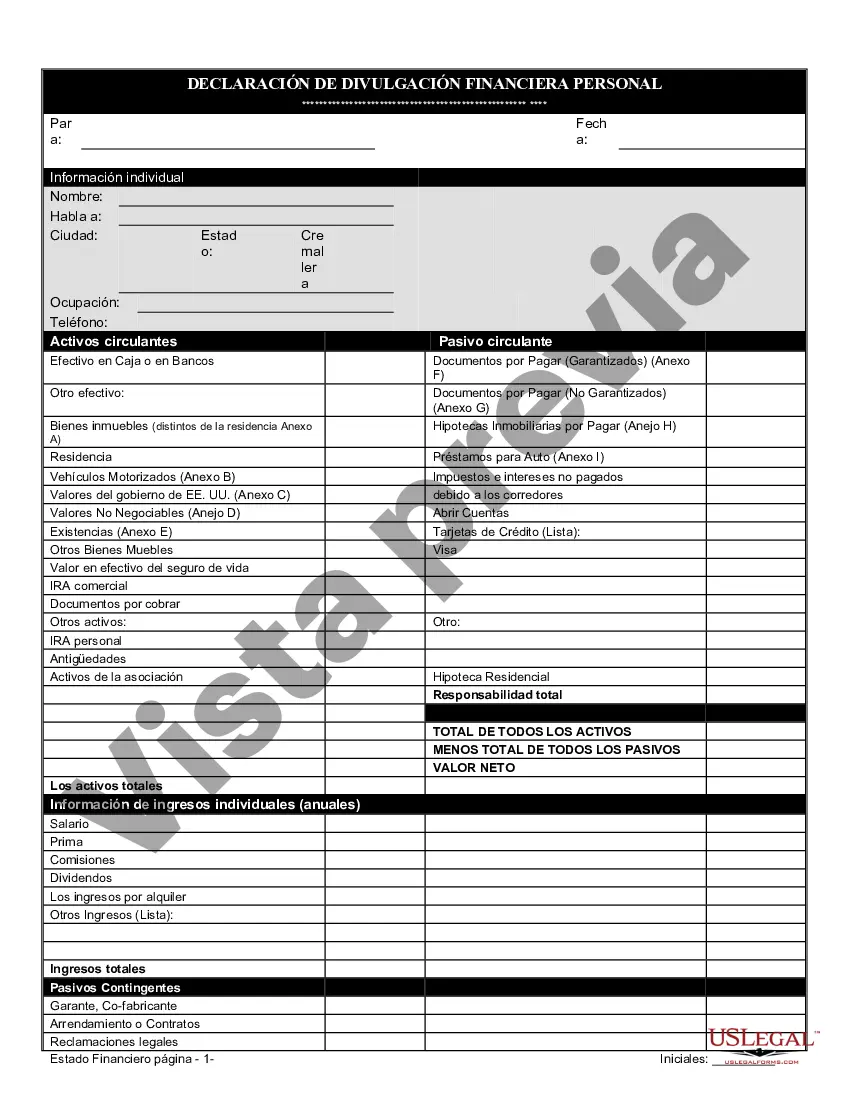

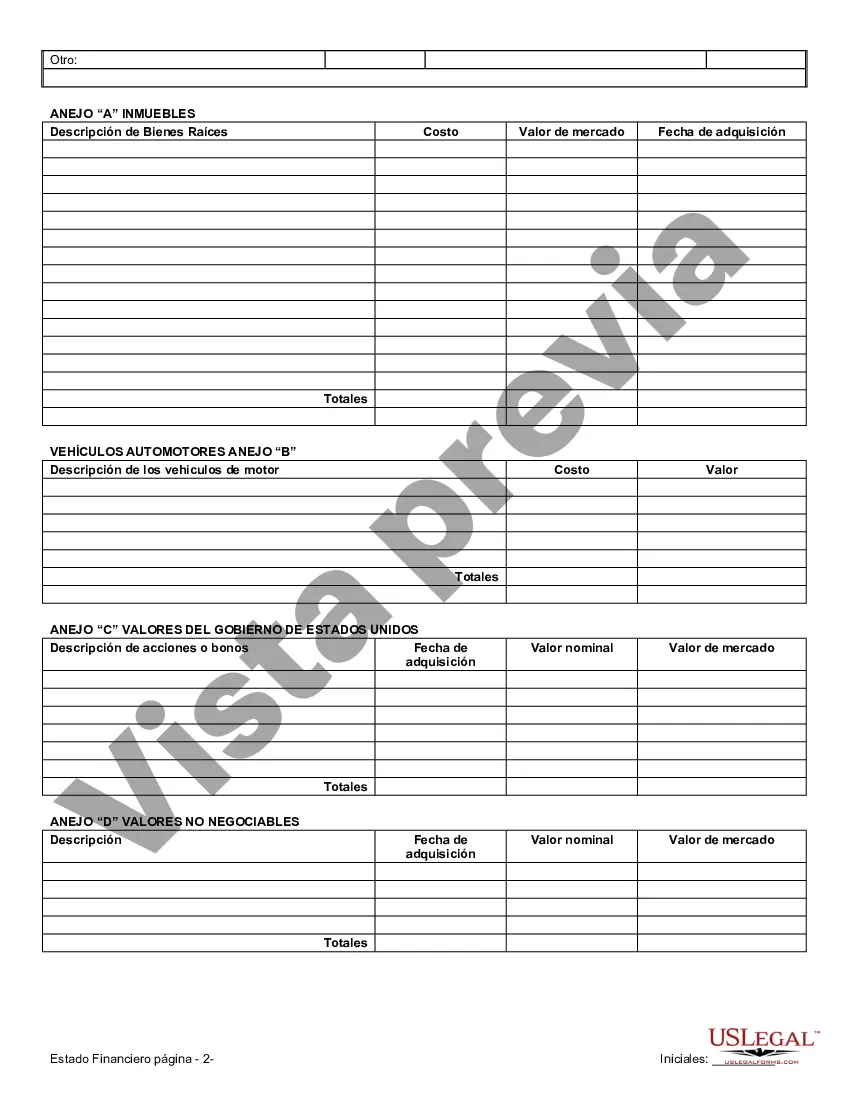

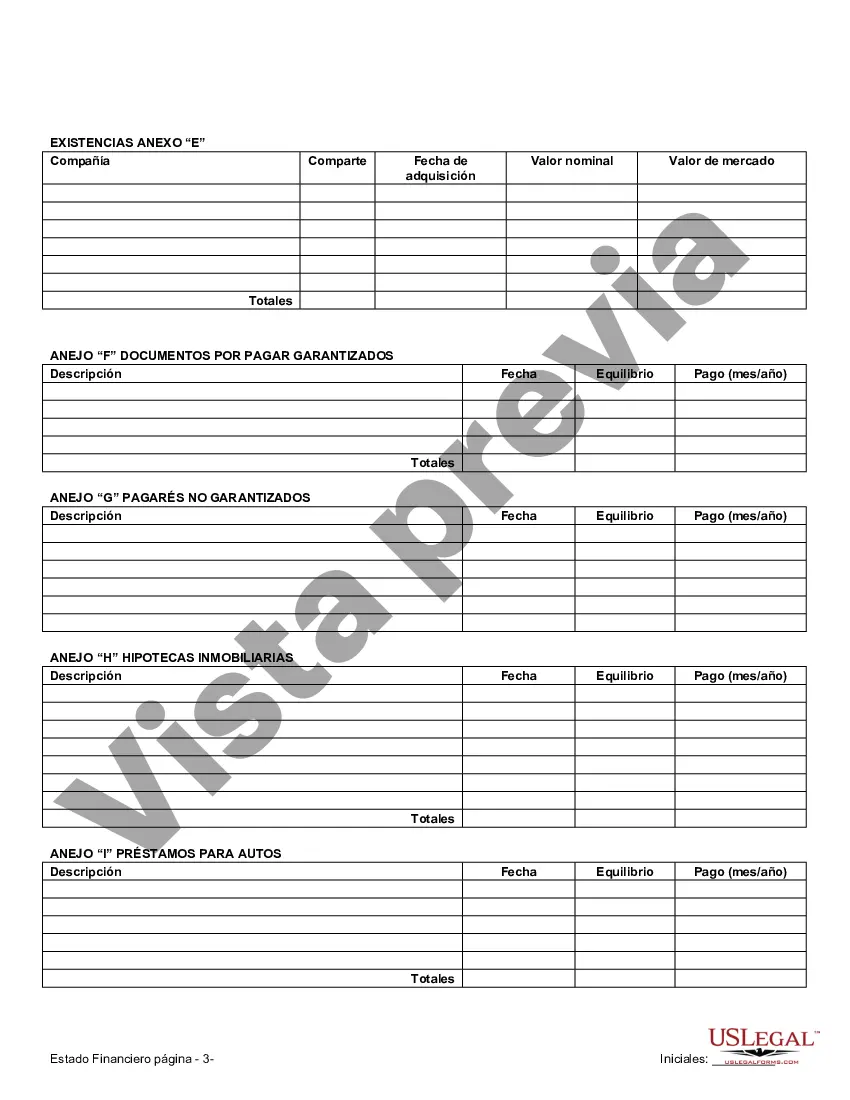

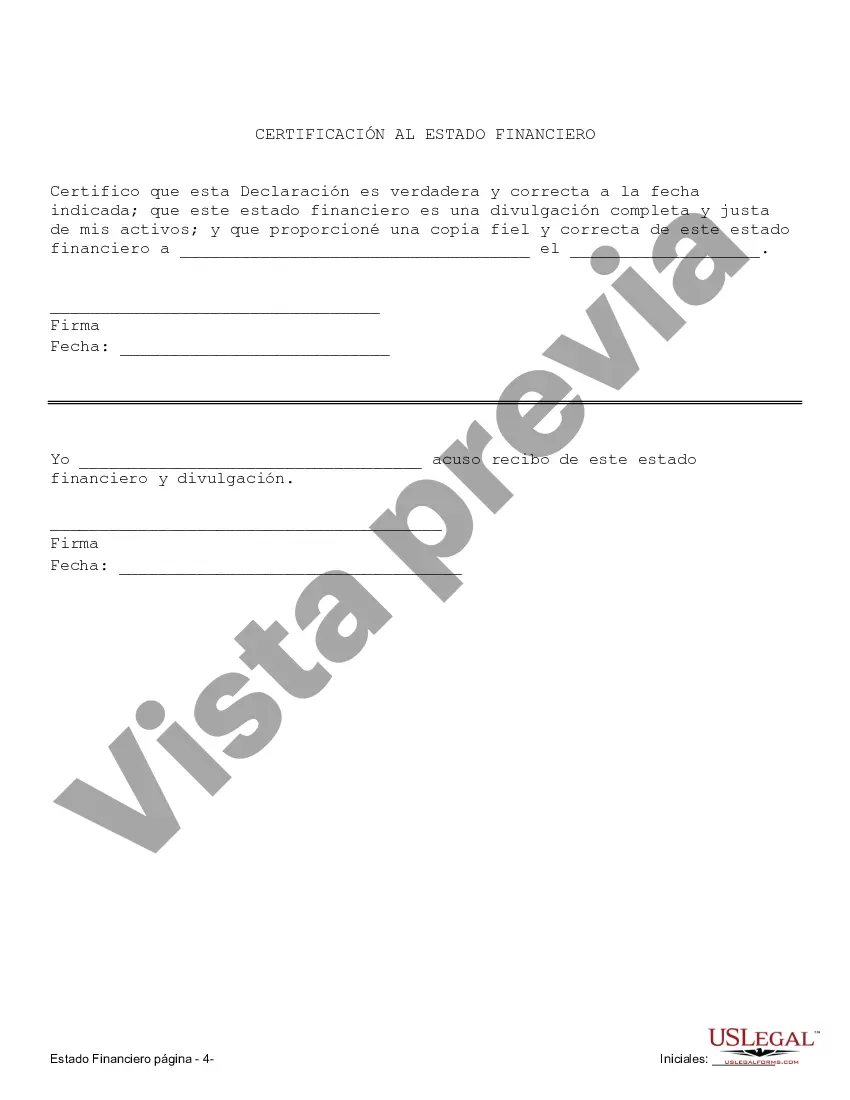

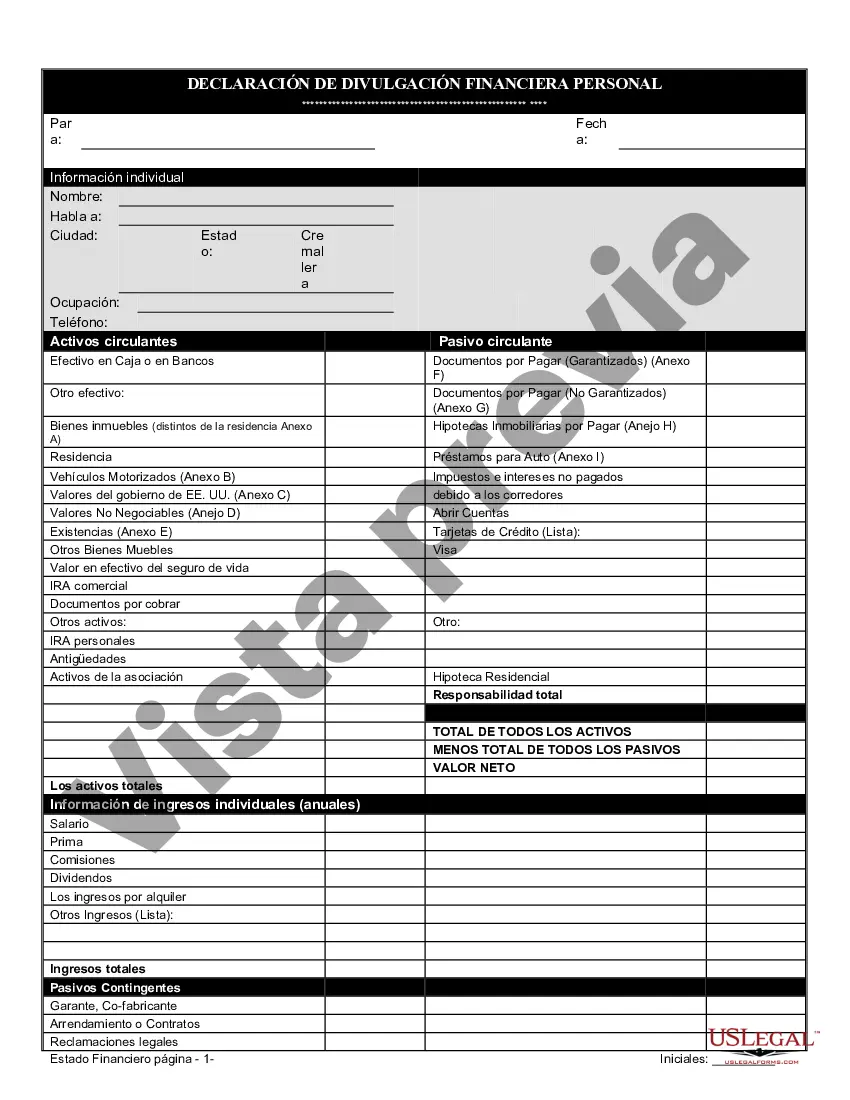

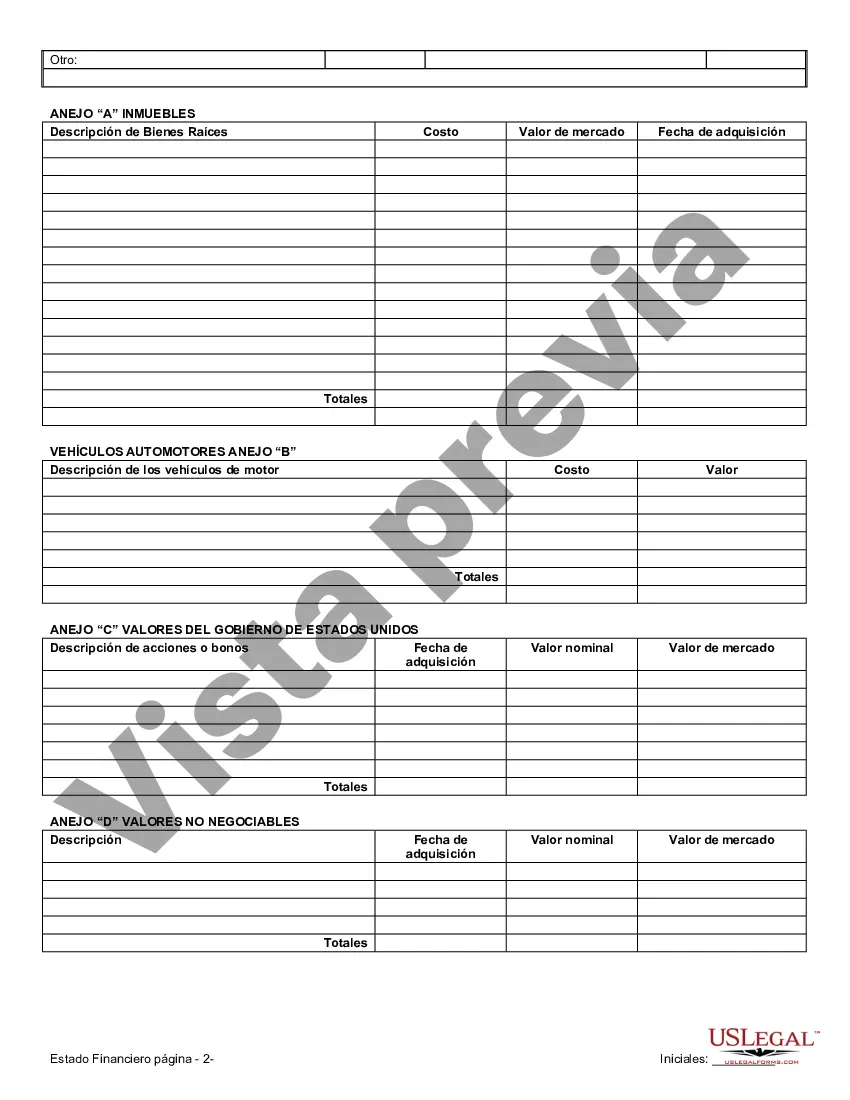

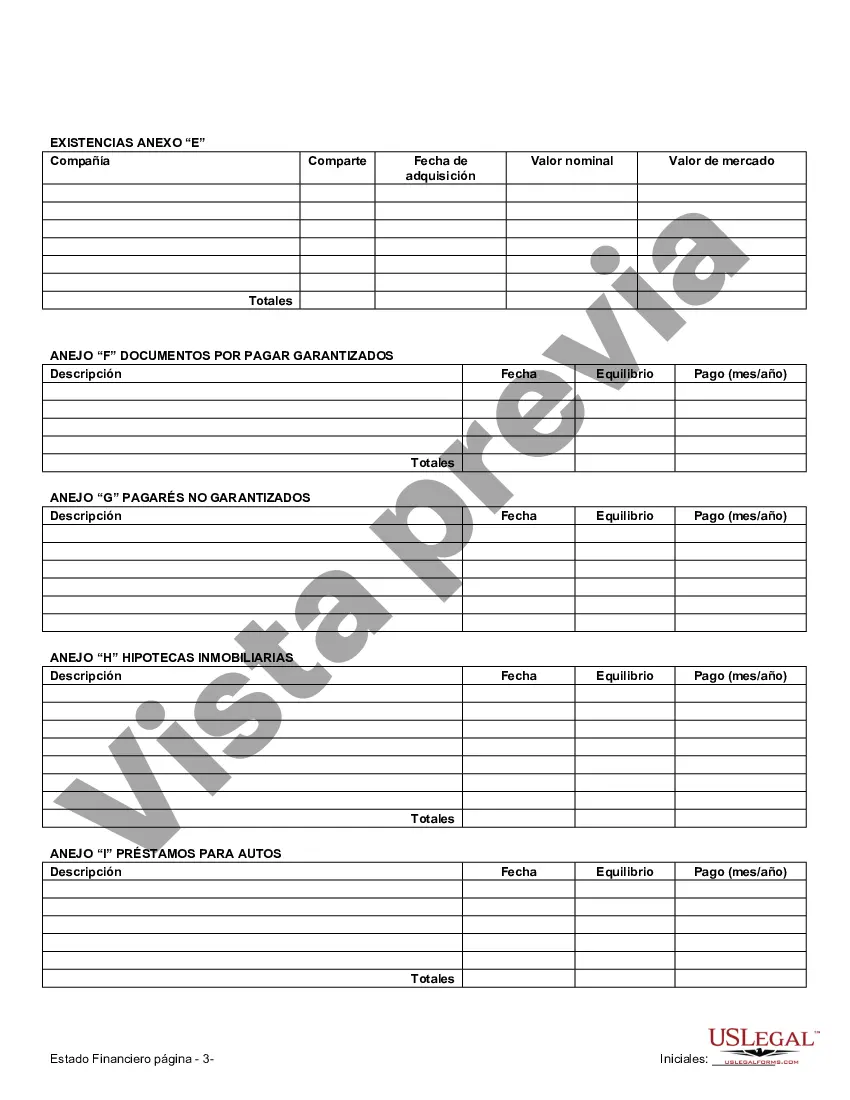

In the context of a prenuptial or premarital agreement in Austin, Texas, financial statements play a crucial role. These statements provide a comprehensive overview of the financial standing of each party entering into the agreement and are essential for ensuring transparency and fairness in the event of a divorce or separation. Financial statements are legally binding documents that outline the assets, liabilities, income, and expenses of each individual involved. They serve as a snapshot of one's financial situation at a particular point in time, usually prior to marriage. Various types of financial statements may be included in connection with a prenuptial or