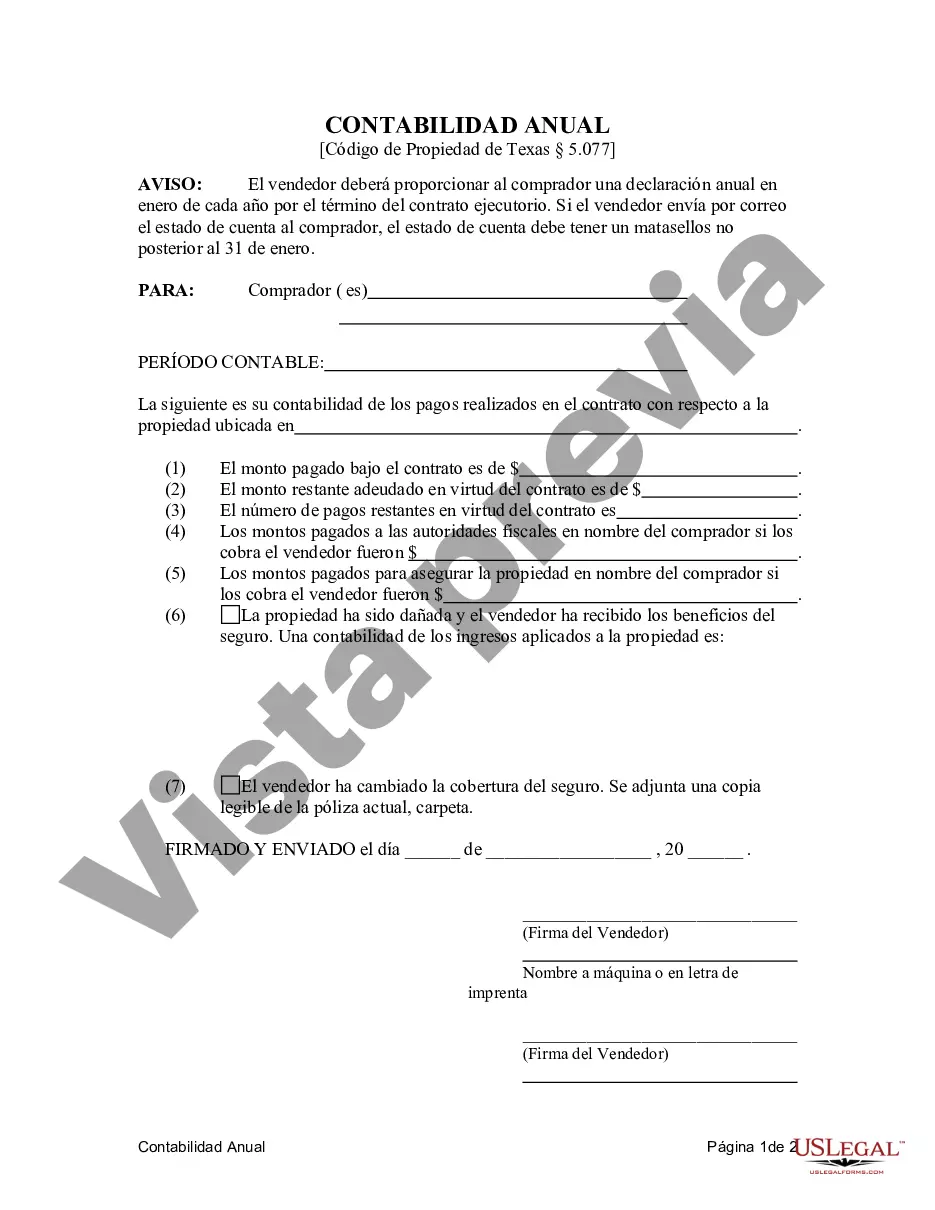

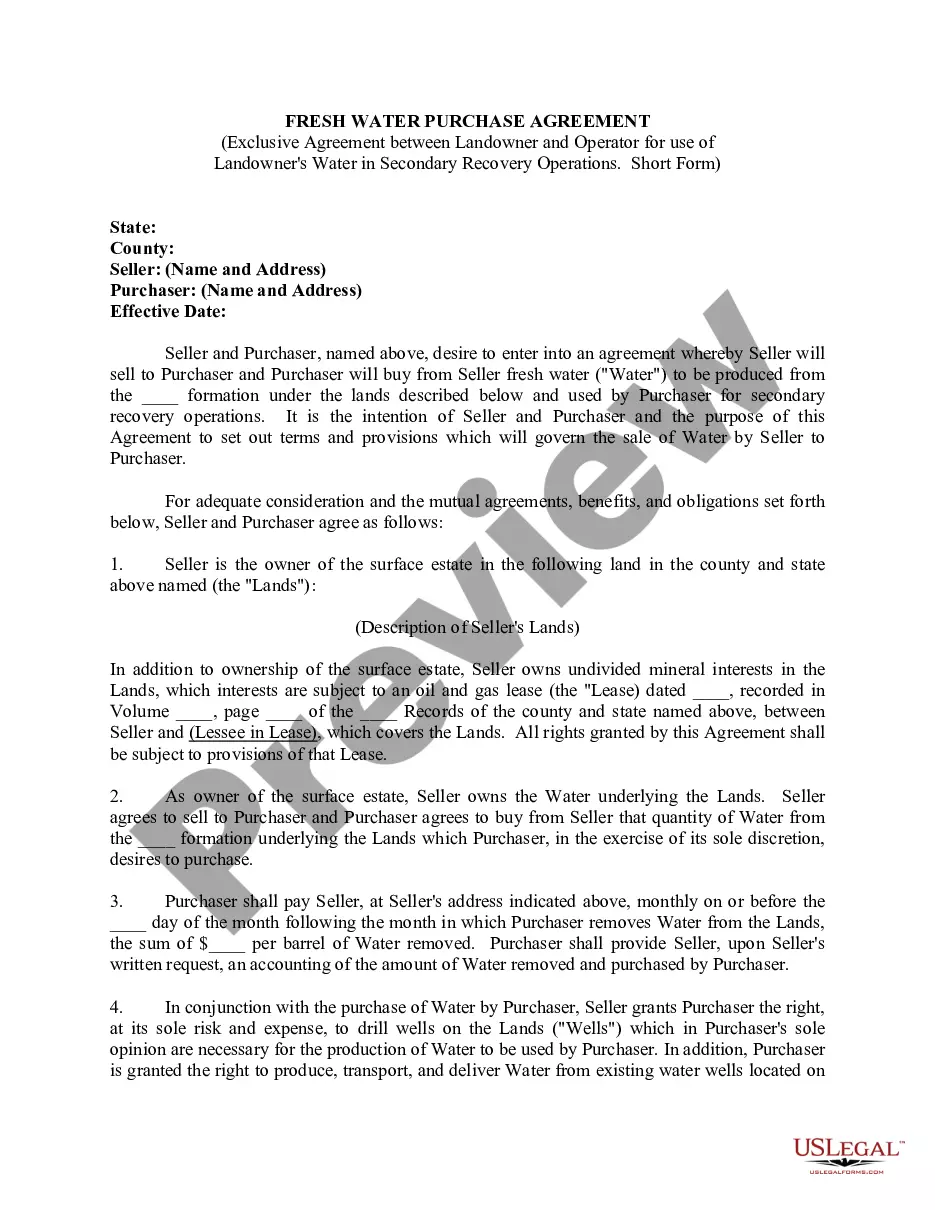

Description: In Waco, Texas, the Contract for Deed Seller's Annual Accounting Statement to Purchaser is an essential document for individuals involved in residential land contracts, also referred to as executory contracts. This statement serves as a comprehensive summary of the financial transactions between the seller and purchaser throughout the year. The Waco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract outlines all the necessary financial details and obligations related to the land contract agreement. It allows both parties to track and ensure accurate accounting and transparency regarding payments, balances, and any relevant expenses related to the property. The annual accounting statement includes various key components that are relevant to the Waco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract: 1. Purchase Price: This section outlines the total amount agreed upon for the property and includes any down payments or installments made. 2. Principal Balance: It details the remaining balance on the contract, which is calculated by deducting the cumulative payments made from the original purchase price. 3. Accrued Interest: This section highlights the interest charges accumulated during the year, based on the agreed-upon interest rate defined in the contract. 4. Payments Received: Here, all the payments made by the purchaser are recorded throughout the year, including the amount, due date, and any late fees incurred. 5. Taxes and Insurance: It displays any taxes or insurance premiums paid by the seller on behalf of the purchaser, along with the detailed breakdown and receipts if necessary. 6. Escrow Account: If an escrow account is established, this section lists the balance and any adjustments made during the year, such as property tax and insurance escrow amounts. 7. Maintenance and Repairs: This segment provides a record of any maintenance or repair expenses incurred by the seller, specifying the nature of the expense, amount, and supporting receipts. 8. Balloon Payment: In the case of a contract with a balloon payment, this section outlines the remaining balance due and the date when it becomes payable. 9. Additional Charges: Any other charges or fees related to the land contract, such as legal fees or property inspections, are detailed comprehensively, ensuring transparency. By providing a thorough annual accounting statement, the Waco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract allows both parties to maintain proper financial records and gauge the progress of the contract accurately. It ensures a clear understanding of each party's financial obligations, creates transparency, and helps avoid any potential disputes related to financial matters. Note: While this description focuses on the general