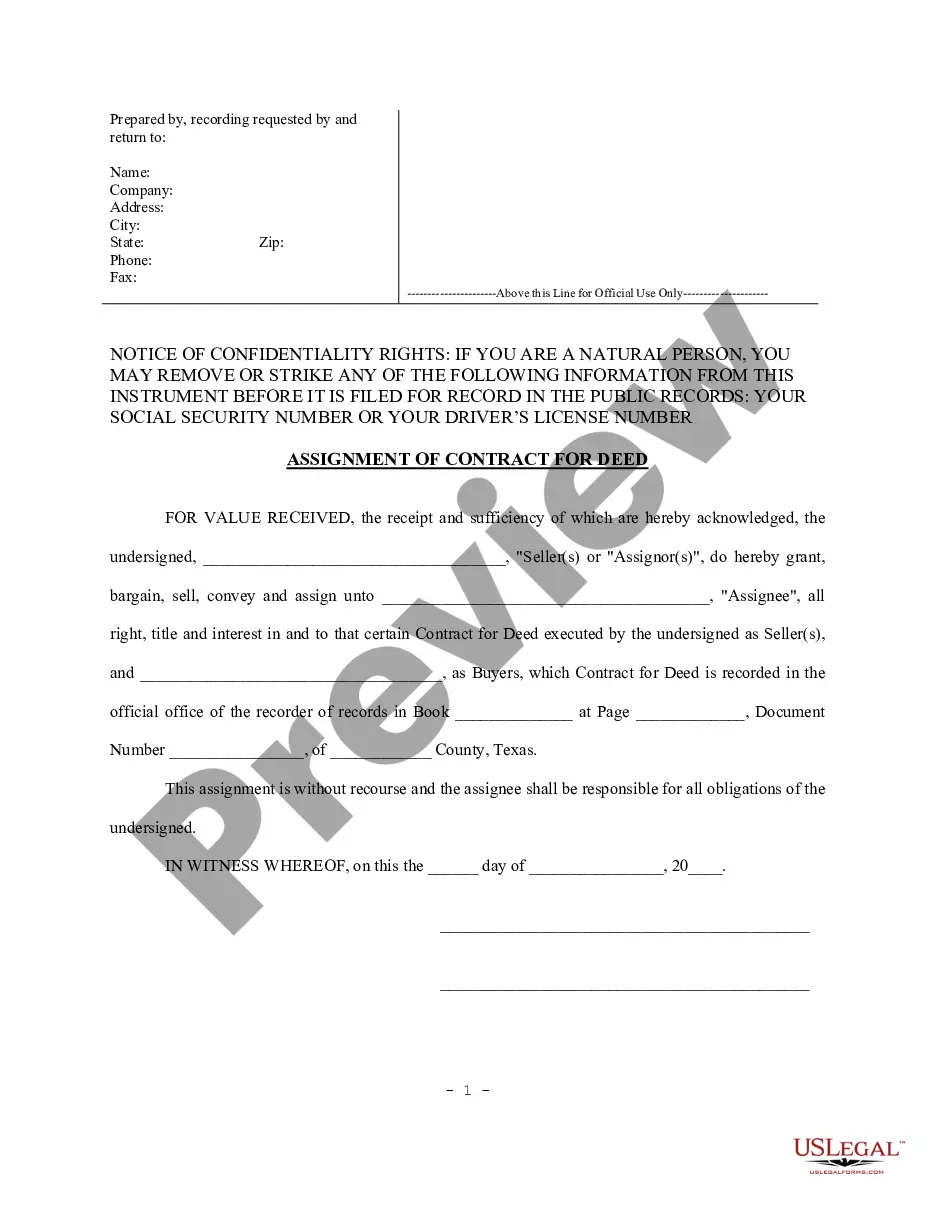

Plano Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract In Plano, Texas, the Contract for Deed Seller's Annual Accounting Statement is an essential document that provides a comprehensive overview of financial transactions between the seller and the purchaser in a residential land contract. Also known as an executory contract, this agreement outlines the financial obligations and rights of both parties involved in the transaction. There are several types of Contract for Deed Seller's Annual Accounting Statements in Plano, Texas, depending on the intricacies of the agreement. They can be categorized into the following: 1. Residential Land Contract: This type of contract specifically pertains to the purchase and sale of residential properties arranged through a land contract. It outlines the terms and conditions of the agreement, including the purchase price, payment schedule, and obligations of both parties. 2. Executory Contract: An executory contract is a legally binding agreement that requires both parties involved to fulfill their obligations in the future. In the context of a Contract for Deed Seller's Annual Accounting Statement, it represents a contract where the seller agrees to transfer the property's ownership to the purchaser upon fulfilling specific conditions or completing all the payments. The Plano Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract typically includes the following key elements: 1. Parties involved: The document clearly identifies both the seller and the purchaser involved in the land contract, providing their legal names, addresses, and contact information. 2. Property details: It includes a detailed description of the property being sold, such as address, legal description, and any unique features or specifications. 3. Financial information: This section outlines the financial aspects of the agreement, including the agreed-upon purchase price, down payment, installment payments, interest rates, and any penalties or fees associated with late payments. 4. Accounting statement: The annual accounting statement summarizes all financial transactions between the seller and the purchaser during a specific year. This includes all payments made by the purchaser, any taxes or insurance payments, and any credits or adjustments relevant to the agreement. 5. Obligations and rights: The statement clarifies the responsibilities and rights of both the seller and the purchaser throughout the duration of the contract. It may cover issues related to property maintenance, repairs, insurance, property taxes, and default remedies. 6. Dispute resolution: In case of disagreements or disputes, the document may include provisions for mediation, arbitration, or other methods of resolving conflicts between the parties involved. It is important to note that the specific details and required elements of a Plano Texas Contract for Deed Seller's Annual Accounting Statement may vary depending on the terms agreed upon between the parties. To ensure legal compliance and accuracy, it is recommended to consult with a qualified real estate attorney or a professional experienced in real estate transactions in Plano, Texas.