premarital agreement in Austin, Texas, including but not limited to: 1. Personal Balance Sheet: This statement lists all assets and liabilities owned individually by each partner before marriage. It includes items such as savings accounts, investments, real estate properties, vehicles, debts, loans, and credit card balances. 2. Statement of Income: This document outlines the sources of income for each individual, including salaries, wages, bonuses, dividends, rental income, or any other form of earnings. 3. Business Financial Statements: If either party owns a business, separate business financial statements may be required. These statements present the financial position of the business, including profit and loss statements, cash flow statements, and balance sheets, providing a thorough understanding of the business's financial health. 4. Retirement Account Statements: Retirement account statements, such as 401(k), IRA, or pension statements, are vital for disclosing the status of retirement savings before entering into the marital union. 5. Tax Returns: Copies of recent tax returns, typically for the past three to five years, are often required to understand the parties' tax history and facilitate the determination of potential tax implications upon divorce or separation. 6. Bank Account Statements: Providing bank account statements allows for an accurate assessment of current cash reserves, regular expenses, and financial habits. 7. Investment Account Statements: Statements from investment accounts, such as brokerage or mutual fund accounts, are necessary to determine the value of investments and potential income derived from them. 8. Real Estate Documents: Copies of deeds, mortgage statements, property tax records, and other real estate-related documents help determine property ownership, value, and potential liabilities. 