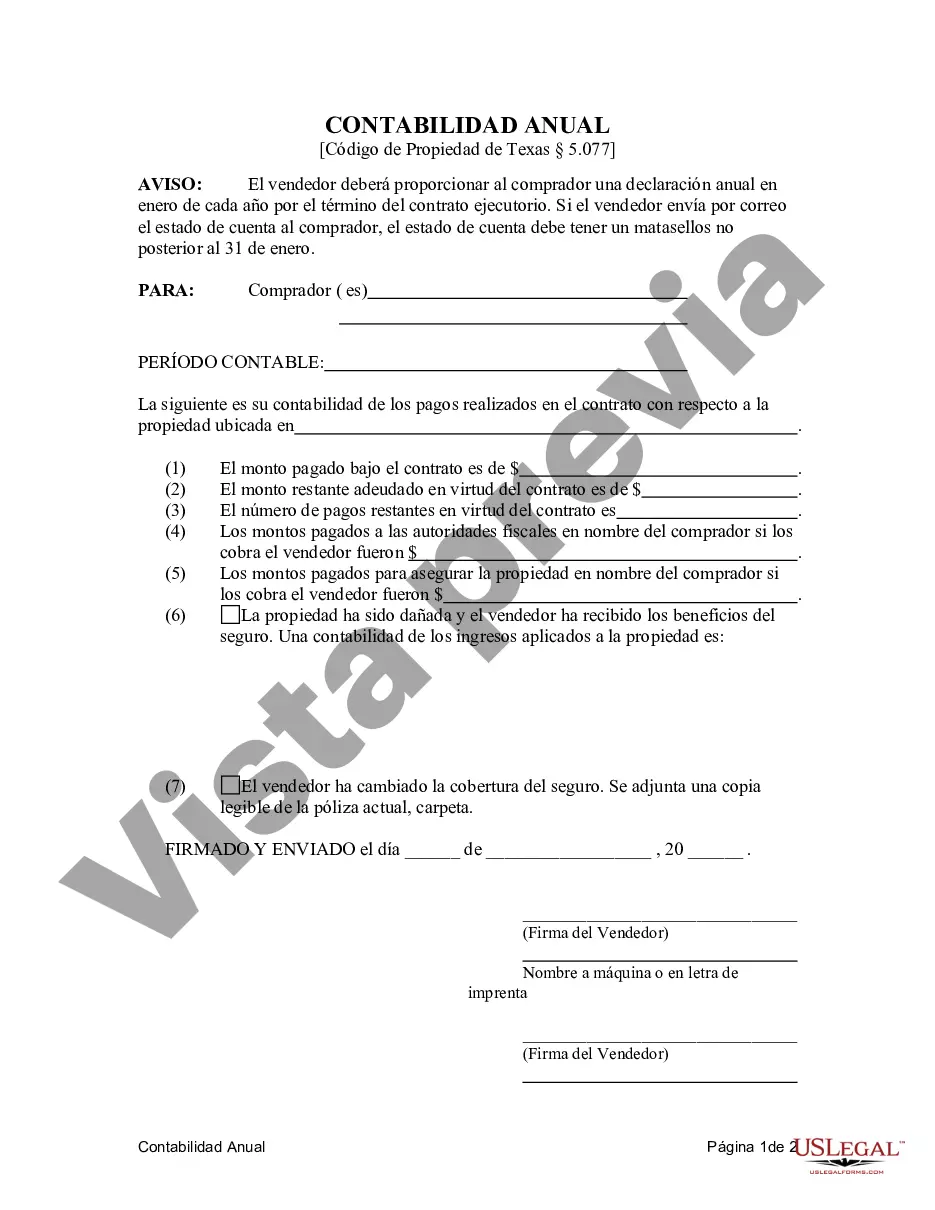

Title: Understanding the Sugar Land Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract Introduction: In the city of Sugar Land, Texas, prospective homebuyers and sellers often engage in land contracts or executory contracts as a means of purchasing residential properties. These contracts play a critical role in facilitating the transfer of property ownership. One essential document in this process is the annual accounting statement, which the seller provides to the purchaser. This article will provide a detailed description of the Sugar Land Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser, encompassing both land contracts and executory contracts. 1. Sugar Land Texas Land Contract: The Sugar Land Texas Land Contract for Deed Seller's Annual Accounting Statement to Purchaser is an important document that outlines the financial transactions between the seller and purchaser over the course of a year. It serves as a comprehensive report showcasing the financial status of the property. This type of contract is primarily used when the seller finances the sale of the property, allowing the purchaser to make periodic payments until the full purchase price is paid. 2. Sugar Land Texas Executory Contract: An Executory Contract in Sugar Land, Texas, is another type of agreement used in residential property transactions. The Sugar Land Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser is applicable in this scenario as well. An executory contract is created when both parties agree on a specific purchase price, but the buyer does not obtain immediate legal ownership of the property. Instead, they possess an equitable interest. The purchaser will gain ownership rights upon fulfilling certain payment obligations or meeting other predetermined conditions specified in the contract. Content of the Seller's Annual Accounting Statement to Purchaser: a) Property Information: The statement should include details about the property, such as the address, legal description, and any relevant identifying numbers (like the parcel or lot number). b) Transaction Summary: The document must provide a comprehensive breakdown of all financial transactions related to the contract during the preceding year. This includes information on payments made by the purchaser, any applicable interest, late fees, taxes, and insurance costs. c) Principal Balance and Escrow Account: The statement should specify the remaining principal balance owed by the purchaser and detail the status of any escrow account established. This account may cover property taxes, insurance, or other expenses associated with the property. d) Disclosures: The annual accounting statement should include any necessary disclosures required by state or local authorities. These may cover information such as the rights and responsibilities of both parties, default provisions, or potential penalties. e) Contact Information: The statement should provide contact details for both the seller and purchaser, ensuring open communication channels for any inquiries or concerns. Conclusion: Understanding the Sugar Land Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, Executory Contract is vital when engaging in real estate transactions in Sugar Land. Both land contracts and executory contracts involve specific financial agreements and obligations for the seller and purchaser. By providing an accurate, detailed annual accounting statement, sellers ensure transparency and help establish a solid relationship with the buyer.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sugar Land Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Sugar Land Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

Benefit from the US Legal Forms and have instant access to any form you need. Our helpful website with a large number of document templates makes it easy to find and get almost any document sample you want. It is possible to save, complete, and certify the Sugar Land Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract in a couple of minutes instead of surfing the Net for hours attempting to find an appropriate template.

Using our catalog is a great way to improve the safety of your document submissions. Our professional lawyers regularly review all the documents to make certain that the templates are appropriate for a particular state and compliant with new acts and polices.

How can you obtain the Sugar Land Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract? If you have a subscription, just log in to the account. The Download button will appear on all the documents you look at. In addition, you can get all the previously saved records in the My Forms menu.

If you don’t have a profile yet, follow the instructions listed below:

- Find the form you need. Ensure that it is the template you were seeking: verify its headline and description, and utilize the Preview feature if it is available. Otherwise, utilize the Search field to look for the appropriate one.

- Start the downloading procedure. Select Buy Now and choose the pricing plan you like. Then, create an account and pay for your order with a credit card or PayPal.

- Export the file. Pick the format to get the Sugar Land Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract and modify and complete, or sign it for your needs.

US Legal Forms is one of the most extensive and trustworthy template libraries on the web. We are always ready to assist you in any legal process, even if it is just downloading the Sugar Land Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract.

Feel free to take advantage of our service and make your document experience as efficient as possible!