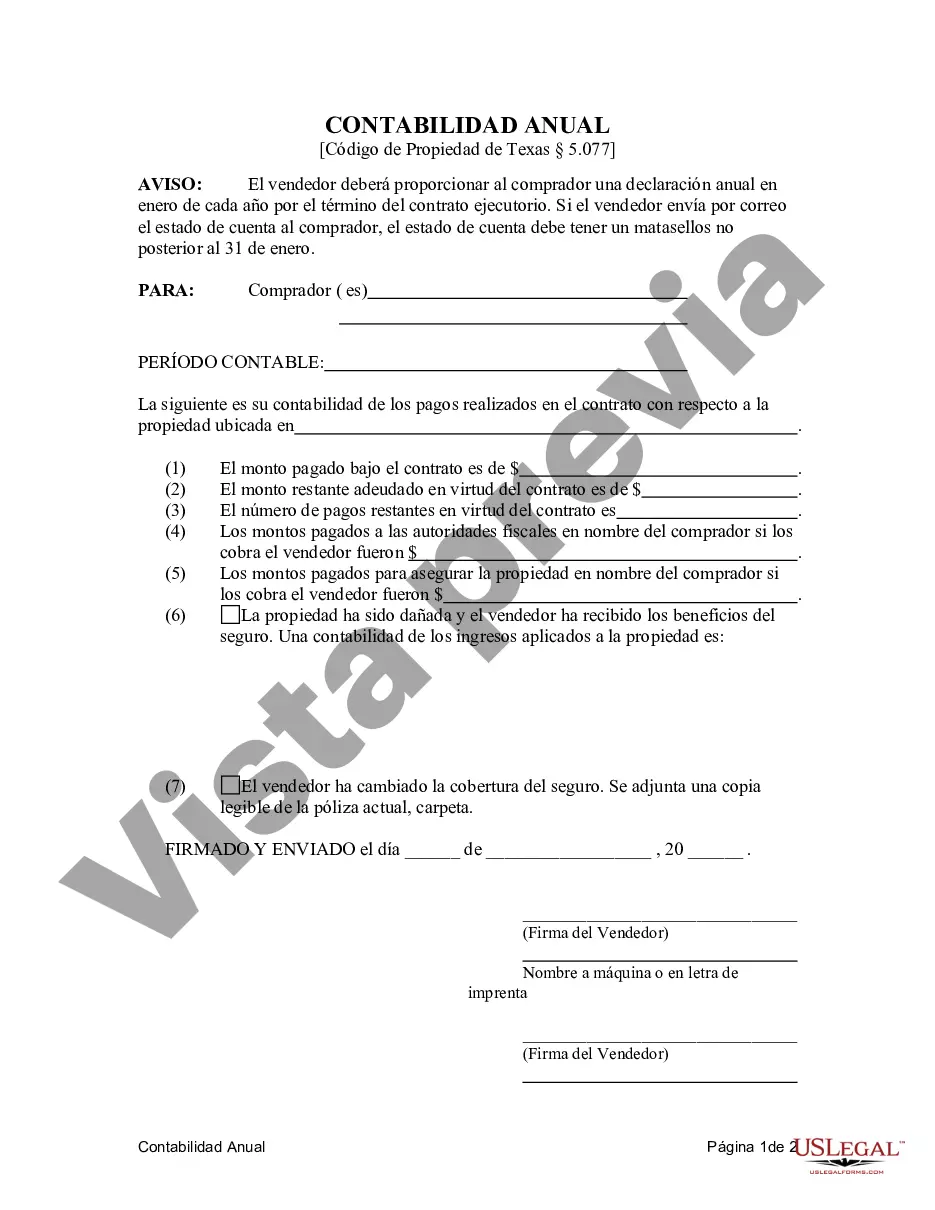

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Plano Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

State:

Texas

City:

Plano

Control #:

TX-00470-4

Format:

Word

Instant download

Description

Declaración por escrito notificando al Comprador el número y monto de los pagos realizados hacia el contrato por el capital e intereses de la escritura.

Plano Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract In Plano, Texas, the Contract for Deed Seller's Annual Accounting Statement is an essential document that provides a comprehensive overview of financial transactions between the seller and the purchaser in a residential land contract. Also known as an executory contract, this agreement outlines the financial obligations and rights of both parties involved in the transaction. There are several types of Contract for Deed Seller's Annual Accounting Statements in Plano, Texas, depending on the intricacies of the agreement. They can be categorized into the following: 1. Residential Land Contract: This type of contract specifically pertains to the purchase and sale of residential properties arranged through a land contract. It outlines the terms and conditions of the agreement, including the purchase price, payment schedule, and obligations of both parties. 2. Executory Contract: An executory contract is a legally binding agreement that requires both parties involved to fulfill their obligations in the future. In the context of a Contract for Deed Seller's Annual Accounting Statement, it represents a contract where the seller agrees to transfer the property's ownership to the purchaser upon fulfilling specific conditions or completing all the payments. The Plano Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract typically includes the following key elements: 1. Parties involved: The document clearly identifies both the seller and the purchaser involved in the land contract, providing their legal names, addresses, and contact information. 2. Property details: It includes a detailed description of the property being sold, such as address, legal description, and any unique features or specifications. 3. Financial information: This section outlines the financial aspects of the agreement, including the agreed-upon purchase price, down payment, installment payments, interest rates, and any penalties or fees associated with late payments. 