Waco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser Residentialia— - Land Contract, variations or additional documents may exist depending on specific contract terms or legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Waco Texas Contrato de Escrituración Estado Contable Anual del Vendedor al Comprador - Residencial - Contrato de Terreno, Contrato de Ejecución - Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract

Description

How to fill out Waco Texas Contrato De Escrituración Estado Contable Anual Del Vendedor Al Comprador - Residencial - Contrato De Terreno, Contrato De Ejecución?

If you are searching for a relevant form template, it’s extremely hard to find a more convenient platform than the US Legal Forms website – one of the most extensive libraries on the internet. Here you can find a huge number of templates for organization and individual purposes by categories and states, or key phrases. With our advanced search feature, finding the latest Waco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract is as easy as 1-2-3. Additionally, the relevance of every document is confirmed by a group of expert attorneys that regularly review the templates on our platform and revise them in accordance with the most recent state and county requirements.

If you already know about our system and have a registered account, all you should do to get the Waco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract is to log in to your profile and click the Download button.

If you make use of US Legal Forms the very first time, just follow the guidelines listed below:

- Make sure you have discovered the sample you want. Read its description and utilize the Preview function (if available) to explore its content. If it doesn’t suit your needs, utilize the Search field at the top of the screen to find the proper record.

- Affirm your selection. Choose the Buy now button. Next, pick your preferred pricing plan and provide credentials to register an account.

- Process the purchase. Use your bank card or PayPal account to complete the registration procedure.

- Obtain the form. Indicate the format and download it to your system.

- Make adjustments. Fill out, modify, print, and sign the acquired Waco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract.

Every form you save in your profile has no expiration date and is yours permanently. It is possible to gain access to them via the My Forms menu, so if you need to have an additional duplicate for editing or printing, you can return and save it again anytime.

Make use of the US Legal Forms extensive catalogue to get access to the Waco Texas Contract for Deed Seller's Annual Accounting Statement to Purchaser - Residential - Land Contract, Executory Contract you were looking for and a huge number of other professional and state-specific samples on one website!