9. Debt Statements: Statements detailing any outstanding debts, such as student loans, car loans, or mortgages, are essential for understanding existing financial obligations and potential future responsibility. When drafting a prenuptial or premarital agreement in Austin, Texas, it is imperative to include financial statements specific to the jurisdiction's legal requirements. These statements serve as vital evidence in court if the agreement is ever challenged or disputed, ensuring that each party's financial interests and assets are thoroughly documented and protected.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Austin Texas Estados financieros solo en relación con el acuerdo prematrimonial prenupcial - Texas Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Austin Texas Estados Financieros Solo En Relación Con El Acuerdo Prematrimonial Prenupcial?

Take advantage of the US Legal Forms and obtain instant access to any form sample you need. Our beneficial website with a huge number of templates simplifies the way to find and get almost any document sample you will need. You can download, fill, and certify the Austin Texas Financial Statements only in Connection with Prenuptial Premarital Agreement in just a matter of minutes instead of surfing the Net for many hours seeking the right template.

Using our catalog is a great strategy to increase the safety of your document submissions. Our experienced lawyers regularly review all the documents to ensure that the templates are appropriate for a particular state and compliant with new laws and regulations.

How do you get the Austin Texas Financial Statements only in Connection with Prenuptial Premarital Agreement? If you already have a profile, just log in to the account. The Download button will appear on all the samples you view. Furthermore, you can find all the previously saved records in the My Forms menu.

If you haven’t registered a profile yet, stick to the instruction listed below:

- Find the form you require. Make certain that it is the template you were looking for: verify its headline and description, and take take advantage of the Preview function when it is available. Otherwise, utilize the Search field to find the needed one.

- Launch the saving procedure. Click Buy Now and select the pricing plan you prefer. Then, sign up for an account and process your order utilizing a credit card or PayPal.

- Save the file. Select the format to get the Austin Texas Financial Statements only in Connection with Prenuptial Premarital Agreement and modify and fill, or sign it for your needs.

US Legal Forms is one of the most significant and trustworthy template libraries on the internet. Our company is always happy to assist you in any legal case, even if it is just downloading the Austin Texas Financial Statements only in Connection with Prenuptial Premarital Agreement.

Feel free to take full advantage of our platform and make your document experience as straightforward as possible!