4. Accounting statement: The annual accounting statement summarizes all financial transactions between the seller and the purchaser during a specific year. This includes all payments made by the purchaser, any taxes or insurance payments, and any credits or adjustments relevant to the agreement. 5. Obligations and rights: The statement clarifies the responsibilities and rights of both the seller and the purchaser throughout the duration of the contract. It may cover issues related to property maintenance, repairs, insurance, property taxes, and default remedies. 6. Dispute resolution: In case of disagreements or disputes, the document may include provisions for mediation, arbitration, or other methods of resolving conflicts between the parties involved. It is important to note that the specific details and required elements of a Plano Texas Contract for Deed Seller's Annual Accounting Statement may vary depending on the terms agreed upon between the parties. To ensure legal compliance and accuracy, it is recommended to consult with a qualified real estate attorney or a professional experienced in real estate transactions in Plano, Texas.

Free preview

How to fill out Plano Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

If you’ve already utilized our service before, log in to your account and download the Plano Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract on your device by clicking the Download button. Make sure your subscription is valid. If not, renew it in accordance with your payment plan.

If this is your first experience with our service, adhere to these simple steps to obtain your file:

- Ensure you’ve found the right document. Read the description and use the Preview option, if available, to check if it meets your requirements. If it doesn’t suit you, use the Search tab above to obtain the appropriate one.

- Purchase the template. Click the Buy Now button and pick a monthly or annual subscription plan.

- Register an account and make a payment. Utilize your credit card details or the PayPal option to complete the purchase.

- Obtain your Plano Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or take advantage of professional online editors to fill it out and sign it electronically.

You have permanent access to every piece of paperwork you have bought: you can locate it in your profile within the My Forms menu whenever you need to reuse it again. Take advantage of the US Legal Forms service to rapidly locate and save any template for your personal or professional needs!