation helps both parties understand the portion of the payment allocated toward interest and its impact on the outstanding balance. In addition to principal and interest payments, the Pasadena Texas Contract for Deed Seller's Annual Accounting Statement includes a section on tax-related transactions. This section highlights property taxes paid by the seller and the purchaser's responsibility for reimbursing the seller accordingly. It ensures accurate accounting of tax obligations and prevents any potential disputes. Furthermore, the statement may encompass insurance-related transactions, with details on premiums paid by the seller and the purchaser's share of that expense. This section guarantees that both parties are aware of their obligations concerning property insurance, safeguarding the property adequately. Different variations of the Pasadena Texas Contract for Deed Seller's Annual Accounting Statement may be available, tailored to specific contractual terms or individual preferences. Some variations might focus on additional financial aspects, such as maintenance costs or repairs financed by the purchaser. In conclusion, the Pasadena Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser plays a crucial role in maintaining transparency and accountability in residential land contracts or executory contracts. It provides comprehensive details regarding principal, interest, taxes, and insurance payments, ensuring both the seller and purchaser have an accurate understanding of their financial obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pasadena Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Pasadena Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

If you’ve already used our service before, log in to your account and download the Pasadena Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract on your device by clicking the Download button. Make certain your subscription is valid. Otherwise, renew it in accordance with your payment plan.

If this is your first experience with our service, follow these simple actions to obtain your document:

- Make certain you’ve found an appropriate document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t fit you, utilize the Search tab above to get the appropriate one.

- Buy the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Use your credit card details or the PayPal option to complete the purchase.

- Get your Pasadena Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract. Choose the file format for your document and save it to your device.

- Fill out your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to each piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to easily find and save any template for your personal or professional needs!